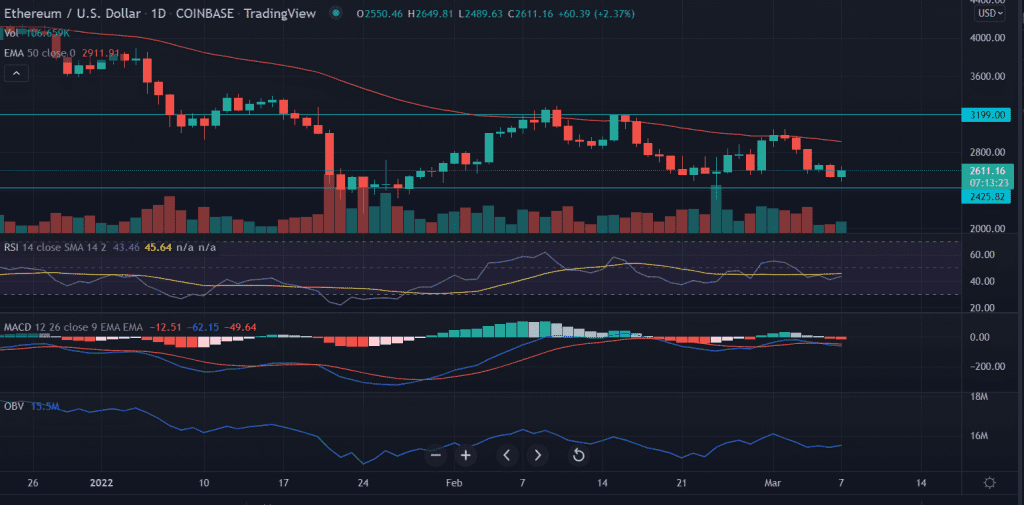

Ethereum (ETH) price makes remarkable gains in the U.S session as the fresh trading week begins. ETH price may continue to ride higher to discover crucial levels of resistance as it found reliable support around $2,500. The Journey toward $3,200 will not be an easy task for bulls as ETH price will face multiple hurdles before tagging the psychological mark.

- Ethereum (ETH) price edges higher on Monday.

- Price bounces off from a short-term support level near $2,500.

- Momentum oscillators give mixed signals with no clear bias.

Ethereum price looks for an upside

Ethereum price formed multiple support barriers near the $2,500 mark on the daily chart, suggesting a short-term bounce back from the current levels. As price briefly test $2,489 and quickly reclaim the $2,600 level with above an average volumes in today’s session.

The immediate first target is placed at Friday’s high of $2,835.95.

Further, an acceptance above 50-day EMA (Exponential Moving Average) at $2,912.51 will bring $3,200 in play.

On the flip side, if selling pressure increases, Ethereum’s price may face immediate support at the horizontal support line at $2,425.82.

Next, an additional foothold will emerge at the lows of January 24 at $2,159. Further selling pressure may stimulate the sellers to revisit $1718.41 levels last seen in July, the long-term optimistic outlook may be invalidated.

Technical indicators:

RSI: The daily Relative Strength Index (RSI) has continuously traded lower since February 15 while trading below the average line. Currently, it reads at 41.

MACD: The Moving Average Convergence Divergence (MACD) coincides with RSI with a negative bias.

OBV: The On Balance Volume rides higher as the price moves north.

In conclusion, Ethereum (ETH) is in a long-term downside trend. But it might continue with its consolidation of $2,500 and $3,200 before a clear directional bias.

As of press time, ETH/USD is trading at $2,608, up 2.28% for the day.