The Ethereum (ETH) buyers made an impressive recovery during the last two weeks, indicating a 37% gain from the January 24th low($3172). The coin price has recently breached the crucial resistance of $3000, indicating the buyers are fighting to take control. Check out the important levels that determine the upcoming trend in ETH.

Key technical points:

- The ETH price acquired the 20-day DMA

- The intraday trading volume in ETH/USD is $10.2 Billion, indicating a 37.2% fall.

The Rising Trendline Stands On Guard

Source-Tradingview

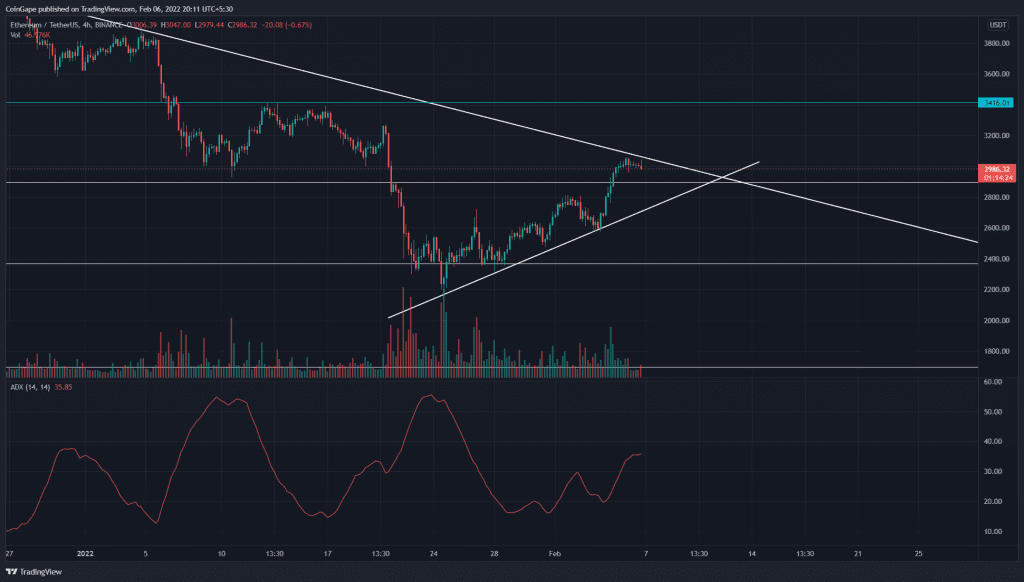

The ETH bears were using the descending trendline to sell on rallies and drive the price lower. The coin chart shows higher price rejection candles at this resistance trendline, indicating the bears are defending this line. If bears continue to exert selling pressure, the coin price would plunge below $3000.

However, the buyers still hold an upcoming support trendline that can bolster the ongoing recovery.

Is ETH Price $3400 On Cards?

Source- Tradingview

The ETH chart indicated a strong breakout candle of 10% intraday gain breached through the overhead resistance. However, another significant resistance, i.e., descending trendline stand at the forefront will retest the buying before any further growth.

The buyers have managed to flip the dynamic resistance of 20-day DMA into potential support. However, the buyers will most likely challenge the 200 DMA near the $3400 mark for a more promising bullish recovery.

Moreover, On Balance Volume (OBV) indicator slope rallying with a new higher high suggests ETH seems to have regained its buying pressure.

The ADX(35) slope presents a steady rally, indicating the rise in underline bullishness.

- Resistance levels- $3000-2950, $3416

- Support levels are $2400 and $1700.