Ethereum’s transition to a Proof-of-Stake (PoS) consensus mechanism was one of the most highly anticipated events in the crypto world. Ethereum 2.0 offers the ability to stake ETH, making it possible for current ETH holders to get positive returns (interest). The new Ethereum blockchain seeks to improve speed and scalability while maintaining the core principle of decentralization. This has been a major challenge in the cryptocurrency space. Ethereum’s co-founder, Vitalik Buterin, released a detailed Ethereum roadmap for the long-awaited Ethereum 2.0 protocol. Let’s explore.

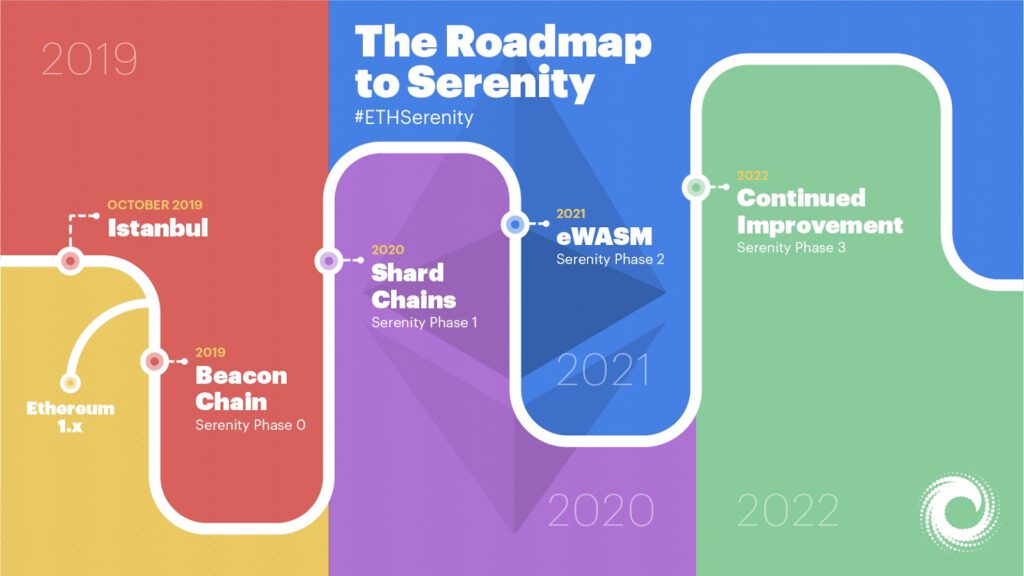

Ethereum Roadmap 2022

The Ethereum roadmap is divided into three major phases: Beacon Chain, Sharding, and eWASM.

Each stage of the Ethereum roadmap is introduced into the protocol in a safe environment without compromising the security and functioning of the blockchain.

Beacon Chain

The first phase of the Serenity Ethereum upgrade timeline will include the release of Beacon Chain, marking the start of the anticipated transition to the PoS system.

The Beacon Chain is a PoS chain that will run in parallel to Ethereum’s current PoW chain. This hybrid approach will enable the transition phase to ensure that the current system is still working as the transition takes place.

For simplicity’s sake, Beacon Chain will be a bare-bones structure for the first implementation. It will not support accounts or smart contracts.

Under the PoS system, two-thirds of miners would need to stake ETH on the next block, making the economic incentive riskier for malicious actors who are looking to compromise the network’s security.

In the PoS system, the consensus is achieved after a validator stakes a fixed amount of ETH in order to participate in the mining process.

The role of the validator is to validate new transactions via a voting process and thereafter propose a block (filled with validated transactions) to the chain.

Validators will receive rewards of more ETH, similar to an interest-earning fixed deposit product. The required number of staked ETH for validators’ stands is 32.

In the event that a validator chooses to act maliciously, he loses all of his staked ETH.

Sharding

The second phase focuses on improving Ethereum’s scalability capabilities. Sharding enables much higher transaction processing and output by dividing the data processing responsibility among nodes in the network.

Sharding is the partitioning of a large database into smaller chunks or “shards,” each with its own chain of transactions.

This division of work facilitates parallel processing and storing of transactions, allowing the network to validate several transactions simultaneously. Buterin explains it like this,

“Imagine that Ethereum is split into thousands of islands. Each island can do its own thing. Each of the islands has its own unique features and everyone belonging to that island can interact with each other, i.e., the accounts can interact with each other and they can freely indulge in all its features. If they want to contact other islands, they will have to use some sort of protocol.”

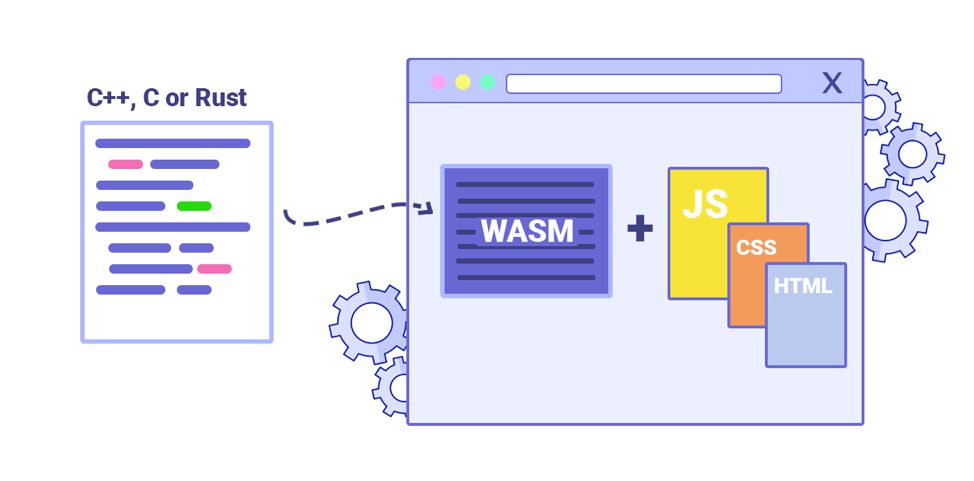

eWASM

The Ethereum-flavored Web Assembly (eWASM) is the last phase of the Ethereum upgrade timeline, which will introduce a more advanced Ethereum Virtual Machine (EVM) that incorporates both PoS and sharding.

eWASM would enhance the functionality of shard chains from basic data markets to fully functioning transactional chains.

The goal of this is to increase Ethereum’s scalability prospects. At this stage, accounts, states, and smart contracts would be reintroduced.

The Merge

The Merge is the upgrade from the original proof of work to the proof of stake mechanism. Ethereum Mainnet (the original execution layer that has existed since genesis) will merge with the Beacon chain, which is now existing as one chain.

The Merge happened on September 15, 2022, and reduced Ethereum’s energy by 99.95%. This is because there is no need for energy-intensive mining. Instead, the network’s security relies on staking ETH.

Ethereum Mainnet, with all its accounts, balances, smart contracts, and blockchain state, continued under proof-of-work while Beacon Chain ran in parallel using proof-of-stake.

This method prevented any loss of transaction history. The entire transactional history of Ethereum merged with Beacon Chain.

At this time, Beacon Chain was not processing mainnet transactions. Instead, it reached a consensus on its own state by identifying active validators and their account balances. Mining is no longer a means to produce valid blocks.

When these systems came together, the proof-of-stake was replaced by the proof-of-work permanently. Experts described this process as ‘switching engines mid-flight.’

Ethereum Roadmap After the Merge

After the Merge, Ethereum will undergo the Surge, Verge, Purge, and finally, Splurge updates in parallel as part of its ongoing Ethereum roadmap.

The Surge

The Surge focuses on scaling Ethereum with Layer-2 solutions such as sharding, in which groups of transactions execute off-chain, improving speed and lowering network fees.

According to Buterin, by the end of the surge, Ethereum will be able to process 100,000 transcripts per second. The end of the surge will see reduced transaction costs, which is one of the challenges of using layer-1 Ethereum.

The Verge

The Verge introduces “Verkle Trees”, a powerful upgrade to Merkle proof which allows for much smaller proof sizes.

Basically, it is another scaling upgrade that optimizes storage on the network and reduces node size.

The Purge

The Purge is more or less a cleanup that deletes some historical data to increase storage and reduce network congestion.

The Splurge

The Splurge, which is the final upgrade on the Ethereum roadmap, consists of several smaller upgrades and fine-tuning to ensure smooth network operations after the previous upgrades.

Ethereum After Updates

Even though it has succeeded in being the backbone of DeFi, Ethereum is far from perfect, and some TradFi institutions are still irked that they can’t regulate this beast. These traditional gatekeepers are financial regulatory bodies, with the SEC being the biggest of them all.

Ethereum might face some obstacles on its journey to beating the blockchain trilemma, and one of them is SEC. Here’s why.

U.S Securities and Their Characteristics

A security is a negotiable financial instrument that holds monetary value and represents an ownership stake in a publicly traded corporation. For example, a security could be stocks, bonds, banknotes, futures, or options.

The ownership of a security is represented by an electronic record, book-entry-only form, or certificate. The company issuing the securities is the issuer.

The US Securities and Exchange Commission (SEC) regulates securities trading and protects investors from fraud.

According to the SEC, securities have the following characteristics:

- They are issued by a company, an individual, and sometimes governments.

- The securities are sold to other parties for a specified price.

- There is a promise of repayment (interest included).

- Securities have a fixed amount of supply.

- They have a specified interest rate

- They have a specific day of maturity.

Ethereum 2.0 vs U.S Securities

Ethereum’s transition to a proof-of-stake system will see the second-largest cryptocurrency turn into a security in the eyes of the US Securities and Exchange.

This is because crypto companies that allow holders to “stake” their coins might pass a key test called the Howey test. The test helps courts determine whether an asset is a security.

The Howey test examines whether investors expect to earn a return for the work of third parties.

Issuers of securities are required to file extensive disclosures with the SEC. Exchanges and brokers that facilitate the trading of securities must comply with strict rules designed to protect investors from conflicts of interest.

Cryptocurrency issuers and trading platforms face strict liabilities if they sell any assets that are deemed to be securities by the SEC or courts.

If a crypto exchange offers staking services to its customers, it is more or less similar to lending. The SEC requires firms offering crypto-lending products to register with the agency or pay a fine if they fail to do so.

Will Updated Ethereum Pass the Howey Test?

The Howey Test states that a transaction becomes an investment contract if money is “invested in a common enterprise with a reasonable expectation of profit to be derived from the efforts of others.”

If a transaction passes the Howey Test, it is an investment, and the contract needs to be registered with the SEC.

When ETH’s value came from proof-of-work, Ethereum was not a security. However, now that its value comes from Proof-of-Stake, staking can potentially be a reasonable expectation of profit.

The SEC made it clear that crypto platforms offering lending services must register with them to operate legally.

According to the Securities Act of 1933, an investment contract should have three prongs that should be satisfied in a contract. If an instrument does not meet even one of the prongs, it is not security.

The prongs include:

- (an) Investment of money;

- (in) A common enterprise;

- (with) Reasonable expectations of profits derived from third parties.

However, Ethereum fails to satisfy the second and third prongs. This means that ETH is not a security as per the Howey Test.

Conclusion

The new and better Ethereum 2.0 is already here, and the experience is about to get even better for users. The Merge has solved several blockchain challenges at once. We expect to see a boom in the new proof-of-stake mechanism whereby other blockchains adopt it as opposed to proof-of-work, which has several limitations.