Ethereum (ETH) tracked a broader recovery in the crypto market, jumping over 5% in the past 24 hours as sentiment improved.

The token was last trading at $1,882.80, according to data from Coinmarketcap.com. But its latest bounce blindsided traders with a big short position on the token.

Data from Coinglass shows that a whopping $682 million short positions were liquidated in the past four hours, with a majority of these occurring on crypto exchange Bitfinex.

The exchange, which has a 100% short rate on Ethereum, saw nearly $670 million in liquidations in the past four hours, all of them short positions.

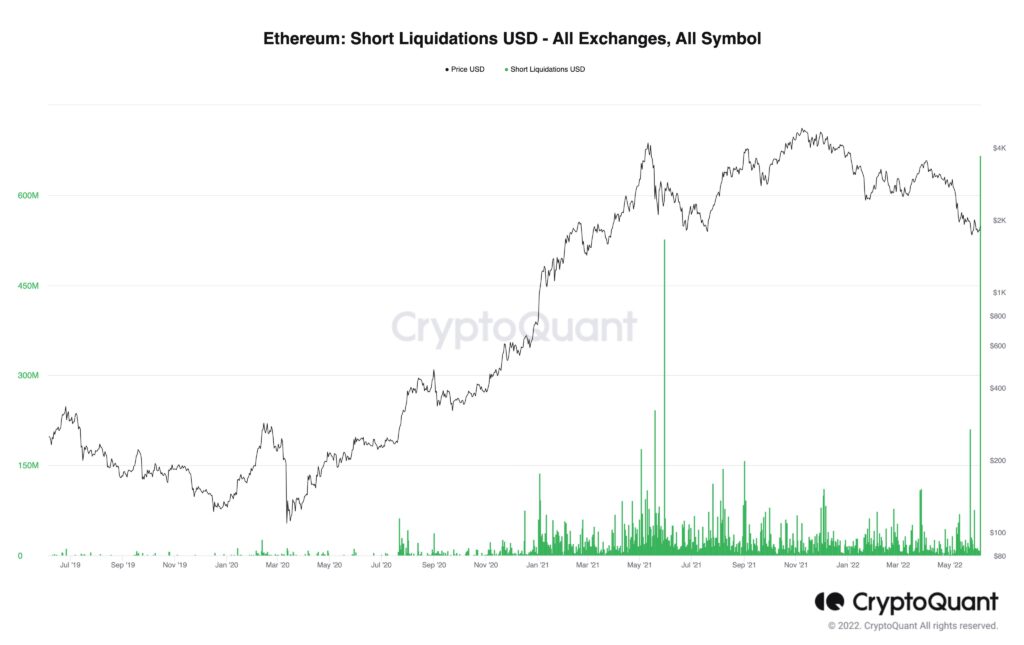

Ethereum sees its biggest single-day short liquidations in three years

With the liquidations on Bitfinex, Ethereum has seen its biggest amount of one-day liquidations in three years, according to data from CryptoQuant. Total liquidations in the past 24 hours stood at nearly $698 million, with 99.5% of these being short.

Trending Stories

The high amount of short positioning indicates that a lot of market sentiment was geared against the second-largest cryptocurrency.

Ethereum was also trading around a key level of $1700- its weakest since July 2021. A breach below this was likely to trigger more losses in the token.

A bulk of Ethereum’s recent price action has been dictated by anticipation of its upcoming shift to proof-of-stake.

Major merge test coming up this week

While Ethereum is rising, it could consolidate these gains ahead of a key PoS test this week. The Ropsten Testnet, one of the blockchain’s most important testnets, is set to deploy a PoS model this week.

The blockchain now has two more testnets to clear before it can even set a date for a broader shift for the merge, according to developer Tim Beiko.

While Ethereum founder Vitalik Buterin said the merge could come by as soon as August, Beiko’s comments may point to a potential delay.

Still, the merge is expected to be bullish for Ethereum, given that it greatly reduces the blockchain’s operating costs and makes it more accessible.