After a relief rally earlier this week, the border crypto market loses steam once again. The world’s second-largest cryptocurrency Ethereum (ETH) has tanked 6% today moving close to $1800 levels.

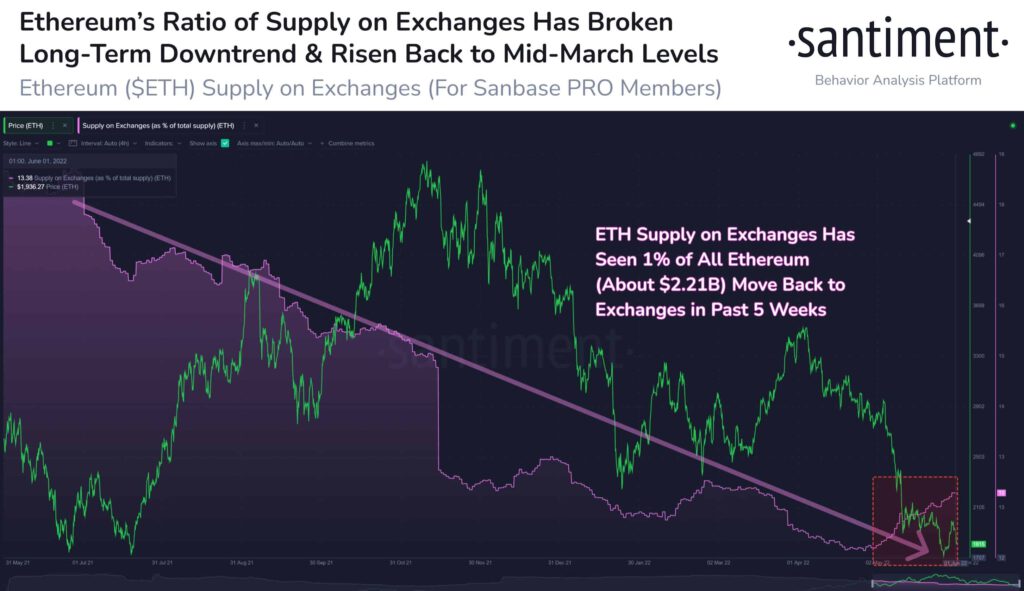

This shows that bears are still holding the grip and the early week’s momentum was nothing but a bear market rally. The sell-off in Ethereum and the broader crypto could intensify further looking at a large number of ETH moving to exchanges. As on-chain data provider Santiment reports:

$2.21B worth of #Ethereum has moved back to exchanges over the past week after a long-term exodus of coins moving off of exchanges, dating back to August of 2020. This is the most sustained upswing in $ETH being moved back to exchanges since May, 2021.

After a strong performance last year, Ethereum (ETH) has entered a massive correction along with the broader crypto market. The ETH price is already trading 50% down since the beginning of the year. Furthermore, ETH has been also losing its crypto market dominance from over 20% last year to now under 18%.

Institutional Investors Ditch Ethereum for Other Altcoins

The report from CoinShares earlier this week shows that Ethereum has been losing the confidence of institutional investors. After a heavy market crash last week, institutional investors did some bottom fishing, however, they decided to increase allocation to other altcoins at the expense of Ethereum. The CoinShares report states:

Trending Stories

“The recent collapse of stable coin UST has seen investors favoring Bitcoin where 39% of respondents now say it has the most compelling growth outlook. Investors have increased weighting on digital assets from 0.5% to 1% as they look to add to positions during the price weakness. The survey highlights increasing allocation to DOT, ADA and XRP at the expense of Ethereum”.

advertisement

While the price erosion of ETH continues, developers have been gearing for implementing The Merge upgrade to the Ropsten testnet next week.