Ethereum[ETH] kicked off this week with a slowdown of the bullish momentum that it delivered last week. Investors are now leaning towards the side of caution especially as the market enters another uncertainty period. The upcoming FOMC meeting might have a lot to do with the current outcome.

Here’s AMBCrypto’s price prediction for Ethereum [ETH] for 2022-2023

ETH investors are likely waiting for the FOMC meeting. This was because the outcome may determine how the rates announcements will sway market sentiment. Meanwhile, Glassnode’s recent alerts revealed that ETH gas fees just reached a four-week low.

📉 #Ethereum $ETH Total Gas Usage (7d MA) just reached a 1-month low of 4,542,790,690.964

View metric:https://t.co/dtnQHnd45B pic.twitter.com/BBLDE7YF1F

— glassnode alerts (@glassnodealerts) October 31, 2022

The low gas fees observed in the last few hours confirmed the drop in investor trading activity related to ETH. The Glassnode analysis team also observed a drop in the number of Ethereum addresses holding more than 32 ETH. This figure reportedly dropped to new a monthly low. Could these observations point towards lower demand for ETH?

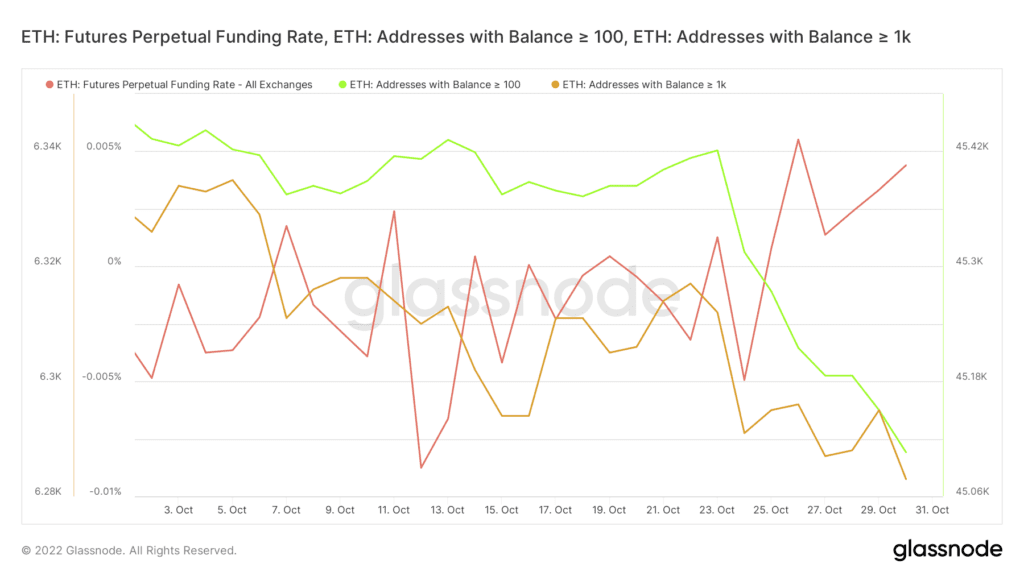

The above observations underscore less demand for ETH in the market. A look at whale addresses confirmed this. For example, ETH addresses holding between 100 and 1,000 coins dropped significantly during the weekend.

However, the demand in the derivatives market painted a different picture. Its futures perpetual funding rate did drop slightly after hitting a monthly high on 26 October. This was notably around the same time that ETH’s price became overbought. It regained the upside a day later, and saw a significant increase since then. The futures funding rate may have behaved this way due to an increase in bearish positions.

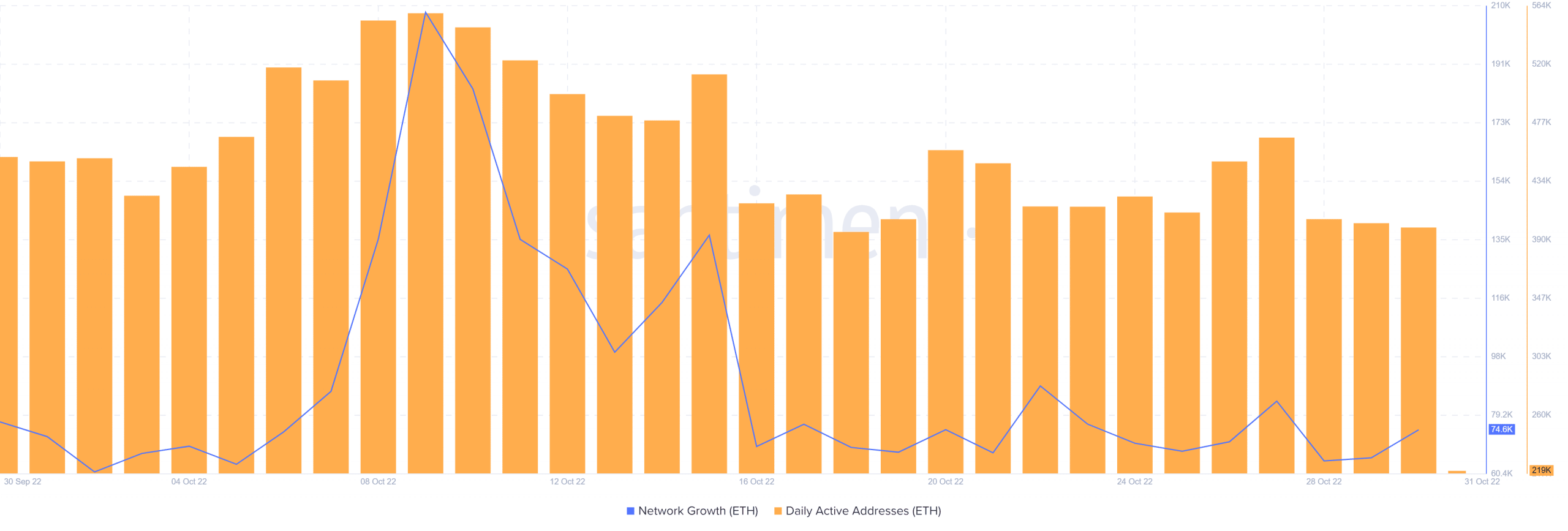

Ethereum’s daily active addresses also experienced a significant decline in the last four days in line with the return of uncertainty. Network growth saw a rally last week but have dropped out slightly in the last few days.

These observations were consistent with the observed drop in trading activity during the weekend after last week’s rally. Another potential reason could be the that buying pressure dropped slightly when the price pushed into the overbought zone.

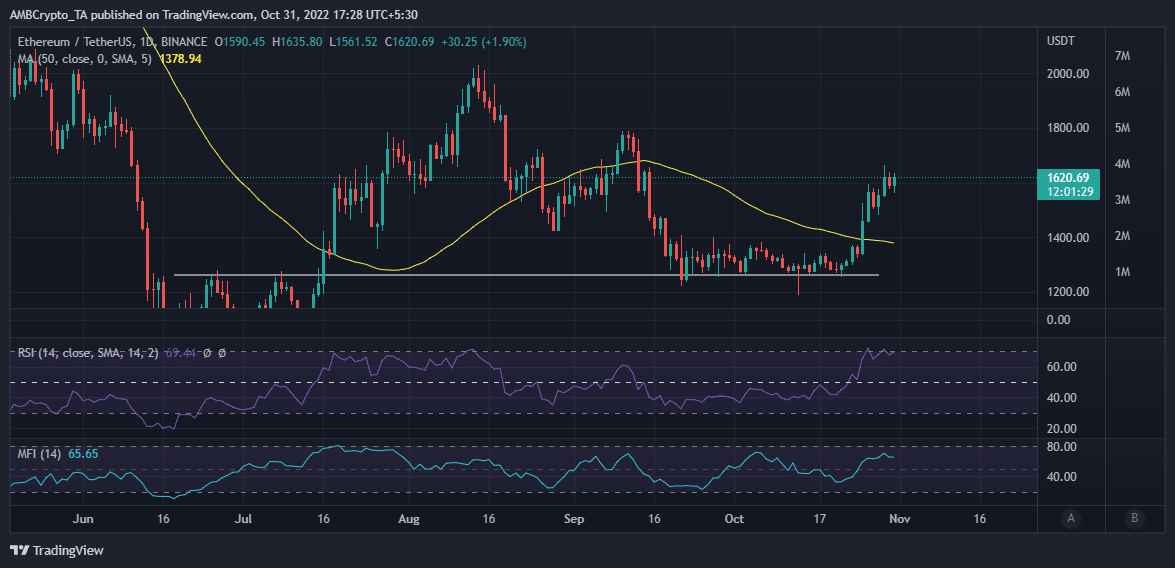

ETH’s price action has been experiencing resistance above the $1,600 price level especially in the last three days. This could be considered as an indication of lower bullish demand, as well as increased sell pressure.

Furthermore, ETH saw some outflows in the last two days after its recent peak. However, the selloff has notably been low, suggesting that many traders opted to hold on to the prospects of more upside.

Investors currently wondering whether it is still a good time to buy ETH may want to hold off on that purchase. The FOMC-related uncertainty means we might see a potential selloff this week, undoing recent gains. The fact that some whales had also been reducing their balances also underscored the possibility of more price slippage.