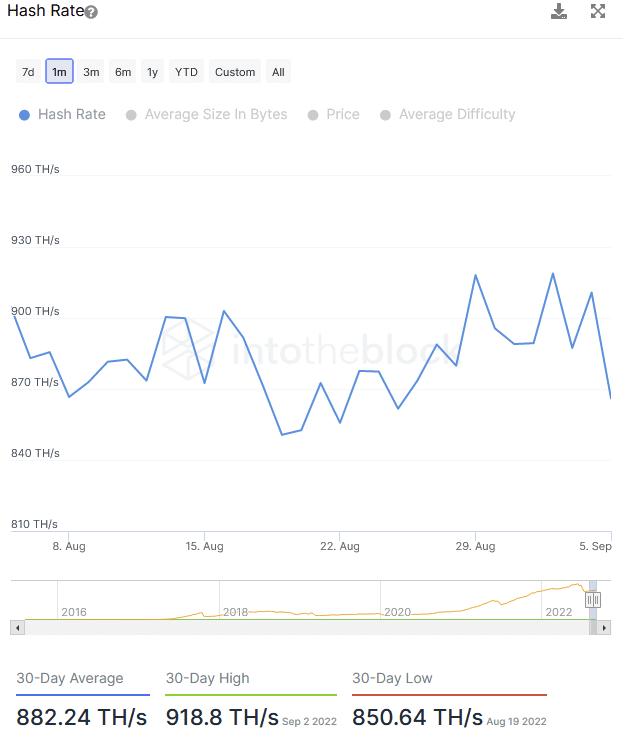

Blockchain analytics platform, IntoTheBlock, released a new report that opined that the likely dates for the Ethereum merge are 14 and 15 September. According to it, if the hashrate on the Ethereum mainnet network maintains an average of about 844 TH/s, the expected merge date will be 15 September at 12:00 UTC.

However, with the 30-day TH/s average, as can be gleaned from the chain, the merge is more likely to fall on 14 September.

The update scheduled for mid-September comes a s a sequel to an earlier released confirmation by the Ethereum [ETH] foundation about the Bellatrix Upgrade. The Bellatrix Upgrade formed one part of the two remaining phases for the transition of the Ethereum into a proof-of-stake (PoS) consensus mechanism. The upgrade took place on 6 September and occurred around 11:34:47am UTC at epoch 144896 on the Beacon Chain.

According to the Ethereum Foundation, the Paris Upgrade is expected to be triggered by the Terminal Total Difficulty (TTD) of 58750000000000000000000, expected between 10 September and 20 September 2022.

What to expect

As per the report, the general consensus remains that the Merge will be a success following the series of a number of testnet merges. IntoTheBlock found that ETH Netflows from exchanges have been negative over the last month to corroborate this position.

According to the analytics platform, this indicates that investors have taken to accumulating the alt or are buying back significantly after the price declines over the last month.

Furthermore, IntoTheBlock noted that when the fork occurs after the Merge, all ETH coins held in wallet addresses can claim the newly forked ETHW token at a 1:1 ratio.

This will open up several trading and arbitrage opportunities. IntoTheBlock also believes this has led many large holders of ETH coins to increase their holdings over the last month.

Also, the total number of addresses holding between 10 and 10,000 ETH has risen by 1.68% within that period in expectation of an eventual fork.

Further, due to an increase in the demand for holding ETH, lending platforms, such as Aave and Compound have restricted borrowing and hiked interest rates to prevent misuse of their platforms. The growing demand ahead of the Merge has also led to a drop in ETH liquidity across liquidity pools.

Miners are in trouble

IntoTheBlock believed that existing miners on the Ethereum network would suffer the most from the Merge. This is because they have invested huge finances into their mining hardware on the PoW network.

Miner outflows have spiked to a three-month high, and increased sell-off of large amounts of miner holdings is imminent if the forked ETHPoW chain fails to pick up.

According to Chainalysis,

“After The Merge, hashrate dedicated to Ethereum mining will either disappear or disperse to other blockchains. However, don’t expect that hashrate to move to Bitcoin. Why? The equipment used to mine Ethereum won’t cut it for Bitcoin.”