Ethereum Ecosystem is making progress daily, so we hope you do not even miss any updates from the past week. Here is a recap of the Ethereum Weekly Ecosystem.

TL;DR

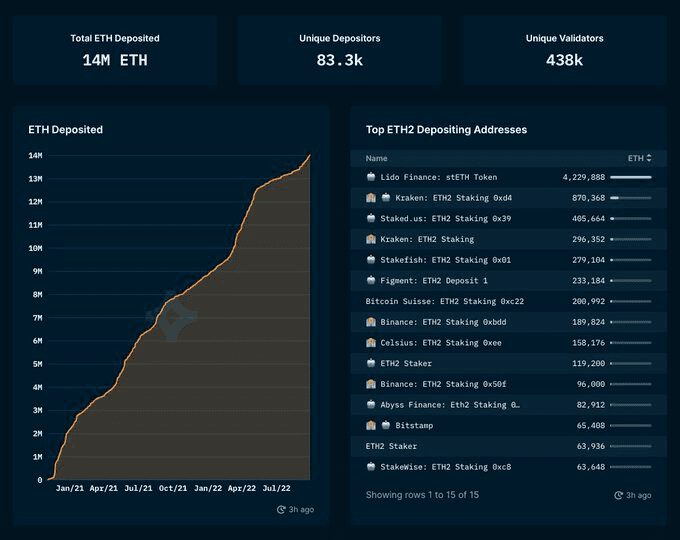

- More than 14 Million $ETH is being staked in the deposit contract

- Uniswap is currently doing more transactions than Cardano

- Social Signal updates for Ethereum

- Optimism NFTs are now live on OpenSea

- Vitalik releases Proof of Stake book

- Hashflow introduces the Hashverse

Ecosystem Updates

Let’s get into some analysis, news, and data with Ethereum Daily in this newsletter!

Ethereum On-chain Data Highlights

More than 14 Million $ETH is being staked in the deposit contract – over 11.6% of all circulating ETH

The current circulating ETH is 120M, whereas 14M is locked. It can be seen in the data provided by Nansen that Lido received more than 4.23M stETH. Since The Merge had been conducted successfully on 15th September, the more attention from investors are easily observed.

The Merge is one of the most significant and anticipated upgrades in the history of Ethereum, and although in the long-term its impact will be felt by everyone, in the near term some folks will need to take action to be fully prepared.

The Merge represents the joining of the existing execution layer of Ethereum (the Mainnet we use today) with its new proof-of-stake consensus layer, the Beacon Chain.

It eliminates the need for energy-intensive mining and instead secures the network using staked ETH.

A truly exciting step in realizing the Ethereum vision – more scalability, security, and sustainability.

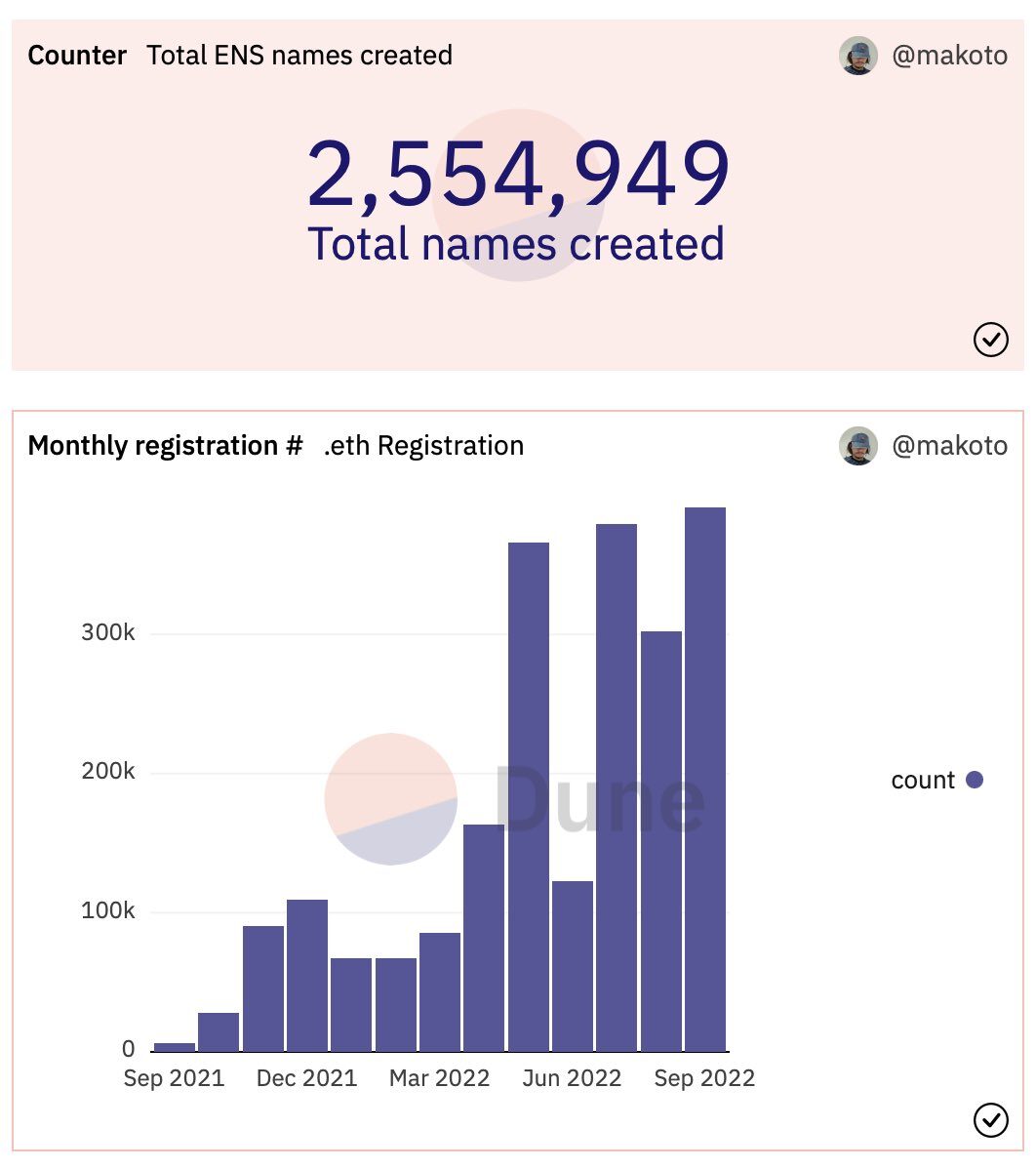

ENS domain registrations surpass 2.5 million

Ethereum Name Service (ENS) registrations have surpassed 2.5 million

September monthly registrations just hit an ATH as well

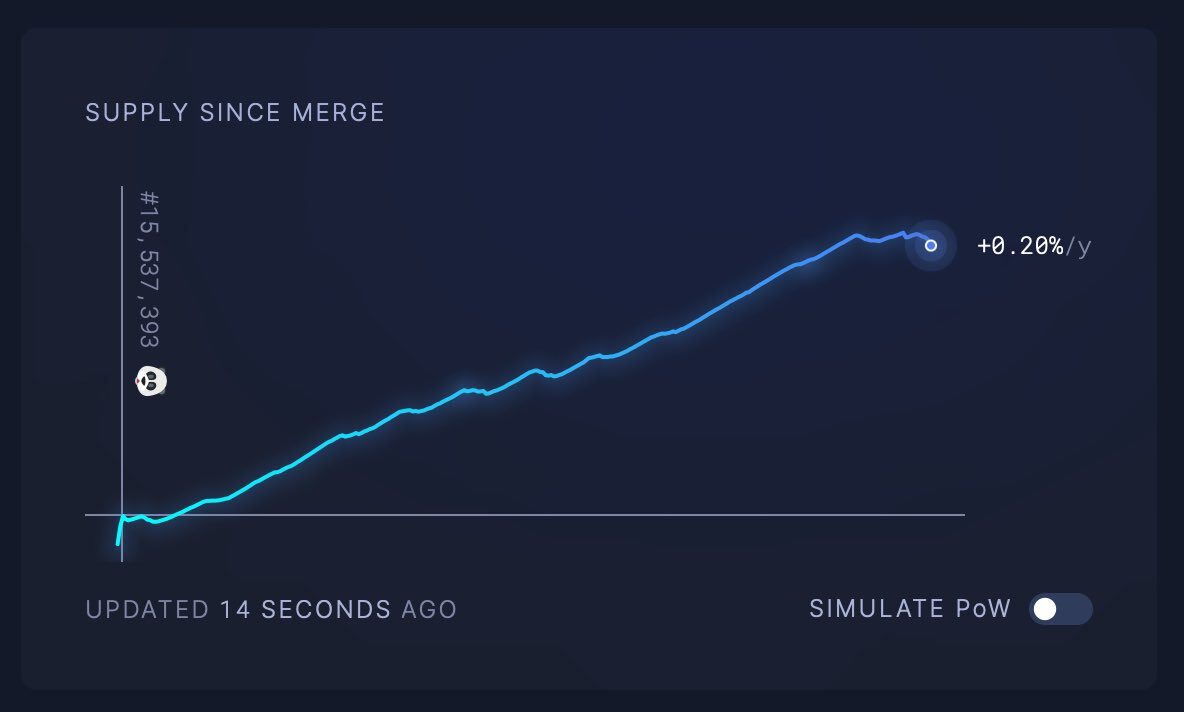

ETH burn has been larger than PoS issuance 86.5% out of the 415 days since EIP-1559 went live

Is Ethereum deflationary? 86.5% out of the 415 days since fee burn started, the burn has been larger than PoS issuance!

The chart shows all days since fee burn started, order by amount of burned ETH

Ethereum is either deflationary or inflationary block by block. The chart shows real numbers for how many days has burn has been larger than PoS issuance since we had both.

It can be seen at any periods of time when trying to build their estimates of fundamental value to Ethereum

ETH goes deflationary over a 24 hour period with 195 ETH ($258K) taken out of supply

The transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) will happen when a pre-announced total difficulty is reached by the chain. This is different from other forks which usually occur at a certain scheduled block number.

Though being predticed to be inflationary, ETH goes deflationary over a 24 hour period with 195 ETH ($258K) taken out of the total supply

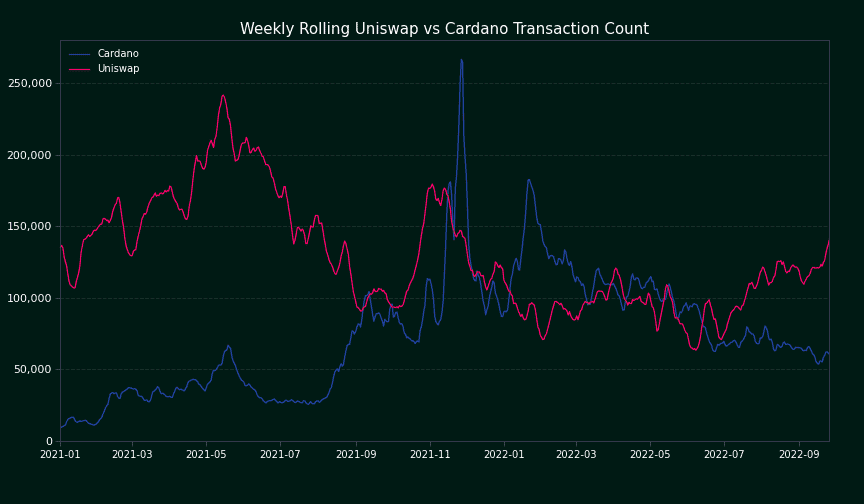

Uniswap is currently doing more transactions than Cardano

Not only does Cardano do less than one transaction per second…

Uniswap does substantially more transactions than Cardano

In fact, Uniswap is only the biggest Decentralized Exchange (DEX) in the whole Ethereum blockchain network. Therefore, it can be seen only one D-app is doing more transactions than a whole blockchain network – Cardano.

To sum up, from the on-chain statistics, it can be seen that there are many good signals for users to accumulate for joining the Ethereum ecosystem. In fact, it cannot be denied that Ethereum has proved itself in the cryptocurrency market since 2016 to be the top leading coin.

Social Signal updates for Ethereum

The Ethereum ecosystem is continually happy to be expanding and improving, regardless of how the market is performing. a summary of Ethereum’s achievements in general and important projects in particular.

Weekly Highlight News

Ethereum News

Loopring lists rETH

Sushiswap 2.0 UI is now live

Hashflow introduces the Hashverse

Stakewise announces StakWise V3 to help decentralize Ethereum

Loopring introduces L2 DeFi Port

Starkscan next generation StarkNet block explorer is now public

Additional Notable Events