The last 24 hours have been marked by a series of interesting activities for the leading altcoin Ethereum [ETH]. According to data from the on-chain analytics platform Santiment, during an intraday trading session on 25 October, an Ethereum whales address that had previously been inactive for over six years moved $22.2 million worth of ETH to an empty wallet.

The coin movement between addresses immediately led the price of ETH to jump by over 8%. This pushed the alt’s price above the $1500 price mark for the first time since the Ethereum merge six weeks ago.

🐳😲 An #Ethereum whale wallet that had not been active for 6+ years woke up today & moved $22.2M worth of $ETH to an empty wallet. $ETH‘s price is +8.1% since this transaction, briefly jumping over $1,500 for the 1st time since the #merge 6 weeks ago. https://t.co/bLwZZwhJSa pic.twitter.com/L78mAfJHq2

— Santiment (@santimentfeed) October 25, 2022

Still on an uptick at press time, ETH’s price was up by 10% in the last 24 hours, data from CoinMarketCap revealed. In addition, the coin’s trading activity also recorded significant traction as trading volume spiked by over 165% within the same period.

As of this writing, $32.80 billion worth of ETH has been traded in the last 24 hours.

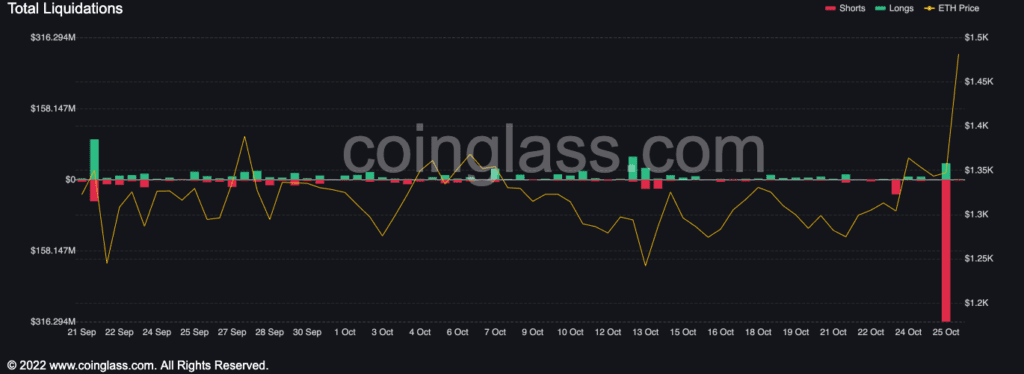

Interestingly, the surge in price led to increased liquidations by ETH holders in the last 24 hours. Of the $809.60 million taken out of the entire cryptocurrency market, ETH liquidations totaled $355.91 million, data from Coinglass showed.

This represented 44% of all monies removed from the market over the day.

Stacking ETH

ETH accumulation was the dominant activity on a daily chart at the time of writing. Key indicators were headed toward the overbought zones. Above the neutral line, ETH’s Relative Strength Index (RSI) was positioned in an uptrend at 66.80. The alt’s Money Flow Index (MFI) was 58.18, at the time of writing.

Further, the dynamic line (green) of ETH’s Chaikin Money Flow (CMF) ticked its spot at 0.08 at press time. Looking north as of this writing. It indicated that buying momentum continued to climb.

In addition, the asset’s Directional Movement Index (DMI) position showed that buyers had control of the market at the time of press. The buyers’ strength (green) at 30.56 rested solidly above the sellers’ (red) at 16.54.

Investors are happy

Per data from Santiment, ETH’s Market Value to Realized Value (MVRV) on a 1-day moving average showed that a sizeable number of coin holders held at a profit at press time. The MVRV was 1.27%.

Also, the spike in price in the last 24 hours led to a surge in positive bias toward the altcoin. As of this writing, ETH’s weighed sentiment posted a positive figure of 0.457.