ETH is showing strong signs of recovery after a recent meltdown of the crypto market. The parity was restored after a near 10% growth surged ETH above $2,000. Impressively, it has been able to hold this position after plunging below $1,700 in the past week. What can we expect from the flagship alt coin?

Is this revival or not?

It surely looks like a revival for ETH. After dropping to despair, Ethereum has come back to life with a point to prove. It is fresh from a near 10% growth and into familiar territory in the $2k range. This is a vote of confidence for the ETH investors who were expecting big changes in this season.

Stat-alert

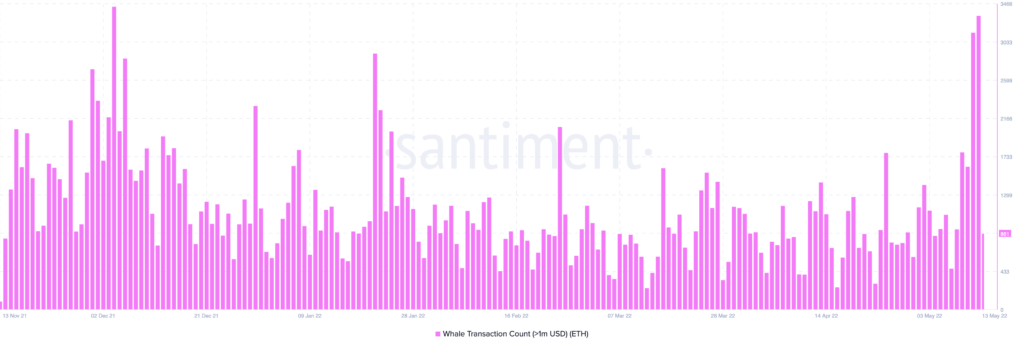

The recent data is particularly bullish for Ethereum with the whales being full swing. One might say, the strong whale movements have been responsible for the upward movement of ETH.

Whale transactions have crossed 3,000 the past two days, through 11-12 May suggesting a developing trend for days to follow.

The surge in whale movements has caused a consequent hike in transaction volume on the Ethereum network. According to data from Santiment, the transaction volume has shown a dramatic increase recently with volumes crossing 9 million on 11 May and 13 million on 12 May.

The RSI is another indicator potentially pointing towards a tide reversal. In the past 24 hours, the index value of RSI has surged to 40.5 from an oversold region of 19. As the RSI consolidates around this region, there is increasingly likelihood of a surge in prices for ETH soon enough.

Let’s hear it from the experts

Mark Cuban, the billionaire Shark Tank investor warned investors while talking to Fortune as he said,

“Don’t go overboard on crypto. Stocks are going through the exact same thing. When money is cheap, people have to put it somewhere and search for returns. When it’s no longer cheap and prices start to go down, people try to protect their gains.”