EthereumPoW (ETHW) was launched on Thursday but has fallen sharply since its listing, despite support from numerous exchanges.

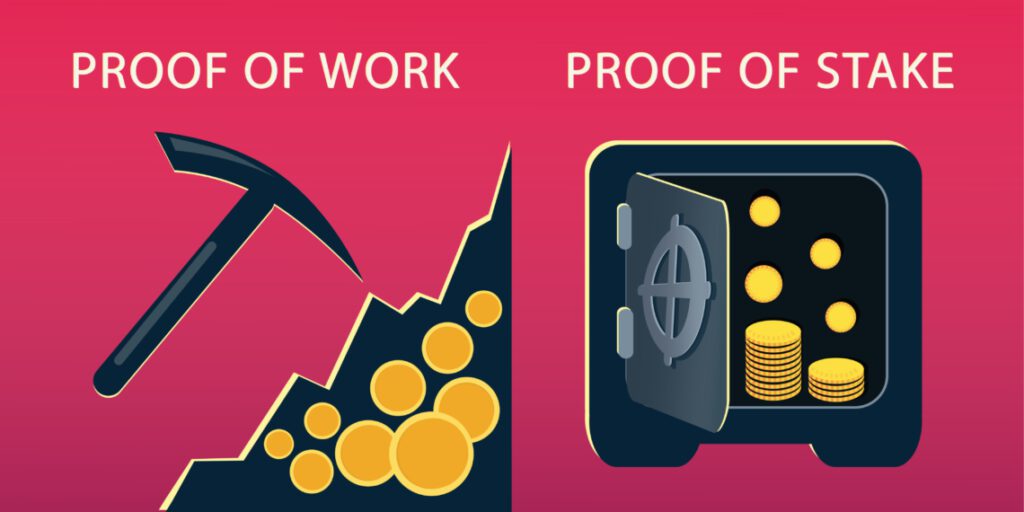

After the Ethereum (ETH) Merge went live, some miners decided to remain and support the proof-of-work (PoW) consensus. This will create a new fork and the launch of the ETHW mainnet. ETHW is a Layer 1 blockchain that preserves the pre-merge PoW consensus.

Some of the first exchanges to list the new coin were FTX, Kraken, Bybit, and Huobi. ETHW was distributed through an airdrop. While some of the biggest Ethereum mining pools, such as Ethermine have decided to shut down operations, more than 20 active mining pools focusing on ETHW.

The transition has not been completely smooth so far, since there was an issue with the proposed Chain ID, which was seemingly already used by a Bitcoin cash testnet.

With that in mind, it is interesting to look at the price movement since the listing, which has been bearish so far.

ETHW falls after listing

ETHW has been falling underneath a descending resistance since its opening day high $27.90. The downward movement led to a low of $11 the next day, before a bounce began.

However, the bounce was short-lived, and the price was rejected by the descending resistance line (red icon) the same day. ETHW has now nearly fallen to the $11 level once more.

The bounce since the lows was contained inside an ascending parallel channel. Such channels usually contain corrective movements, meaning that a breakdown from it would be expected.

ETHW did break down on Friday and validated the channel as resistance afterward (red icon). This is in alignment with the previously outlined descending resistance line.

If the downward movement continues, the closest support levels would be at $9.33 and $6.80, created by the 1.27 and 1.61 external Fib retracement levels, respectively.

For Be[in]Crypto’s previous Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.