They say you can’t always be the most talented in the room, but you can be the most competitive. Well, the Ethereum network seems to have adopted the same narrative. It seems, in 2022, one of the biggest stories in crypto-investing is going to be blockchain players that are expected to eat into Ethereum’s market share.

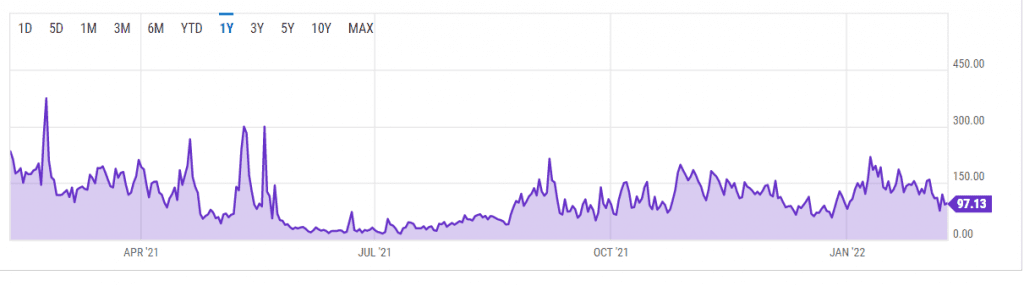

Even so, Ethereum is set to complete its biggest protocol change in history. Proof of Work (PoW), the environmentally unfriendly consensus mechanism will be replaced by the much more eco-friendly Proof of Stake (PoS) consensus mechanism. However, the problem of gas fees remains constant. In fact, Ethereum’s average gas price stood at 97.13 Gwei on 9 February, down from the recent high of 218.55 Gwei on 10 January.

Source: ycharts.com

Pricey ETH?

The network seems to be incorporating massive changes in order to keep up with its rivals. However, the price hasn’t been deceptive of the broader market trend. After the coin fell from its $4,000 top, the bulls struggled for demand. ETH saw a major sell-off post 20 January, signalling that investors couldn’t put faith in it at the time.

However, the selling pressure couldn’t sustain itself for long as ETH climbed up to its psychological level of $3,000 within a few days. While the RSI was hinting at buyer’s interest, the volume oscillator flashed a red flag with a reading of -23.85%, at the time of writing.

Expectations in check

Notably, the most pertinent question remains – Will Ethereum break past the $4,000-mark during this rally? Well, on-chain metrics speak volumes. In the chart below, a fairly simple metric has been taken into consideration. Further, the 14d Moving Average has been applied here in order to smooth out the daily noise.

Post January 2020, the number of active addresses has risen even on the back of a bearish price move. However, since the beginning of 2022, investors’ interest seems to have waned a little. It appears, investors who came in just for the hype and the gains have been flushed out of the market.

Interestingly, the level of activity in this bear market was higher than activities across previous bear market lows. All this potentially hints that there has been adequate demand, despite the downtrend.

In fact, the number of transactions has been decreasing even when ETH seems to be making a recovery post 24 January. This can be an area of concern as it speaks of a potential reversal in price, one that might happen going forward.

At the time of writing, 5.18 million addresses were out of money. This hinted that the investors have already cut losses. However, many have preferred opening their short positions, despite a recent uptick.

It is also to be noted that Ethereum’s correlation with BTC has seen a rise lately. This might come off as a piece of good news to investors since BTC is on an upward trajectory too.

Notably, at the time of writing, 24.68 million ETH remained with the whales. And, there hasn’t been any significant movement from their end. On-chain metrics as a whole seem to be giving mixed signals at this time. However, the drawdown is definitely not coming to an end with a price rally directly towards its all-time high.