Ethereum just concluded the blockchain industry’s most anticipated event of 2022. The Merge garnered a lot of hype, especially in the last weeks but the entire period turned out anticlimactic for ETH’s price action.

ETH failed to deliver a meaningful rally despite heavy expectations ahead of the Merge event. Cryptocurrencies have historically been bullish in the days ahead of a major upgrade to their native blockchain network.

ETH leveraged long positions may have had something to do with its unenthusiastic price action. Initial post-Merge reports suggest that ETH might be about to take a bullish turn.

Reportedly, ETH produced deflationary results after positive Merge reports.

#ethereum is already deflationary in the first minutes after The Merge! pic.twitter.com/y0FYQYmk2R

— Lark Davis (@TheCryptoLark) September 15, 2022

The Merge did at least yield a stronger long-term outlook. This is due to the combination of factors such as deflationary characteristics coupled with better POS tokenomics. The declining ETH supply will contribute to more value for the cryptocurrency, especially if it can secure more demand.

Unfortunately, the bullish expectations have so far not had any impact on ETH’s short-term price action. This might have something to do with the fact that some of the largest whales have been suppressing the price.

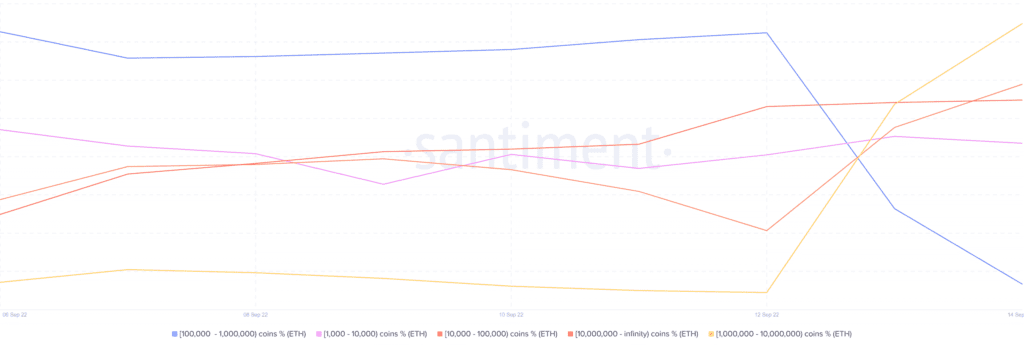

ETH’s largest whales (addresses with more than 100,000 coins) currently own the lion’s share of the cryptocurrency in circulation.

However, the same group has been selling its holdings since 12 September. Thus, contributing to the prevailing sell pressure.

Meanwhile, the other whale categories were bullish during the same three-day period but their impact was limited.

Is ETH demand on a recovery path?

Ethereum recorded a net increase in the number of new addresses since 4 September. This reflects the positive expectations ahead of the Merge even though the buying volumes were not enough to offset the selling pressure.

The number of addresses holding more than 1,000 ETH also grew in the last 10 days. It reflects the buying pressure from some of the whales and could be a sign that ETH demand is slowly recovering. This level of demand would yield a strong upside if whales pump the brakes on trimming their balances.

There are still some concerns about the Merge despite the successful outcome. One of those concerns is staking pool decentralization. More than 55% of ETH’s total supply is currently in four of the top staking entities including LIDO.

We profiled a few more entities.

Total ETH staked 13.7M

10M ETH in known providers –> 73%

8.13M in Top 4 –> 59.3%

4.17M in Lido

1.92M in Coinbase

1.14M in Kraken

0.9M in Binance pic.twitter.com/shloQzaIVt— _Checkɱate 🔑⚡🦬🌋☢️🛢️ (@_Checkmatey_) September 15, 2022

Well, concerns arise regarding the centralized nature of some of these entities and the potential risks involved. However, Ethereum’s PoS just went through its birth stage and is expected to become more decentralized over time.