Ethereum price edges higher with minute gains. The price opened lower but quickly recovered to test the session’s high. ETH extends the recovery following the previous session’s sell-off.

- Ethereum price prints respectable gains on Monday.

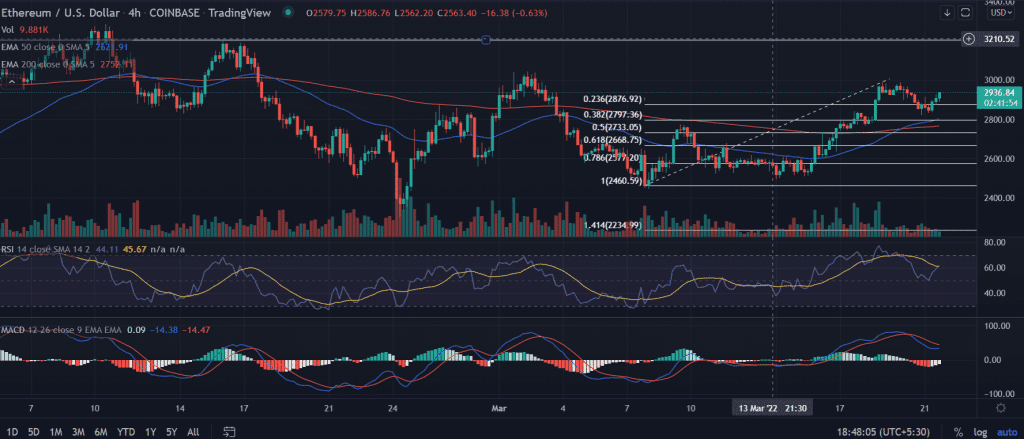

- Expect a downswing in the price on a break below the 0.23% Fibonacci Retracement level.

- A daily close above $3,000 will set the direction for another leg up.

As of publication time, ETH/USD is trading at $2,898.05, up 1.32% for the day. The 24-hour trading volume stands at $13,934,780,993 as per the CoinMarketCap.

Ethereum price trades near crucial support

On the 4-hour chart, Ethereum’s price is struggling near the $2,900 mark after retracing from the $2,987.0 made on March 19. A renewed buying pressure will push the price into a higher trajectory toward $3,000.

Ethereum price is sitting comfortably above the 50-day and 200-day SMA (Simple Moving Average). Thus, making bulls comfortable about the upside momentum in the short-term.

A decisive close above the $3,000 crucial level will set the path for the horizontal resistance level at $3,200.

On the flip side, a fall below the 0.23% Fibonacci retracement level at $2,876.92 will reverse the current upside. On the downside, the interim target is placed at $2,795.22. Furthermore, a dive below the 200-EMA at $2,723.70 will find the support at $2,733.05.

ETH has depreciated nearly 65% from the record highs made on November 10. After breaking the crucial $3,200 support level, ETH tested a record low on January 22 at $2,301.60. Bulls attempt to break away from the support-turned-resistance on February 9 but failed to do so.

Technical indicator:

RSI: The daily Relative Strength Index approaches toward the average line with a bullish bias.

MACD: The Moving Average Convergence Divergence trades above the midline. An uptick in the indicator will make the bulls hopeful.