A new crypto study has found that major obstacles await crypto adoption across the world. Bitstamp, a global cryptocurrency exchange, carried out the survey of over 23000 retail and 5000 institutional respondents. Major obstacles have been pointed out in the study for different regions across the world.

For most respondents in the EU and UK, risk and lack of awareness remain the biggest concerns over crypto adoption.

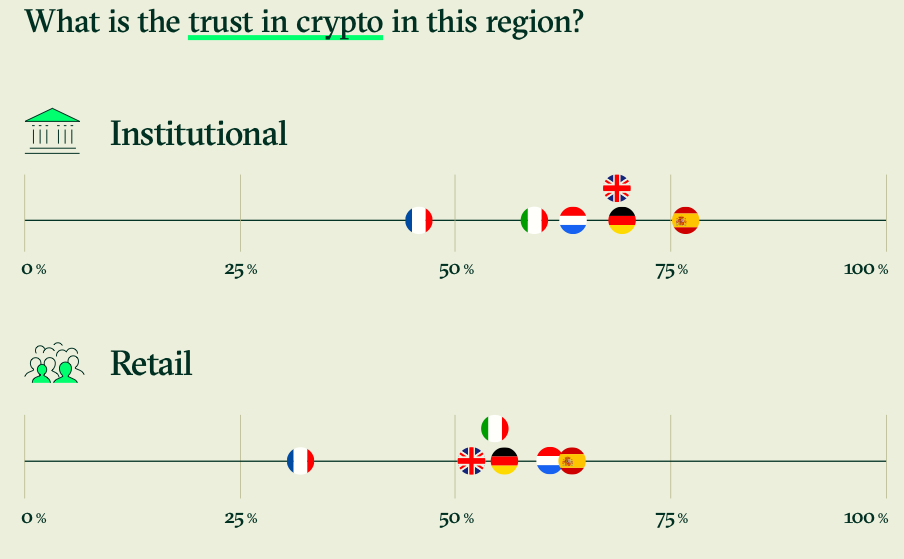

As per the report, these region represents a unique challenge for adoption. There is more than 50% of the trust level in crypto among both retail and institutional investors.

More than two in five investors said they didn’t know enough, whilst one-third of institutions felt risk and volatility were too high. It is to be noted here that there is definitely a lack of awareness regarding the industry in the region which needs to be prioritized for any growth.

Also, there are apprehensions in the EU after the recent crypto trading ban on uncustodied wallets. Officials suggest it is an initiative aimed at curbing money laundering leaving the crypto community in disarray.

There is optimism in the macro scale however. Over two-thirds of retail investors believe crypto will become mainstream within a decade. An overwhelming majority of 78% of institutional investors further agree on this note.

Government support recently across many states has further renewed hope for crypto after clampdowns from major economies of China and India.

Here’s a case study

In a recent development, the southern Mediterranean-based British territory is pushing to become a crypto hub in the region. Gibraltar passed a crypto regulation on Wednesday to battle market manipulation and insider trading.

Recently the Gibraltar Stock Exchange agreed to a takeover by blockchain firm, Valereum. Once this is underway, it would make Gibraltar the first country to have a regulated share and crypto trading exchange.

The Gibraltar Financial Services Commission said firms must combat “manipulation or improper influencing of prices, liquidity or market information, or any other behavior which is inimical to market integrity.”

Albert Isola, Gibraltar’s Minister for Digital and Financial Services, opined,

“We were the first jurisdiction in 2018 to launch the legal and regulatory framework, and we’re now the first jurisdiction to launch a framework for market integrity.”