Exactly one year ago, on Jan. 9, 2021, Cointelegraph launched its subscription-based data intelligence service, Markets Pro. On that day, Bitcoin (BTC) was trading at around $40,200, and today’s price of $41,800 marks a year-to-year increase of 4%. An automated testing strategy based on Markets Pro’s key indicator, the VORTECS™ Score, yielded a 20,573% return on investment over the same period. Here is what it means for retail traders like you and me.

How can I get my 20,000% a year?

The short answer is – you can’t. Nor can any other human. But it doesn’t mean that crypto investors cannot massively enhance their altcoin trading game by using the same principles that underlie this eye-popping ROI.

The figure in the headline comes from live testing of various VORTECS™-based trading strategies that kicked off on the day of the platform’s launch. Here is how it works.

The VORTECS™ Score is an AI-powered trading indicator whose job is to sift through each digital asset’s past performance and identify multi-dimensional combinations of trading and social sentiment metrics that are historically bullish or bearish. For example, consider a hypothetical situation where each time Solana (SOL) sees an extra 150% of positive tweet mentions combined with a 20% to 30% in trading volume against a flat price, its price spikes massively within the next two to three days.

Upon detecting a historically bullish arrangement like this one in, say, SOL’s real-time data, the algorithm will assign the asset a strong VORTECS™ Score. The conventional cutoff for bullishness is 80, and the more confident the model is that the outlook is favorable, the higher the Score.

In order to get a sense of how the model performs, starting from day one the Markets Pro team live-tested a number of hypothetical trading strategies based on “buying” all assets that cross a certain VORTECS™ Score and then “selling” them after a fixed amount of time.

These transactions were executed in a spreadsheet rather than an exchange (hence no fees to eat off the gains), 24/7, and involved complex algorithmic rebalancing to ensure that at any given moment all assets that hit a reference Score are held in equal shares in the portfolio. In short, following these strategies was something only a computer could do.

The winning strategy, “Buy 80, Sell 24 hours” entailed buying every asset that reached the Score of 80 and selling it exactly 24 hours later. This algorithm yielded a hypothetical 20,573% of gains over one year. Even among other humanly impossible strategies, it is an outlier: the second-best one, “Buy 80, Sell 12 hours,” generated 13,137%, and number three, “Buy 80, Sell 48 hours,” yielded a “mere” 5,747%.

Down to earth

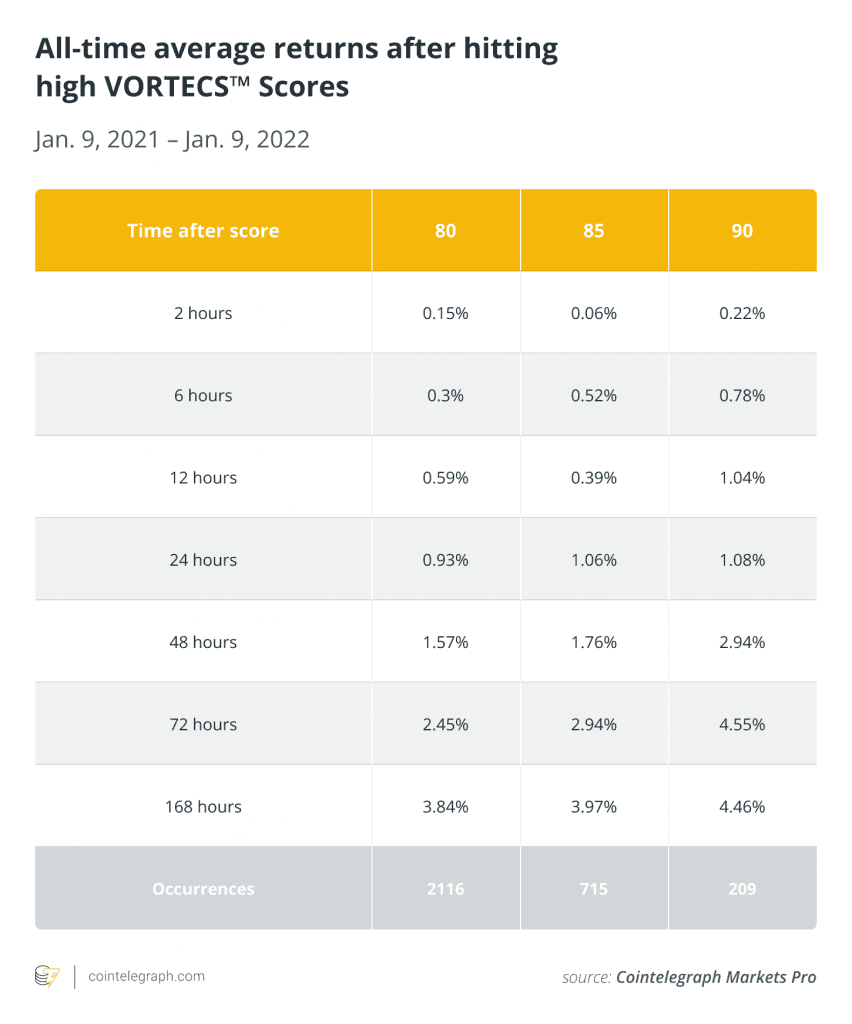

What these insane numbers show is that the returns that high- VORTECS™ assets generated compounded nicely over time. But what’s the use if real-life traders could not replicate the compounding strategy? A more practical way to look at the VORTECS™ model’s performance is through average returns after high Scores. No fancy rebalancing, just a plain average price change that all high-scoring tokens demonstrated X hours after reaching the Score of Y. Here are the numbers:

These look much more modest, don’t they? However, if you think of it, the picture that these averages paint is no less powerful than the mind-blowing hypothetical annual returns. The table demonstrates robust positive price dynamics after high Scores, averaging across all types of assets and in all market situations that occurred throughout the year.

The trend is unmistakable: tokens that hit VORTECS™ Scores of 80, 85, and 90, tend to appreciate within the next 168 hours. Higher Scores are associated with greater gains: the algorithm’s stronger confidence in the bullishness of the observed conditions, indeed, comes with greater yields (although higher Scores are also rarer). Another important factor is time: the longer the wait after a reference threshold is reached, the greater the average ROI.

In this sense, rather than trying to follow the complex “Buy 80, Sell 24 hours” algorithmic strategy (which is, again, a futile exercise), real-life traders could maximize their fortunes by buying at higher Scores and holding for longer times.

Varying predictability

A separate stream of internal Markets Pro research looked at whether some coins are more prone than others to exhibit historically bullish trading conditions before dramatic price increases. This turned out to be the case, with tokens like AXS, MATIC, AAVE and LUNA leading the pack in terms of the most reliable positive price dynamics following historically favorable setups. Overall, the majority of frequent high-VORTECS™ performers delivered robust positive returns.

After a full year in operation, these disparate pieces of quantitative evidence – the mind-bending ROIs of algorithmic live-testing strategies, high-VORTECS™ assets’ sound average gains, and individual coins’ steady average returns after high Scores – present a compelling case for the utility of the “history rhymes” approach to crypto trading.

Obviously, a favorable historic outlook, captured by a strong VORTECS™ Score, is never a guarantee of an impending rally. Yet, an extra pair of algorithmic eyes capable of seeing through and comparing across billions of historical data points to alert you of digital assets’ bullish setups before they materialize can be an incredibly powerful addition to any trader’s toolkit.

Cointelegraph is a publisher of financial information, not an investment adviser. We do not provide personalized or individualized investment advice. Cryptocurrencies are volatile investments and carry significant risk including the risk of permanent and total loss. Past performance is not indicative of future results. Figures and charts are correct at the time of writing or as otherwise specified. Live-tested strategies are not recommendations. Consult your financial advisor before making financial decisions.