- Exodus Class A common shares can now be traded on Securitize, a SEC-registered platform.

- Exodus’ Class A common stock (EXOD) is digitally represented on the Algorand blockchain via common stock tokens.

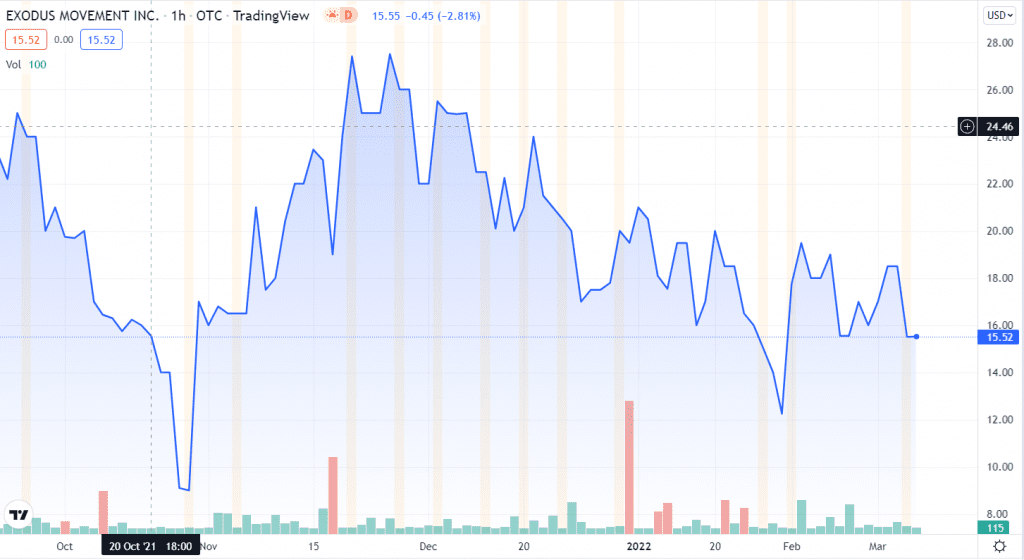

- EXOD is currently trading at $15.52, down 16.1%.

Prominent cryptocurrency wallet provider Exodus is now trading on a SEC-registered platform.

The major cryptocurrency wallet software company has gone public on a SEC-registered platform, Securitize Markets, following a $75 million crowdfund capital raise.

Investors from all across the US, as well as international investors from more than 40 countries can now trade Exodus Class A common stock (EXOD) after Exodus’ shares started trading on Securitize beginning March 16.

EXOD is digitally represented on the Algorand blockchain via common stock tokens.

According to an Exodus spokesperson, Securitize Markets is the second trading platform to list Exodus shares following a launch on tZero in September 2021. The new Securitize listing allows the firm to onboard new retail investors whilst also raising funds.

Jp Richardson, the CEO and co-founder of Exodus, said:

Securitize’s platform enabled us to onboard over 6,800 mostly retail investors and raise $75 million. Now, with the trading of Exodus shares on their platform, it’s all under one roof. We are very excited about the increased ability to trade our shares.

The Securitize platform was previously registered by the SEC as a transfer agent in 2019. The digital securities platform is backed by major cryptocurrency companies including Coinbase, Morgan Stanley investment funds, and Blockchain Capital.

As can be seen from the chart above, EXOD is trading at $15.52 at the time of writing. Initially, EXOD was trading at $27.42 per unit when the company launched back in 2015.

Last week, Exodus reported nearly $96 million in revenues for the 2021 fiscal year, which is a 350% year-over-year increase.