Bitcoin has suffered a lot over the past two weeks. It traded in the red early on 23 February thanks to the uncertainty around the Russia-Ukraine crisis. Russia’s actions towards Ukraine have prompted the United States and Europe to vow sanctions. This has cast a long shadow over global markets, including cryptocurrencies.

In fact, as a recent article highlighted, BTC has faced several headwinds of late. These have ranged from dwindling demand on-chain to over 4.7M BTC held at an unrealized loss.

Looking at the bright side

Despite the aforementioned hiccups, Bitcoin proponents have a few optimistic narratives to dish out for the flagship coin. Bloomberg’s Senior Commodity Strategist Mike McGlone, for instance, posted a tweet picturing BTC’s sheer buying opportunity.

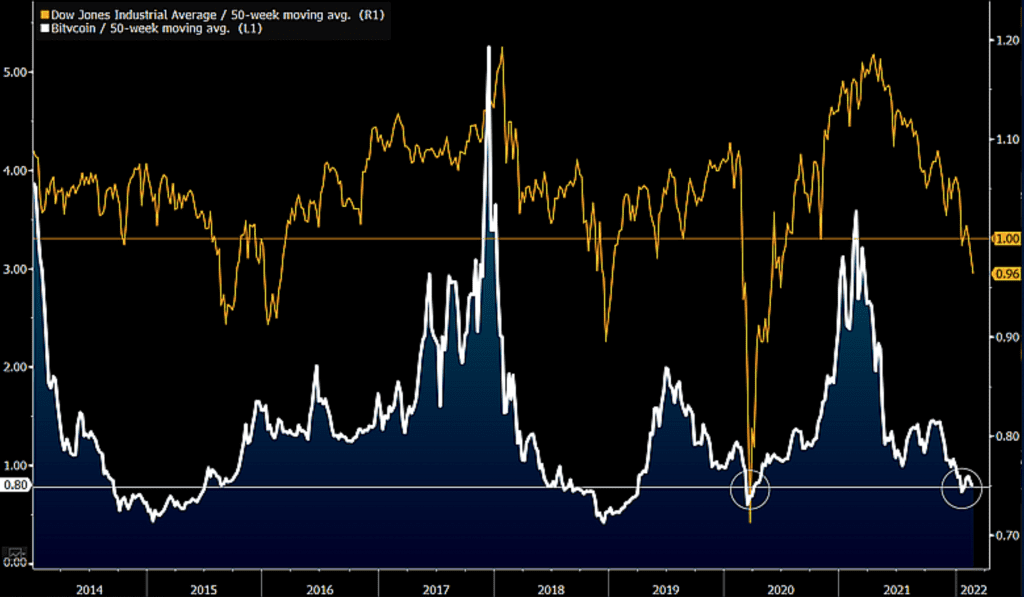

Bitcoin is currently on-sale relative to “its annual average since the 2020 and 2018 lows,” he argued, with the same underlined by the following chart.

Source: Twitter

McGlone asserted,

“About 20% below its 50-week MA, Bitcoin is approaching too-cold levels that have often resulted in good price support. Our graphic depicts the most extreme discount for the crypto vs. its annual average since the 2020 and 2018 lows. On 22 February, the Dow Jones was close to parity.”

Here, the Dow Jones Industrial Average, or simply the Dow, is a price-weighted measurement stock market index. It incorporates 30 prominent companies listed on stock exchanges in the United States. Ergo, if the attached graph is taken into consideration, the stock market might be more vulnerable than Bitcoin.

Talking about various demand zones (buy-zones), on-chain analysis firm Whalemap added some stats to supplement the argument. BTC wallets, for instance, saw heavy inflows over the past four months as per the tweet below.

Areas of whale interest are very well defined now.

34k awaits below 36-37k

Macro trend reversal above $48,500

Picture below includes everything one should know about current important supports and resistances pic.twitter.com/yx38hpfY9a

— whalemap (@whale_map) February 22, 2022

What if?

Well, things could go south as well IF Bitcoin fails to achieve the set goals. Popular crypto-trader Rekt Capital, for example, cautioned its 290k+ Twitter users about the worst-case scenario.

“Bitcoin is in the process of trying to turn the ~$38,000 area into support If it fails to do that & ~$38K turns into resistance. Bitcoin will confirm a return to the $28K-$38K range which was home to consolidation in Q1 & Q2 in 2021. Until then – retest in progress.”

Overall, Bitcoin investors have something to look forward to. Especially after more than a quarter of all network entities were underwater on their position.