The Fantom Ecosystem detailed report of Q3/2022 on Network Activity, Highlights Events & Projects, and Future Projection.

Key Takeaways

- The main theme of the Fantom ecosystem in Q3 is Building and Upgrading

- Fantom On-chain activities in Q3 had a relatively large decline compared to the first two quarters of the year. However, there are still some bright spots

- The biggest crypto event in Q3 – The Merge has some short-term impact on Fantom

- Spirit Swap released a v2 model with a unique mechanism

- Magic Craft & Hector Network – two great spotlights of the Fantom ecosystem in Q3

- DeFi protocols on Fantom need a breakthrough to regain their glory days

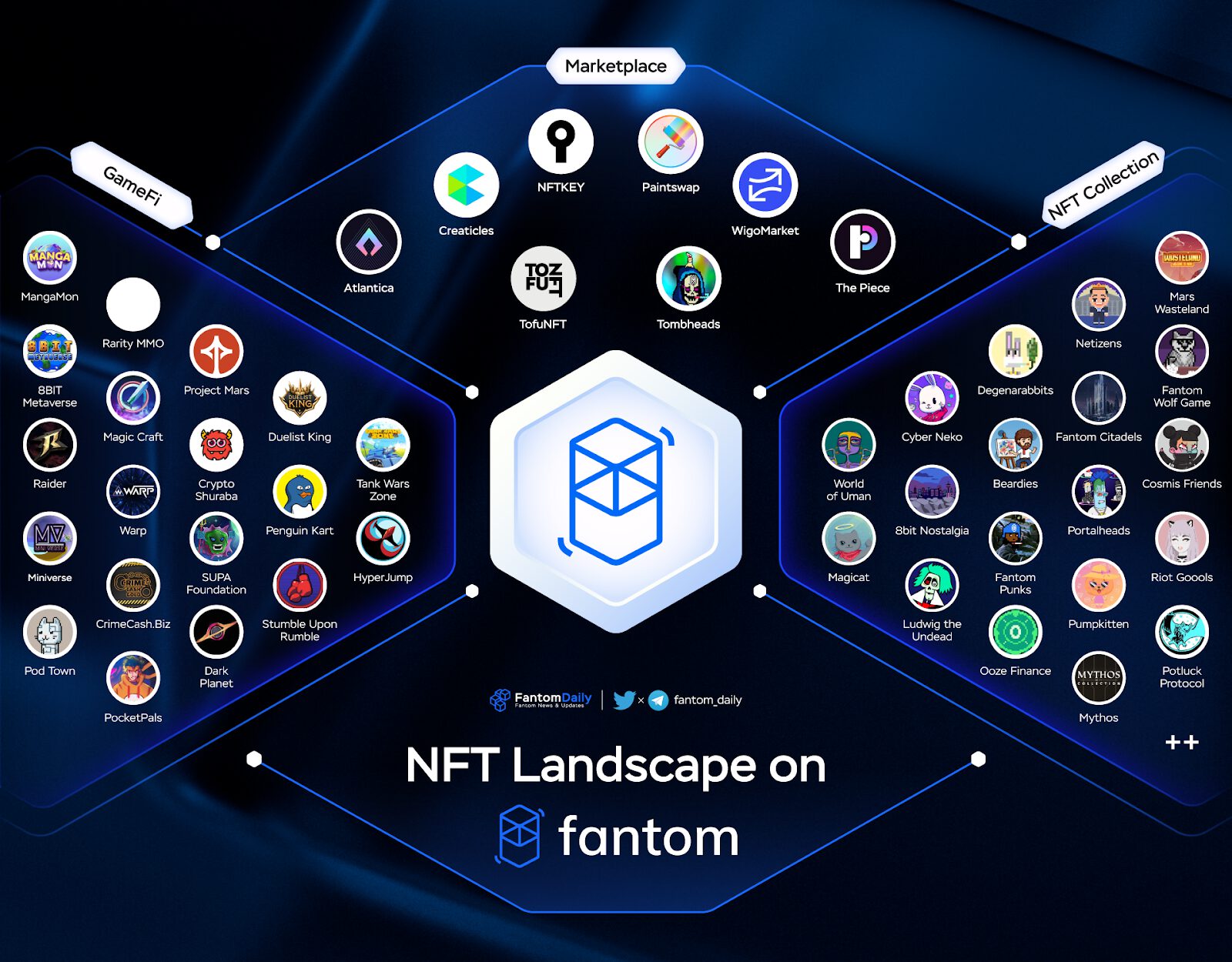

- Q3 2022 showed the potential of NFT and GameFi on Fantom. However, this category needs a tipping point to become the next big thing

Introduction

Fantom is an EVM-compatible smart contract blockchain platform with a Lachesis consensus mechanism. With the fast transaction speed & low gas fees benefit from Lachesis, Fantom has a thriving ecosystem with numerous native DeFi protocols,

The bearish situation from the last Q2 seems to cool down in Q3 2022. The main theme of Fantom this quarter is Building and Upgrading. Fantom chooses the vertical scaling method to improve core technology and solve current problems.

Network Activity

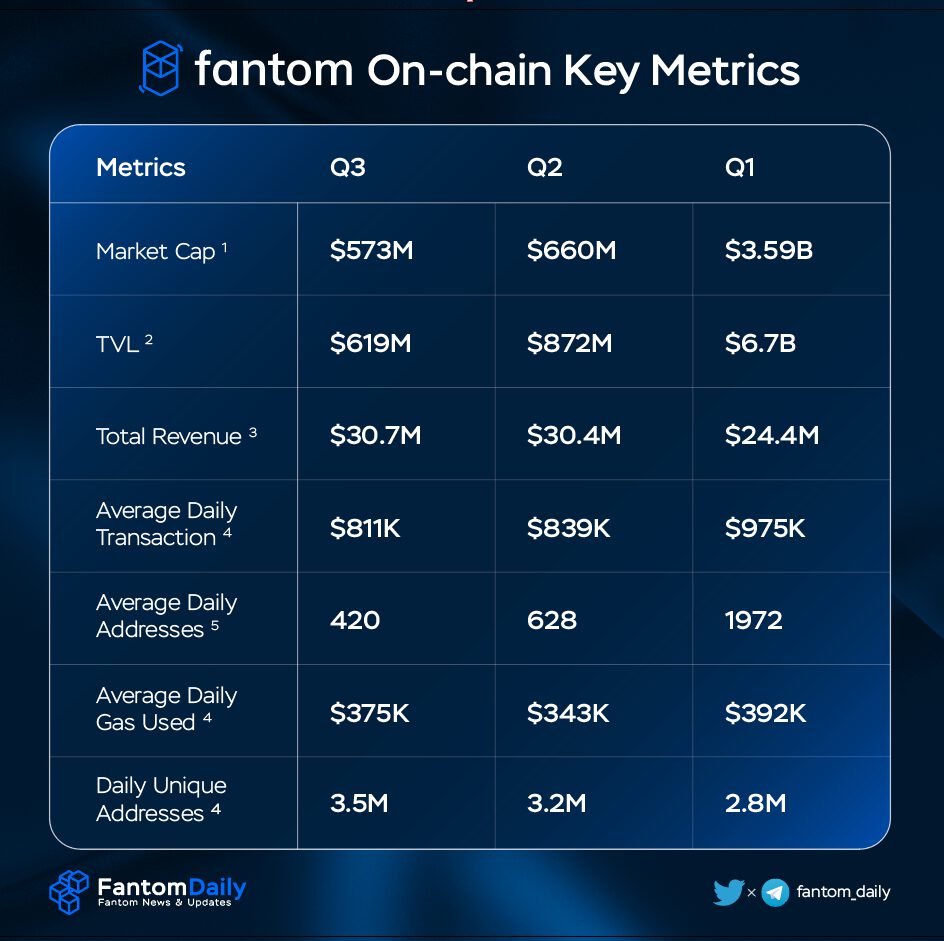

Key on-chain metrics

After the Q2 plummet with the macro-induced meltdown and Terra’s collapse, the storm has passed in this quarter. Fantom experienced a stabilized status at a relatively low level compared to previous quarters. Although there were some rebounds, Fantom has still struggled to regain the previous level.

Market Cap and Total Value Locked have received significant declines, especially if we compare them to Q1. The Average Daily Transaction and Average Daily Active Addresses received a slighter decrease.

Fortunately, there are some positive signals. Total Revenue has still steadily grown, while the Average Daily Gas Used rebounded, reaching close to Q1, even though the gas fee of Fantom has been significantly reduced since the Snapsync update.

The Daily Unique Addresses of Fantom has also reached a new milestone in this Q3 – 3.5 million Unique Addresses. This is a prove of the activeness of Opera Chain.

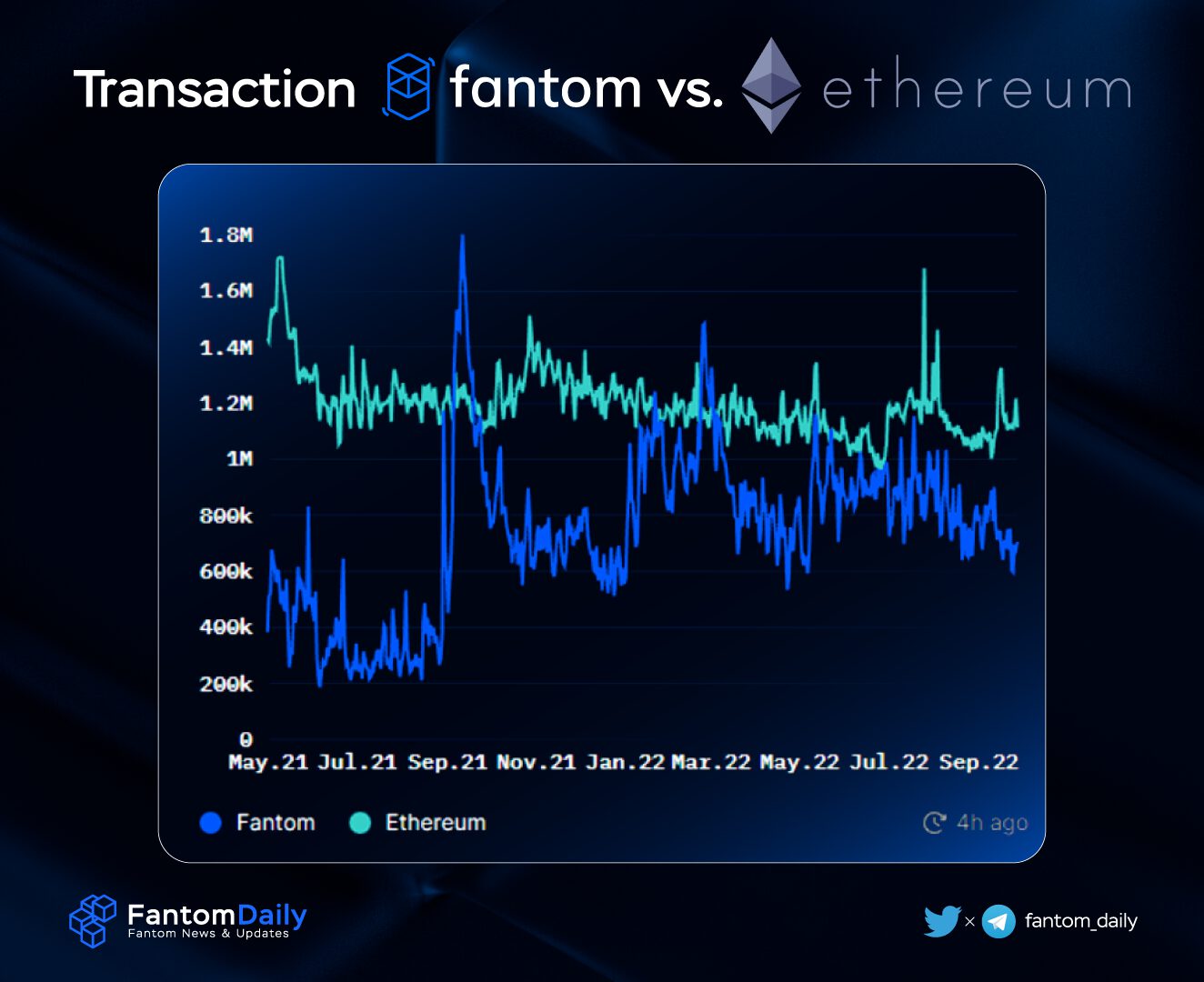

Transactions vs Ethereum

While The Merge’s spotlight helps Ethereum maintain its daily transactions in a stable state; those of Fantom have gradually declined in Q3. However, the fact that Fantom can maintain many daily transactions close to Ethereum is still a positive sign.

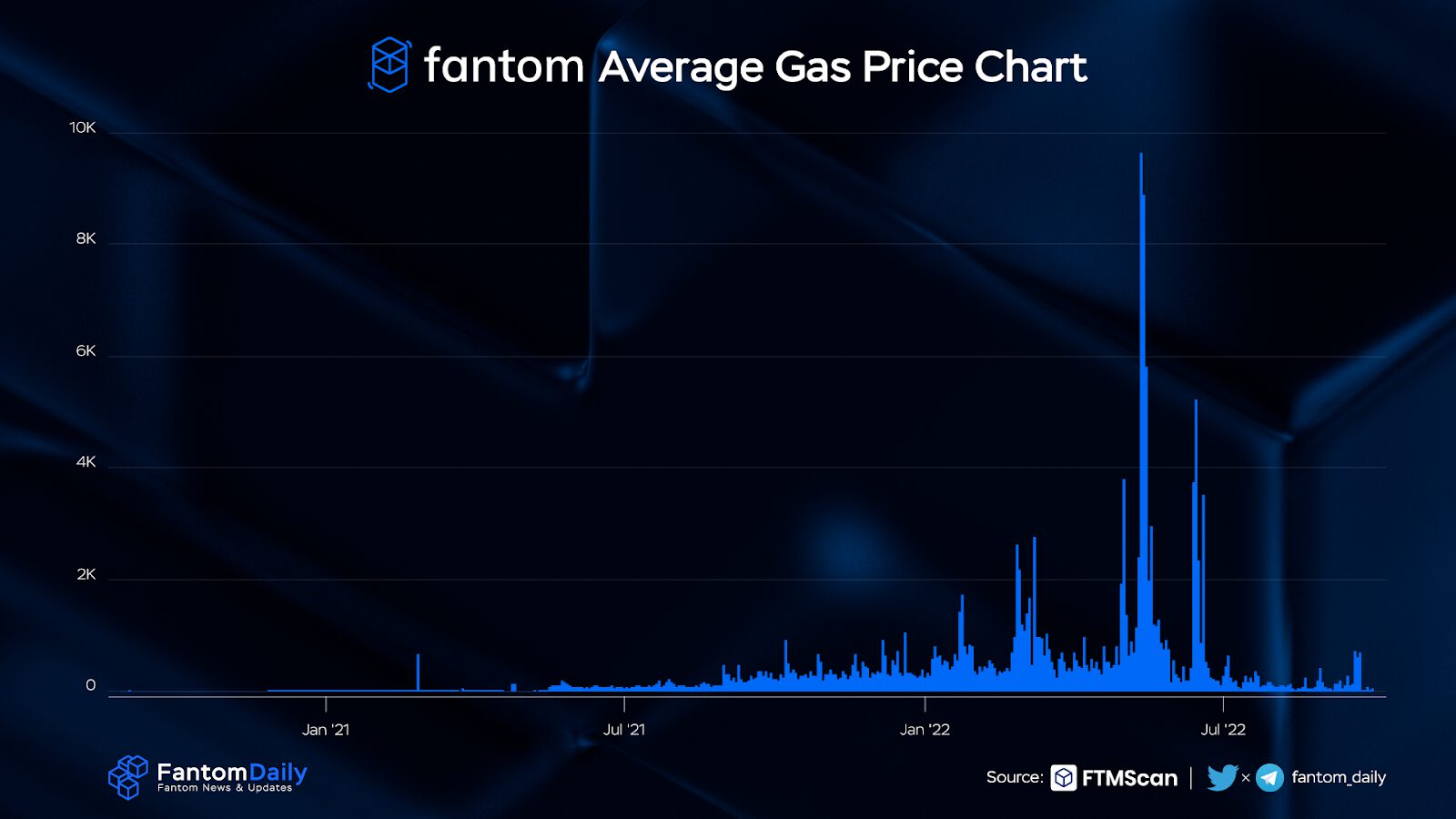

Average Gas Fee

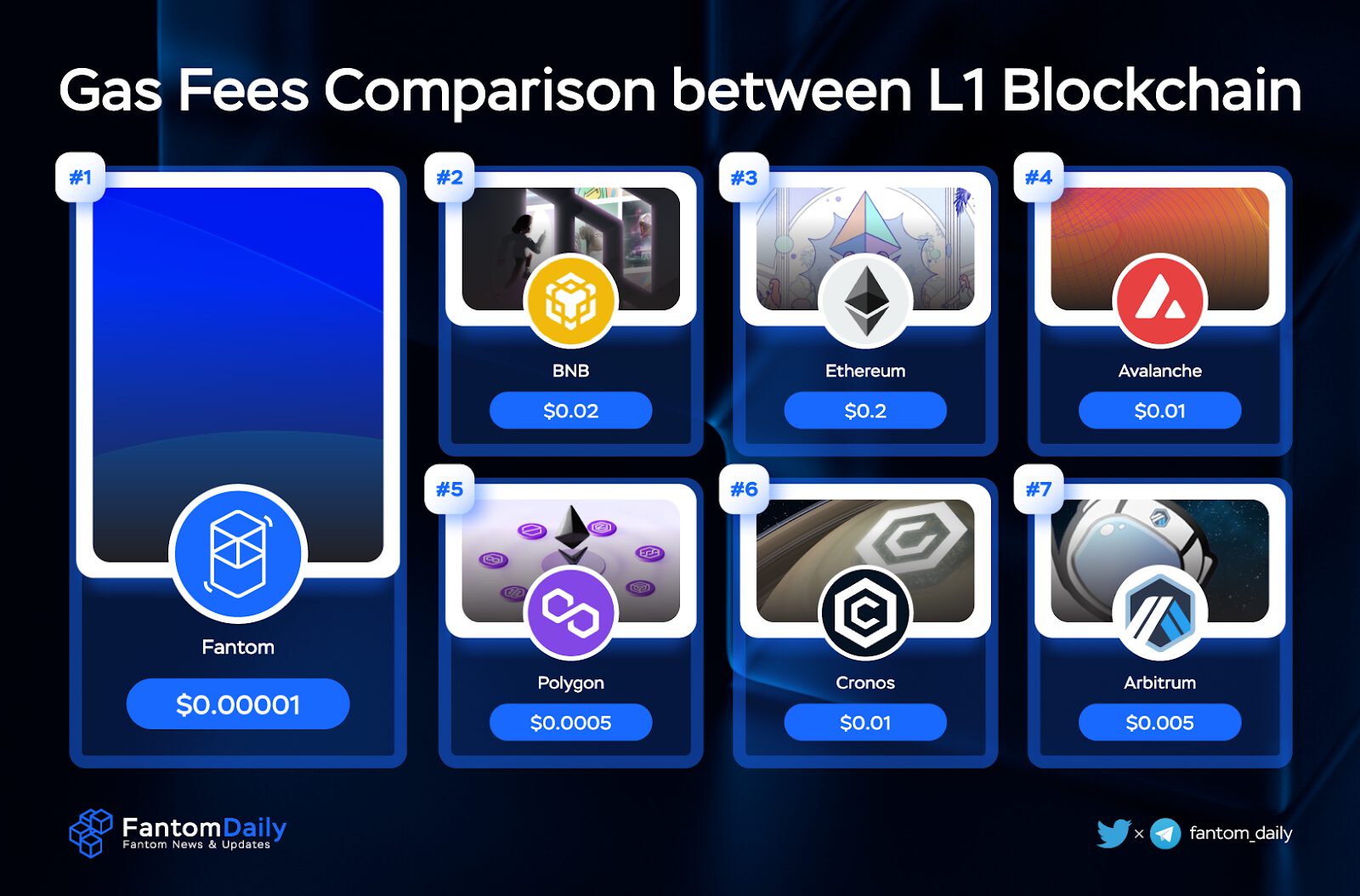

With the Snapsync upgrade, gas fees on the Fantom Opera network are significantly reduced, at least 10 times cheaper. the Average Gas Fee in Q1 and Q2 was around $0,00003, in Q3 users now only have to pay a $0,000001 gas fee for a transaction on Fantom.

Fantom is now currently one of the Layer-1 Blockchain with the cheapest gas fee on the market, far cheaper than other EVM-Blockchain such as Ethereum, BNB Chain, Polygon, or Avalanche; and can now compete with Solana

Total FTM Burned

Fantom has burned 30% of its transaction fees since May 2022. The FTM supply will now be reduced throughout the time, which means FTM is deflationary, and the price will increase in the ideal condition.

Currently, FTM has been burned forever from the token supply at the time this report is written.

Ecosystem Breakdown

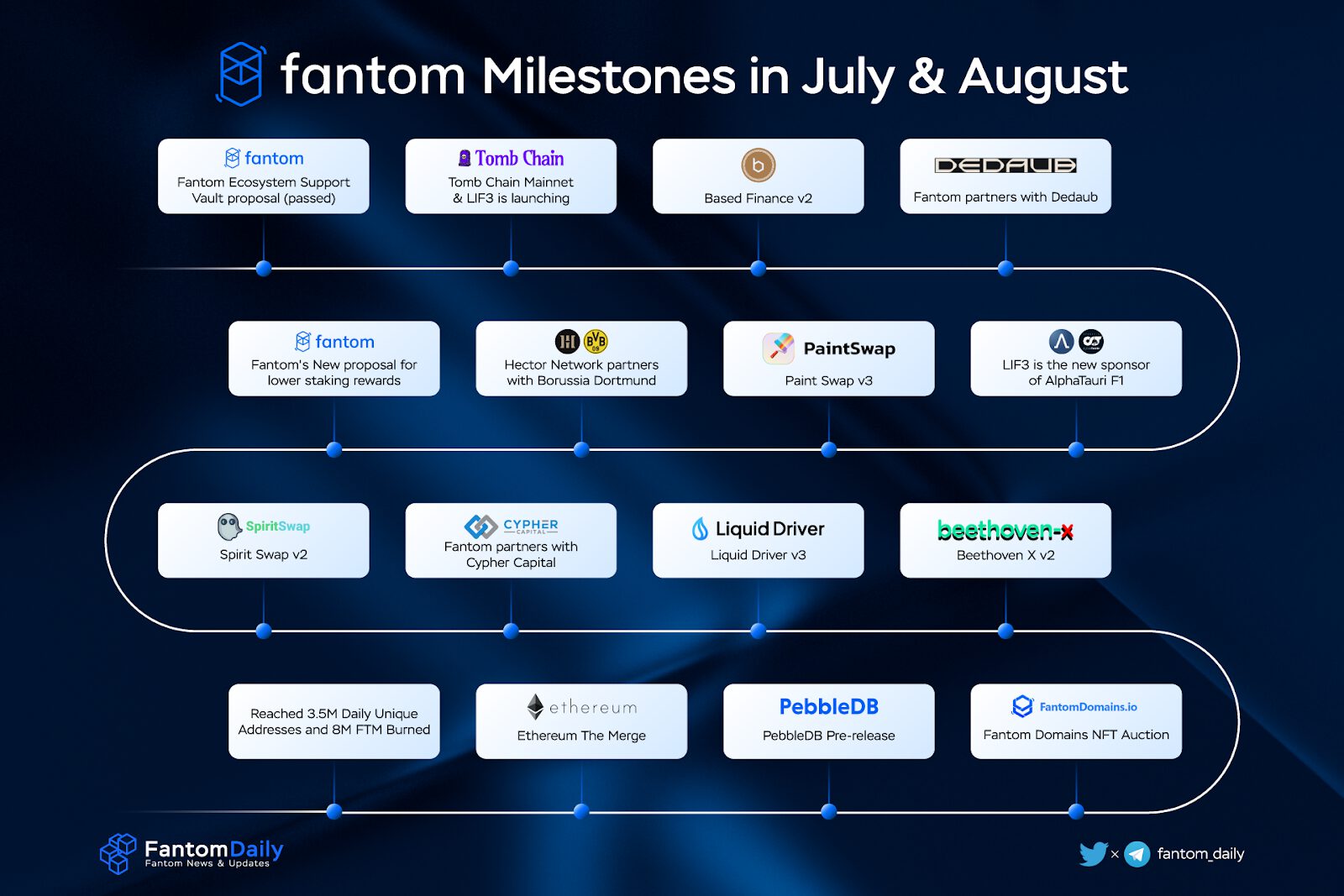

With the main theme being Building & Upgrading, there are many project updates, notable news, events, and partnerships that happened in Q3 2022 of the Fantom ecosystem.

Highlight Events

July

- Strongblock launches new Fantom nodes

- Fantom partners with Mapleblock Capital to support the ecosystem

- Smart Contract Security Tool Watchdog will deploy on Fantom

- Fantom’s Ecosystem Support Vault

- Fantom Blockchain Expo Vietnam

August

- Fantom governance proposal: Lower Staking Rewards

- Node service provider Blockdaemon added Fantom support

- Fantom partnered with Cypher Capital

- PaintSwap released V3 of their NFT marketplace

- SpiritSwap v2 is released

- Hector Network announced a strategic partnership with Borussia Dortmund

- Fantom partnered with GDA Capital

- Liquid Driver v3 is released

- WigoSwap released the new NFT Marketplace: WigoMarket

September

- Ethereum’s The Merge

- Fantom Domains released a big update & NFT Auction on Paintswap

- Fantom TVC on Bloomberg, Newsmax, and Fox Business

- Fantom Pebble DB Pre-release

- Reached 3.5M Daily Unique Addresses and 8M FTM Burned

Highlight Event: Ethereum’s The Merge & The Effects to Fantom

The Merge upgrade is Ethereum’s migration from a “Proof-of-Work” consensus mechanism to a “Proof-of-Stake”. The purpose is to reduce Ethereum’s power consumption while increasing decentralization, scalability, and security.

For Fantom, The Merge has some short-term impacts. Ethereum can get all the spotlights & drain liquidity and users from other blockchains. Also, in such a big event, high market volatility is inevitable, as Ethereum is the altcoin leader.

However, The Merge would not transaction speed & gas fees. At least until Ethereum completes all five of its major updates, Fantom will not be affected much.

Highlight Event: Fantom’s Ecosystem Support Vault

The Ecosystem Support Vault empowers the Fantom community of validators and stakers as part of the ongoing decentralization evolution of Fantom. This Vault will offer a different route for supporting ideas, initiatives, and creations on the Opera network through community-driven decisions.

Since this proposal was passed, now ⅓ of the existing 30% burn rate from transaction fees (or 10% of transaction fees) will be diverted to the vault.

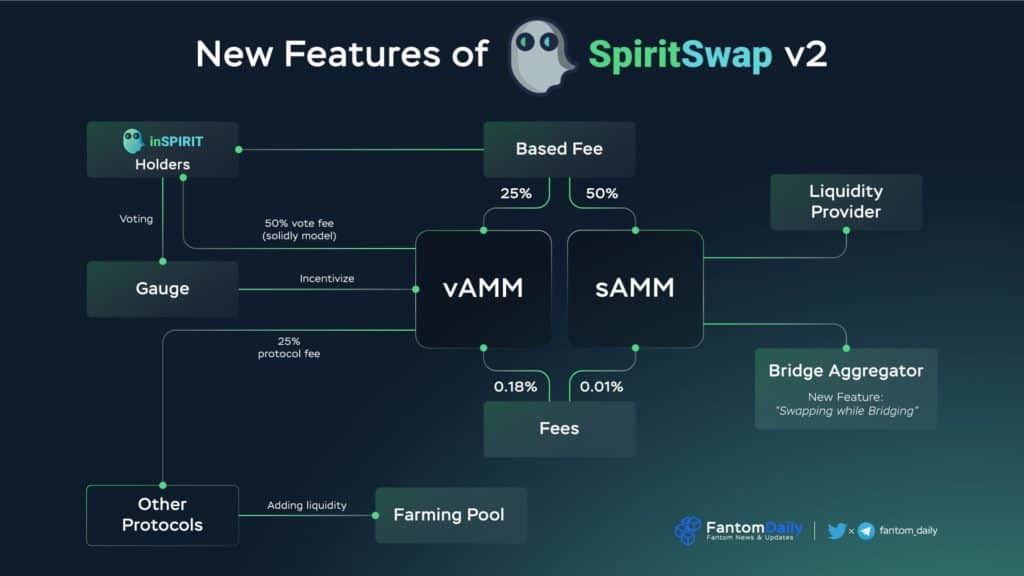

Highlight Event: The Release of Spirit Swap v2

SpiritSwap is one of the biggest DEX on Fantom that was originally based on Uniswap. However, with the release of SpiritSwap v2, the protocol has stepped away from the original design, bringing a unique experience to the Fantom community.

In the new v2 model, Spirit Swap includes two types of AMMs with a new fee structure:

- vAMM: A normal AMM with a 0,18% fee. Fee then will be distributed to inSPIRIT holders and other protocols

- sAMM: A stable AMM with a 0,05% fee. Fee then will be distributed to inSPIRIT holders

A new bridge aggregator with a “swap while bridging” function alongside new BribeUI for inSPIRIT will also be introduced in this v2.

functions like Yield Farming, Lending and Borrowing, inSPIRIT with veTokenomic, etc. into one mega-hub, SpiritSwap v2 is a one-stop shop for all things DeFi 2.0 on Fantom!

Fantom Ecosystem Spotlight of Q3 2022

The Fantom Ecosystem Spotlight is a series where Fantom Foundation directly interviews notable projects that contribute to the ecosystem. Above are those who participated in Ecosystem Spotlight this Q3.

Highlight Project – Magic Craft

Magic Craft is PVP game, where players can join and to earn MCRT as a reward. Each character is an NFT that can be traded a Marketplace and Staked for further rewards.

Magic Craft is in the final step, with the first of gameplay and NFT heroes, alongside a revamped combined with a strong community the MCRT token skyrocketed in price and became one of the most traded tokens in the Fantom ecosystem.

Highlight project – Hector Network

Q3 was a busy period for Hector Network with lots of great partnerships and project updates. The main spotlight was the strategic partnership with Borussia Dortmund – one of the biggest football clubs in the world.

With the current rapid progress & a large upcoming Web3 ecosystem, Hector Network will easily get the No.1 position in the Fantom Opera chain.

Projection

With the macro economy still having a lot of instability, the long-term bear crypto market is expected . Therefore, the Fantom ecosystem cannot have significant growth at least until the end of 2022.

In the Vertical Block Podcast, Fantom mentioned the goal of Vertical Scaling. This is clearly shown in this Q3 with many infrastructure upgrades, such as the of Watchdog; partnerships with node providers & venture capitals; governance proposals, etc.

On the other hand, Fantom needs to increase its marketing activities to further expand its brand name and push its native projects to compete in a larger field.

DeFi

DeFi protocols on Fantom while still constantly changing & releasing new updates, like Spirit Swap v2 or Liquid Driver v3; none of them can make a great enough impact or no new breakthrough projects to attract cash flow into the ecosystem like Solidly did in Q1 2022.

There are a large number of DeFi dApps on Fantom, but only a few big ones are actually active. Many native protocols on Fantom are recently moving to the more active or trending blockchain, for example, Velodrome – Optimism. This raises a lot of questions about if Fantom can in the future.

NFT & GameFi

The Fantom ecosystem is expanding into more categories in this Q3. NFT & GameFi is the most notable trend on Fantom.

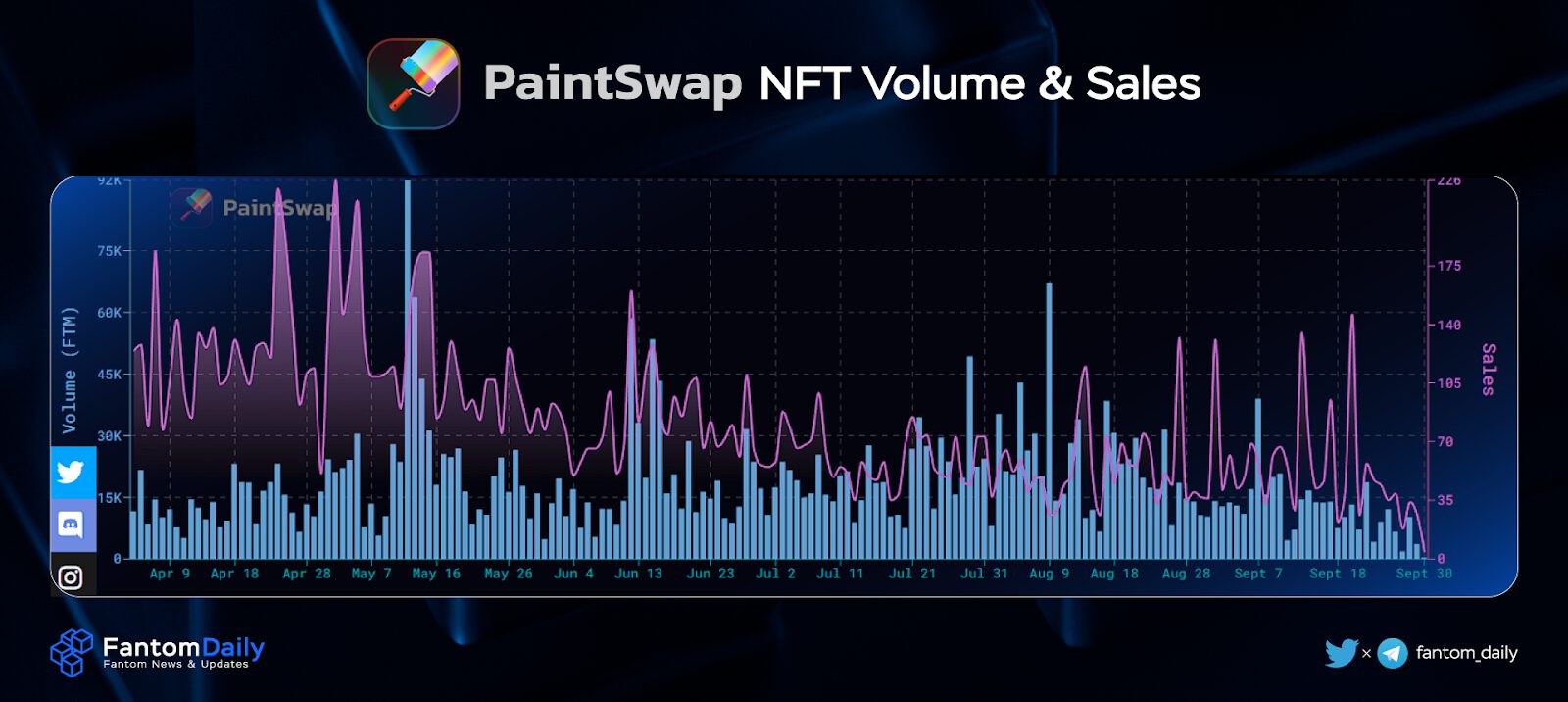

The NFT Volume & Sales on Paint Swap – the largest Marketplace has shown an increase in NFT Collections trading volume in this Q3, despite the lower number of sales. This proves that NFT on Fantom is not only more active, but NFT collections are also more valuable than before.

However, although the number of projects is increasing, until now no name has been able to make a great breakthrough that is enough to make NFT & GameFi into a real trend on Fantom.

The NFT collection sector, although many in number, have yet to have a name that is strong enough to create a fever. Meanwhile, GameFi projects are still mainly multichain ones while native projects, either haven’t launched yet or are not really prominent.

Conclusion

With the of Building & Upgrading, the Fantom ecosystem in Q3 has many notable highlights, project updates, and partnerships.

However, as the harsh macroeconomic situation is still on while there is no great breakthrough in any project on the ecosystem, Fantom will have a long way to go to its glory days in the near future. Nevertheless, with solid steps from Fantom and the native projects, the future of the Fantom ecosystem is still very bright.

Disclaimer

This report is for informational purposes only, not financial advice. This is not a recommendation to purchase tokens or any other assets. Any investments made with the mentioned projects or assets are up to your own responsibility.