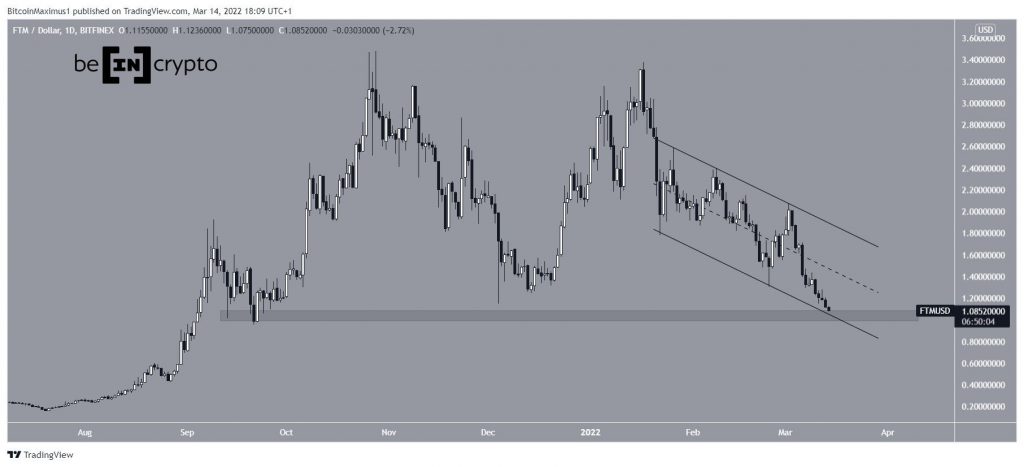

Fantom (FTM) has been decreasing inside a corrective pattern since Jan 22 and is approaching a long-term horizontal support area.

FTM has been decreasing since reaching a high of $3.37 on Jan 17. So far, it has reached a low of $1.07 on March 14. This amounted to a new yearly low and even took the price below the Dec 2021 lows at $1.14.

Since Jan 20, FTM has been trading inside a descending parallel channels. Such channels usually contain corrective structures, meaning that an eventual breakout from it would be likely.

FTM is currently approaching the $1.03 horizontal support area. The area was previously reached on Dec 2021. Since it coincides with the support line of the channel, it is possible that it will initiate a bounce.

Future movement

Despite the fact that FTM is approaching a confluence of support level, technical indicators have yet to show any signs of a potential bullish reversal.

This is visible in both the RSI and MACD, which are both falling. Furthermore, the former is below 50 while the latter is negative, both signs of a bearish trend.

Finally, FTM has not yet even fallen below its lower Bollinger Band. The Bollinger band is an indicator that measures the range of the movement, and deviations below/above it (red circle) usually lead to a reversal.

Wave count analysis

Cryptocurrency trader @CryptoCapo_ tweeted a chart of FTM, stating that the correction is just beginning and FTM will eventually drop below $0.60.

While this is indeed possible in the long-term, it is worth mentioning that both parts of the decrease have had an exactly 1:1 ratio. This is common in A-B-C corrective structures.

Therefore, if this is a corrective structure, it would make sense to end near the current level, since FTM is also approaching a strong support level.

However, as outlined above, there are no bullish reversal signs in place yet.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.