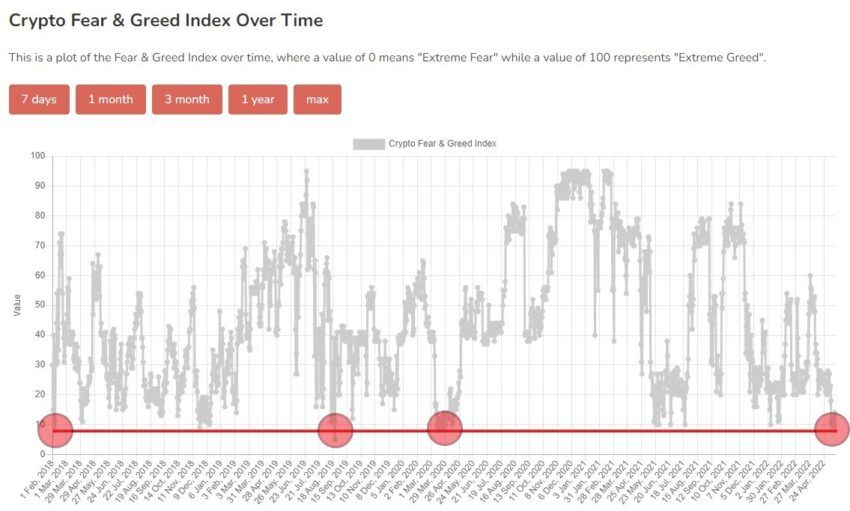

The Fear and Greed Index is one of the simplest yet most popular indicators of cryptocurrency market sentiment. Today, its value dropped to 8 on a 0-100 scale, which last happened over two years ago during the COVID-19 crash.

The Fear and Greed Index is one of the simplest yet most popular indicators of cryptocurrency market sentiment. Today, its value dropped to 8 on a 0-100 scale, which last happened over 2 years ago during the COVID-19 crash.

The extremely low values of the Fear and Greed Index indicate that there is an extreme fear in the cryptocurrency market today. Usually such conditions, according to Warren Buffett’s popular motto, are excellent buying opportunities.

“Be fearful when others are greedy. Be greedy when others are fearful.”

Despite this, a simple, direct interpretation of this indicator in the crypto market could lead to a quick liquidation of funds. Extreme fear often starts at the very beginning of declines, and extreme greed long before the increases end.

Moreover, a historical analysis of the Fear and Greed Index moving averages shows that even the end of declines did not mean the start of uptrends. It turns out that it always took several months from the extreme lows of the index to the start of the cryptocurrency bull market. This time was usually a period of long consolidation and a sideways trend.

Fear and Greed Index lowest since COVID-19 crash

According to data from Alternative.me today’s value of the Fear and Greed Index is 8 on a 0-100 scale. This value comes after about 6 months of declines. During this period, the index has very rarely gone beyond the extreme fear (0-24 range) or fear (25-49) area.

In the entire available history of the index, a value of 8 or lower has only been reached 3 times before (red circles). This happened in February 2018 (BTC bottomed at $6,000), August 2019 (BTC bottomed at $9,320), and March 2020 (BTC bottomed at $3,782).

Even when bitcoin reached the macro bottom of the previous bear market at $3156 in December 2018, it drove the Fear and Greed Index to a reading of 9. Today we see a reading of 8 or lower for the 4th time since this indicator was created.

The end of the bear market? Not necessarily!

It would seem that extreme low values of the Fear and Greed Index appear only at absolute lows in the BTC price. However, only by examining the examples above, we can see that even extreme readings do not necessarily signal a bottom in the Bitcoin price.

Crypto market analyst @Pladizow tweeted a chart of the BTC price, pointing out areas where the index gave extremely low readings. He confirmed – according to our analysis – that the indicator has been this low only 4 times in history (the March 2020 crash appears twice in his chart). However, he added that “after first two, price dropped much further.”

Another illustration of the same concern not to interpret the index in a simple, inverse way is provided by a chart from LookIntoBitcoin.com. It color-codes the long-term chart of Bitcoin to provide information about the Fear and Greed Index on a given day.

Indeed, extreme red readings appear at the lows of the BTC price. However, in addition to this, we can successfully find them at various stages of extended declines. Conversely, we see extreme green readings already in the first weeks and months of increases. Moreover, reaching the previous two all-time highs – $64,500 in April 2021 and $69,000 in November 2021 – were not at all accompanied by the greenest of green dots.

Waiting for EMO cross

In a recent analysis for BeInCrypto, @AtomowyInvestor pointed out how the moving averages of the index can be used to better determine the state of the cryptocurrency market. He pointed out the so-called “EMO cross,” which in the previous two instances was a good signal for the start of bull markets.

An EMO cross is when the short-term moving averages (quarterly, SMA 91 and semi-annual, SMA 182) of the Fear and Greed Index cross above the long-term (annual, SMA 365). In addition, the quarterly also crosses above the semi-annual at this point. The last two times this has happened (white circles), it has signaled the initiation of the 2019 and 2020-2021 bull markets.

In the current market situation, the moving averages we are interested in are already in their pre-bull market positions. However, they are still quite far from being crossed. Moreover, in recent weeks, their charts remain flat and do not show a trend leading to a quick breakout. Atomic Investor refers to such status as “Awaiting”.

In conclusion, the extreme low readings of the Fear and Greed Index are not so much a signal of a market bottom as a progressive trend toward one. Therefore, simply interpreting maximum fear in the market as a short-term buy signal is a flawed strategy.

Nevertheless, negative sentiment should be the point at which an intelligent investor takes an increasingly strong interest in the bleeding market and patiently looks for opportunities to join in. Usually, however, the opposite is true.

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.