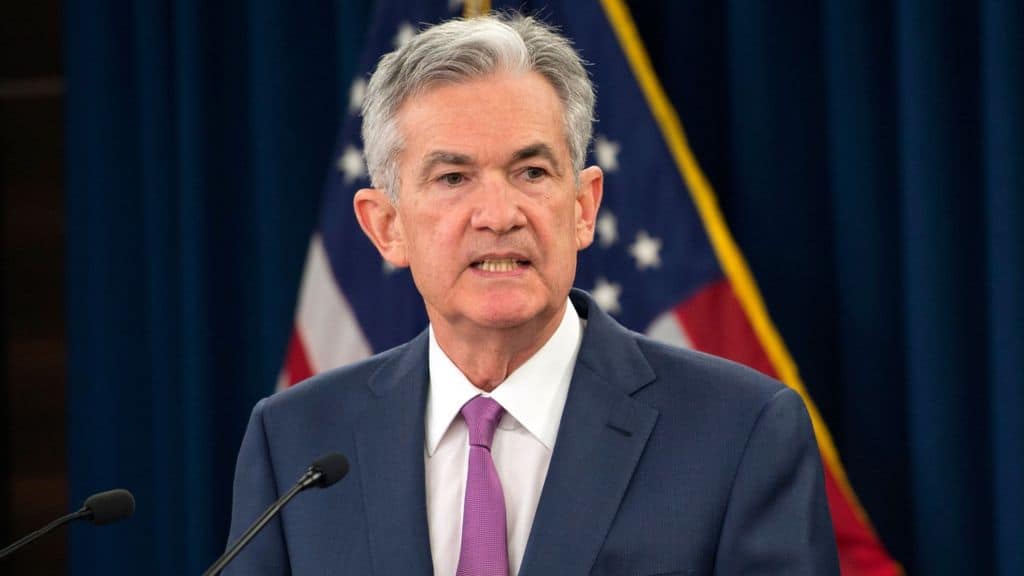

Jerome Powell, the current Chairman of the Federal Reserve, believes the nation’s central bank supports innovation in digital financial products. However, he warned that certain technologies, including cryptocurrencies, could possess risks that have to be handled before their mass adoption.

- Speaking on Wednesday, Powell noted that it is “easy to see the risks” related to digital assets that require new rules. The United States has been rather indecisive with its approach towards the industry, with President Biden signing an executive order earlier this month that caused some controversy.

- As such, Fed’s Chair outlined the need for new and improved rules that could capture the nature of cryptocurrencies, which is a different asset class than stocks and bonds.

“There are potential financial-stability concerns for some products. We don’t know how some digital products will behave in times of market stress.”

- He further predicted it is “highly likely” that such digital financial products, which are currently outside the regulatory perimeter, will soon be “brought within it.” Powell described this as a necessary step to “level the playing field, keep [the] trust of users, protect consumers, and all of that.”

- It’s worth noting that the Fed Chair reassured the crypto industry last year that the US has no intentions to follow China and implement an all-out ban on digital asset operations.

- Powell also touched upon the topic of a central bank digital currency, saying that the US is “only at the beginning of this journey.” He previously said it would be better to be “right rather than first” when it comes down to launching a digital version of the dollar.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.