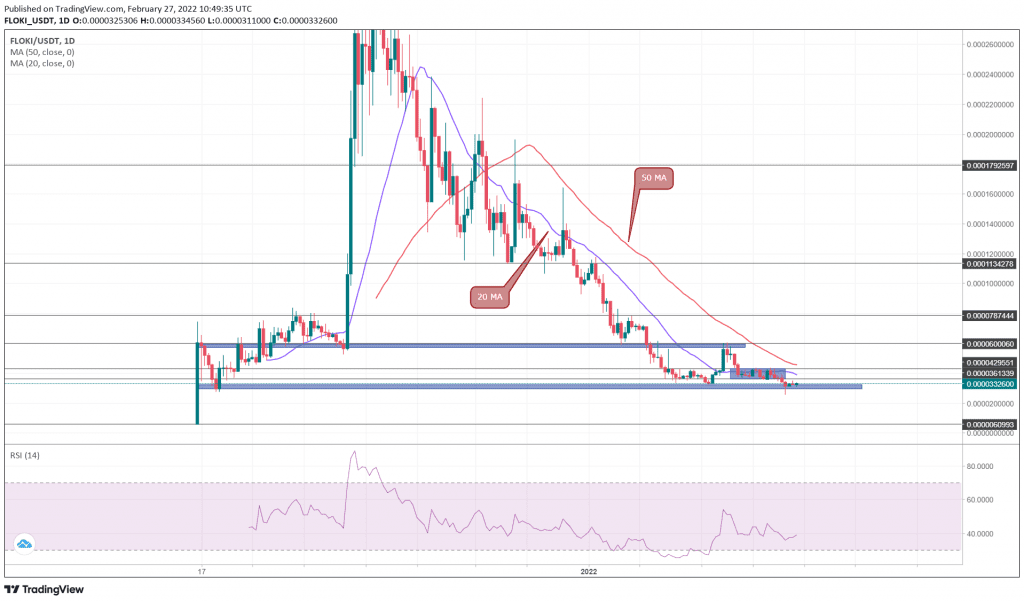

The Floki Inu (FLOKI) bears have engulfed all the gains traders made during February’s first week. The meme coin turned down from the $0.00006 resistance and hit the January low support of $0.000032. However, this 48% devaluation has interested the market participants, suggesting a possible reversal.

Key technical points:

- The FLOKI price rally jumps 28% from the low of $0.000025

- The FLOKI buyers facing strong resistance from 20-day EMA

- The intraday trading volume in the Floki Inu token is $3.7Million, indicating a 20% loss

Source- Tradingview

During February’s third week, the Floki Inu (FLOKI) price continued to resonate in a narrow range stretching from $0.000043 and $0.000036. On Feb 23rd, the sellers breached the range support and slumped 10% to the monthly support of $0.000032.

The bears attempted to breach this crucial support on Feb 24th; however, the buyers prevented further losses and rejected the price with a long-tail accounting of 20%.

The declining crucial MAs(20, 50), along with bearish alignment and the Relative strength index (39), are wavering in bearish territory, indicating the sellers have the upper hand.

Can This Bear Trap Kickstart A New Recovery?

Source- Tradingview

In the 4-hour time frame chart, the FLOKI price provided a closing below the $0.000032 support. However, as mentioned above, the sellers couldn’t sustain this level resulting in a fake-out.

If buyers take advantage of the trapped short-sellers, the altcoin will surge to the immediate resistance of $0.000036

Contrary to the bullish thesis, sellers giving a bearish breakdown and closing below the $0.000032 bottom support will nullify the uptrend possibility. The selling would intensify and sink the price to a $0.00003 psychological level.

The downsloping ADX(17) slope indicates the underlying bearish momentum is decreasing.

- Resistance levels- $0.000036 and $0.000043

- Support levels-$0.000032 and $0.00003