Hi Everyone! Welcome to another BeInCrypto AMA Session!

Today we welcome 0xTinkerer (@zeroxtinkerer), who is a quant researcher at Flynt Finance.

(This AMA has been edited for clarity)

COMMUNITY: Here is how things will work. I’ll have 10 questions for him. After that, our chat will be open for you to drop your questions so that he can pick up 5 out of all the questions you asked. Good luck to you all!

Let’s get started >>

BeInCrypto: I would like to ask you something general to kick things off, so please provide some personal background as well as a few more details about the core team behind Flynt Finance’s development.

0xTinkerer: The core team has been in the crypto space since 2017 and has not stopped building since! The CEO was an early employee at one of the first exchanges in Korea, and the CTO is well known for her experience in building trading platforms for most major Korean exchanges.

I personally have experience in building big data-based models for corporates, but then went full-time crypto in 2017.

BeInCrypto: I know the idea behind your project is great, but can you tell us what you guys looked at before creating Flynt? References, etc.

0xTinkerer: There are a couple of places that offer structured option products, both centralized and decentralized. The major Chinese exchanges have popular dual-investment services and shark-fin products, but these aren’t really set-and-forget products.

I’ve tried them personally, and I’m never sure whether I’m making or losing money. The defi option vaults, and DOVs are more similar to what we’re doing. They have been quite successful since Ribbon finance launched theirs in 2021. Friktion is also another great service on Solana.

BeInCrypto: Great, thanks for this explanation. Flynt introduces a user-friendly crypto asset management platform which automates difficult-covered call trading into systematic yield generators by selling out the money options. What’s the APY we can expect from such a strategy? In short, how does it work?

0xTinkerer: The APY changes every week, but at the moment we are seeing a weekly yield of about 0.7-1% per week. We did 0.99% returns this week without fees, and 0.79% with fees. So, annualized and compounded, that’s about a 33%-67% APY. Our competitors are doing about 10–25% APY for bitcoin.

The way it works is pretty simple. You deposit BTC into the strategy, and the strategy runs in 1-week cycles. So the funds are locked for a week.

BeInCrypto: I see. You use a method called the “Bitcoin Covered Call Strategy”. How would you explain it to a newbie? (Not too much technically, please 🙂

0xTinkerer: Selling call options is kind of like selling insurance. You collect premiums often and pay out when the price increases over a certain price.

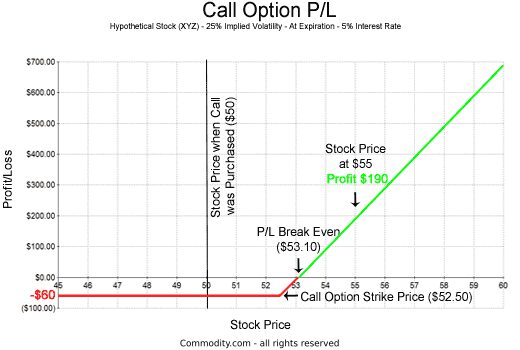

So, if we’re selling calls, why would someone buy calls? A call option is basically like a futures long position. You make money when BTC goes up. But unlike futures, you can use a lot of leverage, like 30x, but there is no liquidation price.

In order to long call options, they pay a small fee and start to earn money if Bitcoin increases above a certain price. The pnl diagram looks like this.

Put simply, call buyers are betting on Bitcoin moving in a certain direction, call sellers are kind of like the house selling those bets.

BeInCrypto: Amazing, thanks a lot for this explanation. I always ask for some media (images, videos, etc.) in order to better present the projects to our community. Would you mind sharing any visuals of Flynt?

0xTinkerer: We’re pretty new, so our site is kinda bare bones atm, but I can share our backtest results, which we are super proud of.

This is the backtest results from using the same specifications as the live strategy.

The green line is how the capital increased.

The blue line is the price of bitcoin, and the red line is the strike price that the strategy tries to stay under.

Over the course of just over 3 years, 10 BTC increased to 26 BTC. That makes the APY around 50%, which is similar to what we’re seeing in the live strategy. The model made 169 trades and 96.4% were profitable.

Modeling options data is hard, but it looks like our model did a good job accurately predicting the range of returns.

During the early stages of the bull market, the options market under-priced the volatility of the swings and lost some trades, however, we are currently researching ways to detect this early and pause the strategy during these times. If we can find a way to detect early pumps, the returns could look more like this…

This model goes from 10 BTC to 48 BTC in 3 years. 114% gains per year.

You can read more about the backtest in our blog too.

BeInCrypto: Cool. What about some key or unique features we can see on Flynt? What benefits can users expect from using it? Why should they use Flynt?

0xTinkerer: Flynt is currently the only service to provide a leveraged covered call strategy. This is how we offer a much higher APY than our competitors. We use leverage to amplify returns and set the strike price further away from the current price, making it safer. This doesn’t make our strategy invincible, though. As we’re using leverage when we do take losses, the losses are larger.

BeInCrypto: Makes sense! I think not all the members here are used to dealing with platforms/apps like yours, so let’s take an educational approach to this question. Is there any tutorial on how to work with Flynt? Any support for someone new on this?

0xTinkerer: Unfortunately, we don’t have that much educational content prepared yet.

However our discord is always open, so you’re also welcome to pop by and ask us questions there too!

We also have a bounty program where we are giving out $100 for any walkthrough guides posted on youtube!

BeInCrypto: Well, it’s time to ask you something about risks and security. How does Flynt deal with and try to protect users from unexpected losses? How safe are all the funds? Any external links from audits or similar processes are welcome!

0xTinkerer: We are using Fireblocks as our custodian. Fireblocks is currently the number one crypto custodian service and is used by the largest crypto services in the industry. So you can’t get much safer than them… And our option trades are run through Deribit and Paradigm, which have also cemented themselves as reputable service providers, dealing in billions of dollars daily.

Our service infrastructure was also designed by our CTO, which has over 20 years of experience building mission-critical financial services in Korea.

We are still in the early stages of our journey, so we intend to continue improving security as there is nothing more important than the safety of our users’ funds.

BeInCrypto: Fine! I suppose your roadmap is fully packed with activities. What can Flynt enthusiasts/users expect when it comes to future plans? What do you have in mind for the project in the next few weeks or months?

0xTinkerer: At the moment, we are mainly concentrating on our premier BTC product, but in our quant lab we have some other strategies that can produce some juicy yields(in a safe way). Such as a USD strategy with yields ranging from 9-20% and a market-beating ETH strategy.

Our benchmark for a good strategy is one that beats buy and hold over long periods of time.

We’ll be releasing them when we’re confident they can consistently beat the market and after they are back-tested thoroughly.

BeInCrypto: Awesome, that’s it. I’m quite sure we’ve covered all the main topics today. Could you please share all the links to your social media channels so that our community can get to know Flynt Finance a little better?

0xTinkerer: Sure! You can follow us on Twitter and myself.

Also, we understand options may feel a bit scary initially, so we’re currently offering principal protection of up to 0.1 BTC for our alpha users. It’s first come for serve so if interested check us out at flynt finance.

COMMUNITY QUESTIONS

Community: Regarding your fundamental technology, what are your plans with technology in the future that can build sales, printing, distribution, manufacturing, etc. innovatively and safely for business people?

0xTinkerer: Hm fundamentally we are continuing to build out risk management features to help users avoid large losses that may occur in similar covered call strategies.

Community: Stability and survivability of projects are important. Who are the collaborators and partners? What trait do you trust that will keep you alive in the long run?

0xTinkerer: Currently, we are working with

Fireblock : Leading crypto custody service

Deribit : Largest options exchange

Paradigm : Crypto derivatives OTC desk

And a few more we will release soon…

Community: Many projects have rug pulled and performed an exit scam recently. Why should investors trust that your project won’t do the same?

0xTinkerer: We would never rug. Transparency is super important to us and so we try to go above and beyond in this regard. Every single trade we make is recorded weekly. Down to how many contracts we purchase. We aim to continue to find ways of earning the trust of our users.

Community: How easy will it be for any normal users to use your platform? Can new users be able to use it properly?

0xTinkerer: Regarding using the platform, it’s super simple. If you can use an exchange, you can use flynt!

Community: Without proper marketing and capital infusion, the project dies. How do you convince us you have adequate marketing power and capital to push flynt finance to a top tier?

0xTinkerer: We are a pretty well-capitalized team that is already making a decent return on our capital as well as revenue from early users, so you don’t have to worry about the financial health of the project.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.