Speaking at the Bitcoin Miami Conference 2022, former SoftBank CEO Marcelo Claure announced the allocation of 10% of its wealth into crypto. Specifically, the former SoftBank executive will put a portion of his capital into BTC as a hedge against inflation.

Related Reading | Bitcoin 2022 Conference, Industry Day: Bukele Steps Down, Tennessee Titans & More

“This is a #Bitcoin conference, not a shitcoin conference!”

“These men are brilliant!” – Greg Foss pic.twitter.com/9QL1Q3mMIt

— Bitcoin 2022 (@TheBitcoinConf) April 7, 2022

Claure spoke at the Billionaire Capital Allocators alongside Ricardo Salinas, President of the Salinas Group and one of the wealthiest individuals in Mexico; Orlando Bravo, co-founder and managing partner of private equity investment firm Thoma Bravo; and Dan Tapiero, founder and CEO at 10T Holdings.

The panel members’ individual wealth easily surpasses $10 billion with the former SoftBank executive commandeering around $1 billion. Therefore, he could have put around $100 million into crypto or over 2,000 BTC.

During the event, Marcelo Claure said the following about the reason behind his investment and the U.S. Federal Reserve (FED) measures to mitigate inflation:

Now we’re going to be the hands in the fed to figure out how to do it. If they overcorect, we are going to move from inflation to recession very very fast.

The U.S. Consumer Price Index (CPI), a metric used to measure inflation, stands at a multi-decade high of around 8%. The last time it saw similar levels was during the 1970s.

This has led to rising prices in the U.S. and the rest of the world. Inflation, according to Bonner Private Research’s Bill Bonner, is a consequence of the FED’s excessive increase of its balance sheet.

The institution grew its assets to prevent an economic depression during the COVID-19 pandemic. This enabled global markets to boom but contribute to generating more inflation.

The U.S. financial institution will begin a tightening process to attempt to stop the inflation phenomenon to break out of control. However, as Bonner explained, the FED’s action could fail to mitigate inflation.

Gold And Bitcoin, The Ultimate Inflation Hedge?

Bonner Private Research has recommended its subscribers to “prepare for the coming uncertainty” by holding “plenty of gold”. Bitcoin and certain crypto assets could provide investors, such as Claure, with protection for further inflation.

The benchmark crypto has increased from a low of around $3,000 to an all-time high of $69,000, on the back of an inflationary economic outlook. This trend could persist if the FED, as Bonner believes, is incapable of stopping inflation.

Orlando Bravo commented the following on inflation and the importance of Bitcoin as a safe haven asset to hedge against the economic phenomenon and the FED itself:

You don’t have to be an economist to see what’s going on with inflation. it is plainly obvious. When you pump that much money into the economy you’re going to grossly devalue the currency. For me, bitcoin represents a competitive system to those government owned monopolistic currency systems.

Related Reading | Bitcoin 2022 Miami Preview: What To Expect From Crypto’s Biggest Conference

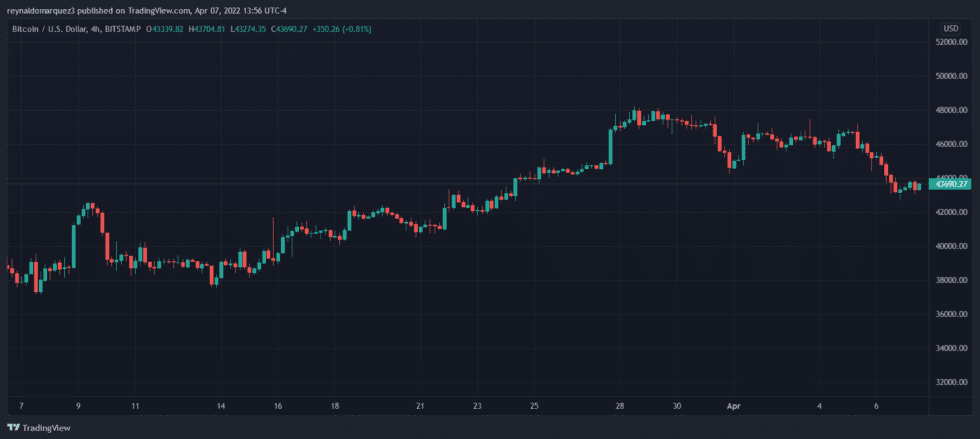

At the time of writing, Bitcoin trades at $43,500 with sideways movement in the last 24-hours.

Bitcoinist @ Bitcoin 2022 Miami

Bitcoinist @ Bitcoin 2022 Miami

Bitcoinist will be at Bitcoin 2022 Miami in Miami Beach, FL from April 6th through 10th reporting live from the show floor and related events. Check out exclusive coverage from the world’s largest BTC conference here.

Bitcoinist @ Bitcoin 2022 Miami

Bitcoinist @ Bitcoin 2022 Miami