The FTX exchange is going through its roughest phases in recent history. Its native token FTT suffered a major crash in the last few days following rumors that the exchange might be on the blink of insolvency.

Here’s AMBCrypto’s price prediction for FTT

The insolvency rumors caught fire following a major transaction in which roughly 23 million FTT was sold. Upon further inspection, it was revealed that Binance was the seller that offloaded the large FTT amount worth over $500 million.

First received FTT almost 3 years ago and gets occasional large transfers from FTX… suggests address is controlled by an insider or investor in FTX. They sent 12 million #FTT to Binance over that time.

The 23 million FTT transferred yesterday had been there for almost a year. pic.twitter.com/W8i6dyBiKY

— DIRTY BUBBLE MEDIA: THE ALAMEDA SPECIAL (@MikeBurgersburg) November 6, 2022

Binance CEO CZ released an official statement revealing that his exchange opted to liquidate the remaining FTT in its portfolio.

The statement by the Binance CEO confirms that Binance cleared the FTT in its portfolio in an attempt to minimize exposure.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

The decision is not surprising given that the market has already experienced the impact of crypto companies going bankrupt.

The latest concerns over Alameda and FTX potentially facing insolvency have the market on the edge. The massive FTT sell-off we have seen in the last few days is a testament to the prevailing investors’ concern.

FTT price action

FTT peaked at $26.43 at the start of November, before embarking on a sell-off by slightly over 18% to as low as $21.42.

Its $22.40 press time price may indicate a slight recovery but the ongoing concerns about FTX and Alameda may trigger more downside.

FTT’s sell pressure resulted in a retest of its 2022 bottom range, with the price coming close to the current year-to-date low.

But is the FTX native coin out of the woods yet? A look at its on-chain metrics may help provide a better view.

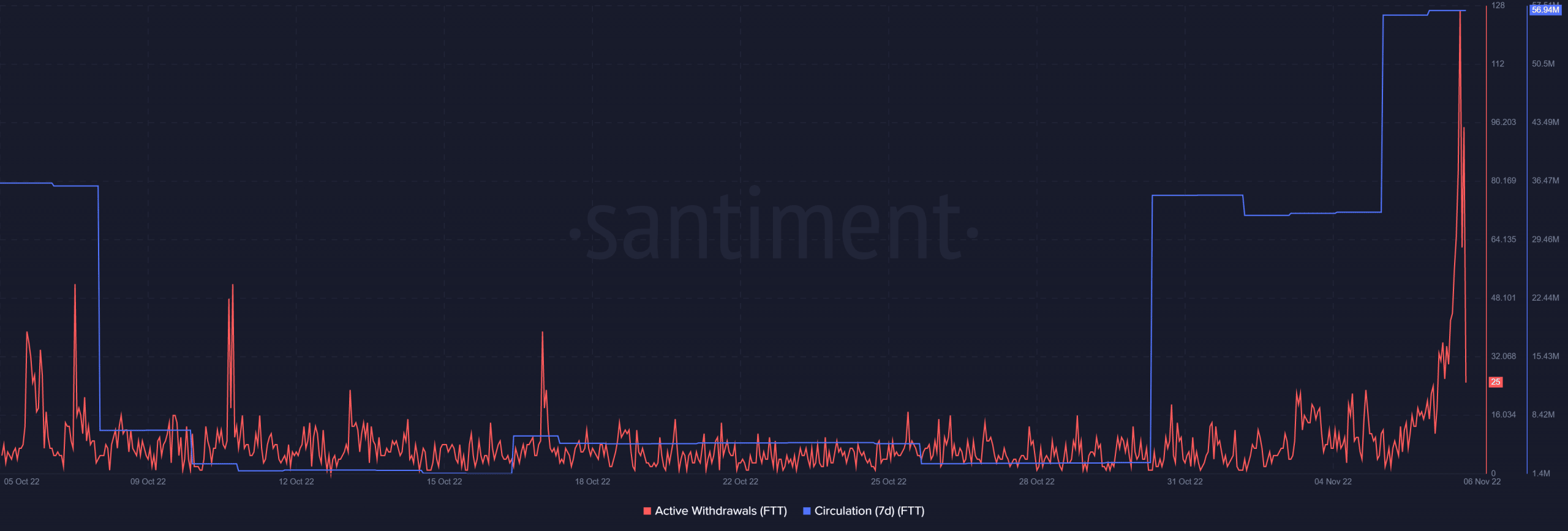

The amount of FTT in circulation went up in the last few days as more coins flooded the market courtesy of the liquidations.

Active withdrawals also experienced the largest monthly spike with withdrawals peaking at 127 a few hours before press time.

The above-mentioned information confirms an increase in activity especially oriented towards exiting FTX.

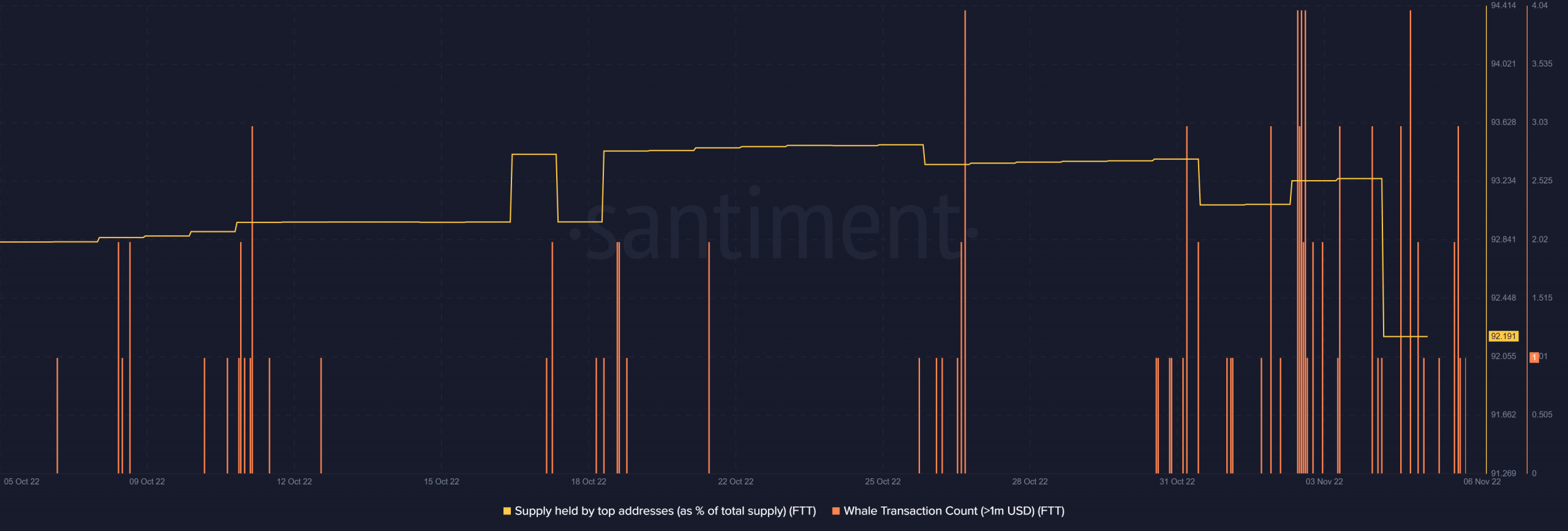

This observation was also confirmed by a spike in whale transaction count (transactions over $1 million). These transactions notably increased in the last few days. At the same time, the supply held by top addresses dropped by a substantial margin.

These observations confirm that whales have been selling off their FTT in light of the recent concerns.

Conclusion

FTX is one of the biggest crypto exchanges and the ongoing situation may severely dent its reputation. We have seen crypto companies crash and burn and it would not be surprising to see FTX suffer the same fate. On the other hand, the extent of the danger remains uncertain and may even be exaggerated.

The fact that whales are selling confirms that the market is spoofed. FTT might be discounted for now but buying the dip before the danger passes might be too much of a risk.