FTX, with all the bad publicity attached to the beleaguered crypto exchange, is sending shivers down the spines of investors and traders. Many people in the crypto space are now bracing for more bad news to come out of the Binance-FTX drama.

Now, Wednesday’s rapid decrease in the share price of cryptocurrency trading platform Coinbase Global may cause some investors to feel uneasy. Not Cathie Wood, the chief investment officer of investment firm Ark Investment Management.

Cathie Wood’s funds have topped up stake in crypto exchange Coinbase Global after its key rival Binance signed an agreement to buy FTX’s non-U.S. business https://t.co/07ZjEekgCi

— Bloomberg (@business) November 9, 2022

Ark Invest Buys $21 Million Worth Of COIN

Ark Invest is obviously undeterred by the goings on in the crypto market of late, especially the Binance-FTX brouhaha. Ark just stepped in to double down on their investment with Coinbase.

Ark Invest acquired 420,949 Coinbase (COIN) shares for around $21.4 million, per the company’s daily trade update. The latest infusion will be added to the 7.7 million dollars now currently held by ARK Invest.

COIN was down roughly 11% late Tuesday, and the stock shed 2.5% in pre-market trading in the U.S. on the same day.

Approximately 330,00 of the total number of purchased shares went to ARKK, the company’s flagship exchange-traded fund (ETF) that invests in disruptive innovation-driven enterprises.

Cathie Wood Unfazed By Ongoing FTX Crisis

Despite Coinbase’s difficult year — nursing a loss of around 80% year-over-year and underperforming Bitcoin’s decline of 62% — celebrity money manager Cathie Wood remains enthusiastic about the company and cryptocurrency in general.

Wood’s purchase was made in the face of the crypto calamity, which included an agreement for Binance, the largest cryptocurrency exchange in the world, to buy out rival Sam Bankman-Fried’s FTX.com.

Following allegations of improper handling of user cash and rumored government investigations, Binance stated on Wednesday that it was shelving its intentions to buy FTX.com.

SBF, who founded FTX, was once hailed as a cryptocurrency prodigy, but his fortunes have since deteriorated significantly.

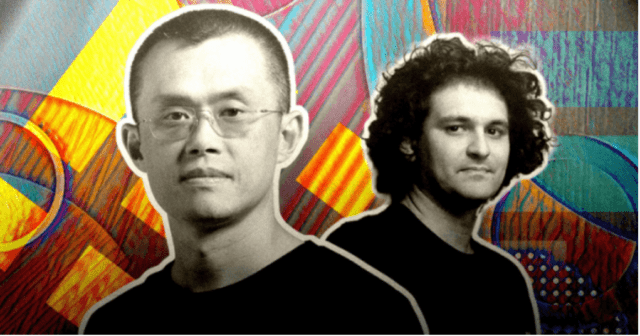

Binance CEO Changpeng Zhao (left) and FTX CEO Sam Bankman-Fried. Image: Cryptoslate.

The cryptocurrency and crypto-related financial markets saw extreme volatility when Binance CEO and founder Changpeng Zhao made the announcement that the exchange would be selling all of its FTT/USD holdings.

Last week, in a communication to its shareholders, Coinbase announced net revenue of $576 million for the third quarter, down 28% from $803 million in the second quarter of this year, with trade volume falling from $217 billion to approximately $160 billion.

In the third quarter, the company saw a rise in subscription and service revenue from $147 million to $211 million.

Late last month, ARK announced that its ARK Innovation ETF would increase its COIN holding by 10,880 shares.

Celebrity Money Manager Has $7 Million In Crypto

Wood has substantial personal bitcoin holdings, having purchased $100,000 worth of the digital commodity in 2015 for $250, valuing her stake at $7.2 million at current market conversion.

Because of her numerous media appearances, Wood has achieved celebrity status in the world of finance. She is a persuasive spokesperson for her investment strategies, breaking down complex topics for laypeople.

Meanwhile, on the sell side, Ark funds disposed of 1,020,738 shares of online securities brokerage Robinhood Markets HOOD, valued at $12.5 million as of the conclusion of trading on November 8th.

As this developed, Coinbase added Primer to its payments network, which works with merchants across numerous industries in Europe, the United States, and Asia-Pacific region, to serve the increasing demand for cryptocurrencies as a payment option.

COINUSD pair trading at $55 on the daily chart | Featured image from NBC News, Chart: TradingView.com