2021 came with numerous technological innovations that saw many developers upgrade to meet the new needs of their clients, investors, and so on. Among others, cryptocurrency centralized exchange, FTX Exchange also underwent a considerable amount of modifications, system upgrades, and additional features. According to them, 2021 was a transformative year and 2022 is already shopping up as a remarkable year for them.

As a result, we will be letting you in on FTX’s latest upgrades, partnerships, products, and many more. The FTX exchange review in this article will provide you with an updated overview of the exchange and its differences since its debut almost three years ago.

Table of contents

FTX Exchange Review

| Website | https://ftx.com/ |

| Available on mobile | Yes |

| Number of supported coins/tokens | 100+ |

| Number of supported trading pairs | 276 |

| Native token | FTX Token (FTT) |

| Supported fiat currencies | USD, USDT, EUR, GBP, BRZ, AUD, CAD, TRYB |

| CEO | Sam Bankman-Fried |

| HQ Location | Hong Kong |

| Company Owner | FTX Trading LTD |

FTX Exchange Overview and Updates

FTX Exchange is a centralized cryptocurrency exchange that focuses on derivatives and leveraged products. FTX, which was founded in 2018 by Sam Bankman-Fried, an MIT graduate and former Jane Street Capital international exchange-traded funds trader, offers a variety of trading products, including derivatives, options, volatility products, and leveraged tokens.

Due to the exponential growth of the NFT market in 2021, FTX launched its own NFT marketplace that supports both ETH and SOL NFTs. Users in the US and internationally may now display, buy, sell, and mint their own NFTs without incurring the gas fees that come with on-chain trading.

Its multi-purpose app still facilitates the onboarding of the next generation of users into the crypto ecosystem. FTX reports that its user base grew 60% since October 2021 while daily trading volumes rose 40% to an average of $14 billion.

It also now offers spot markets in more than 100 cryptocurrency trading pairs, including BTC/USDT, ETH/USDT, XRP/USDT, and FTT/USDT, its native token. FTX, domiciled in the Bahamas, and its US partner, FTX US, have similar management teams but different financing structures. Only FTX US allows US residents to trade.

Just recently, FTX Exchange raised $400 million in a Series C financing round, valuing the firm at $32 billion. Thanks to its investors in the U.S. affiliate, FTX has now raised a combined $2 billion in venture funding to date. The Series-C round saw participation from Temasek, Paradigm, Lightspeed Venture Partners, SoftBank Vision Fund 2, Ontario Teachers’ Pension Plan Board, Steadview Capital, and Tiger Global.

FTX intends to expand this year, with the funds likely going toward mergers and acquisitions, according to CEO Sam Bankman-Fried. FTX has spent about $1 billion on recent acquisitions, including Blockfolio, which will help the company increase its retail user base, and LedgerX (now known as FTX US Derivatives), a crypto derivatives platform that was purchased last year.

2022 is definitely a year for the crypto exchange as it has also laid out plans to acquire licenses in several companies. In addition, its U.S. arm is now authorized to sell derivatives products such as futures and options.

Payments businesses, NFT-centric organizations, and the metaverse are all interesting sectors to target they are looking to invest in.

Not to mention, FTX is now starting to license its software to other businesses in the domain of fintech and gaming. The company also launched a $2billion venture fund to invest in crypto start-ups. At the moment over 90% of FTX’s equity ownership is held by the founders and employees.

FTX Exchange Review

Trading Basics

The FTX exchange is a crypto trading platform for investors of all skill levels, from beginners to seasoned pros. With the customizable interface, users can change the UI/UX to suit them. FTX runs a margin and risk engine, which is natively blockchain-based, real-time, cross-margined, and automated.

The platform offers a vast choice of products and easy-to-use desktop and mobile trading programs from spot markets with fiat support, perpetual and quarterly futures, Leveraged Tokens, and volatility products.

In addition, it has a referral program and a VIP program for professional traders. FTX also provides a Backstop Liquidity Provider program for Market makers.

The US dollar, euro, British pound, Australian dollar, Hong Kong dollar, Singapore dollar, Canadian dollar, Swiss franc, and Brazilian real are among the nine fiat currencies that investors can deposit and withdraw via wire transfer at FTX. However, you have to be KYC level 2 to deposit or withdraw fiat currencies.

You can use CONVERT to buy or sell any of the fiat currencies. Best of all, all fiat can be used as collateral on FTX.

FTX has a tiered trading fee structure for all futures and spot markets. Of note, fees for the spot market are charged in the target currency for maker orders and the quote currency for taker orders.

For most crypto assets, FTX Exchange does not charge deposit or withdrawal fees. Withdrawals of more than 0.01 bitcoin are completely free. After the initial withdrawal, which is free, withdrawals of less than 0.01 Bitcoin per day are subject to a 0.1 percent fee. Withdrawals in fiat currency worth more than $5,000 are free, as is one withdrawal each week worth less than $5,000.

FTX Token (FTT)

Trading with FTX’s native token FTT gives you access to a slew of benefits on the exchange as it is the backbone of the FTX ecosystem. There are a total of 350,000,000 FTT tokens in existence, and no more will be created and 175,000,000 of those are treasury tokens and will be unlocked over the next three years.

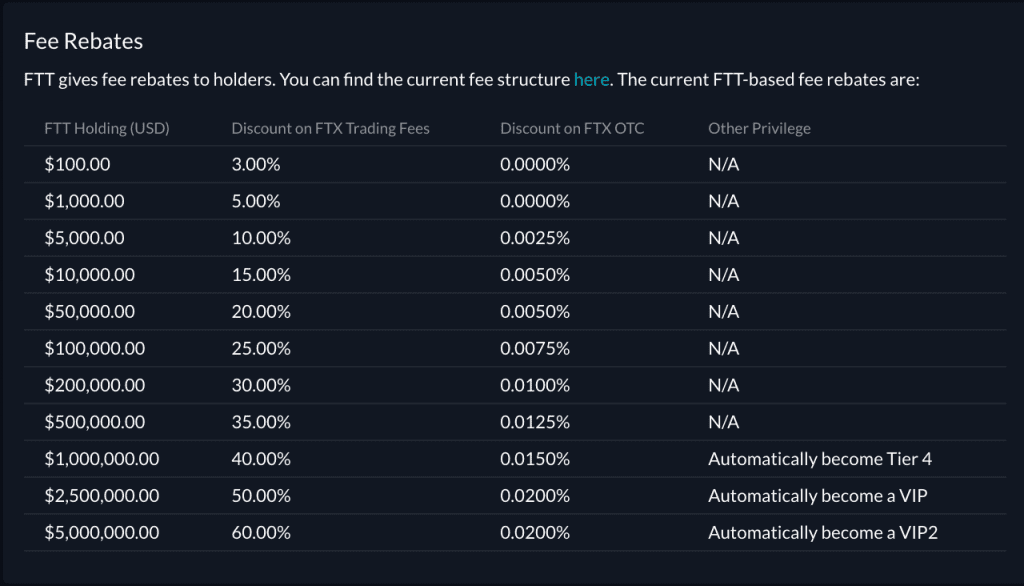

Rebates: One can get up to 60% FTX trading fee discount, 0.02% OTC discount, have the opportunity to become a VIP2, and participate in the weekly SRM airdrops.

FTT has listed spot FTT/USD, FTT/USDT, and FTT/BTC markets. FTT is now available to be traded on Binance, Bitfinex, Huobi, BitMax, CoinEx, Wazirx, AscendEx, and more.

FTT Staking: FTT stakers receive maker discounts as low as -0.00030%. Not only that, When you stake up to 25 FTT, you are guaranteed 0 maker fees.

Below are some of the perks of staking FTT.

Furthermore, FTX Exchange conducts a weekly buy and burn of 1/3 of our trading revenue! Finally, you can use FTT as collateral for all futures on FTX, so you can hold your capital on FTX in FTT and still trade with it.

FTX Major Feature

Futures, leveraged tokens, options, MOVE, and spot markets are among FTX’s most popular products.

Futures: Traders may place long and short bets on prominent cryptocurrencies using over 100 quarterly and perpetual futures pairings with up to 101x leverage. To open and hold trades, stablecoins such as USD and tether (USDT) are utilized as collateral.

Spot Markets: FTX has spot markets whose interface is similar to futures where you can trade FTT, BTC, and other altcoins. In total, it offers over 100 different spot trading pairs. Meanwhile, its U.S. arm offers almost 60 cryptocurrency and currency spot trading pairs and options contracts denominated in 0.01 Bitcoin and 0.1 Ether crypto swaps. Alongside, Bitcoin mini futures.

Leveraged Token: FTX offers ERC20-based tokens with up to 3X leveraged exposure against the underlying trading pair. There are no margin requirements for FTX’s leveraged tokens. There are currently four leveraged tokens for every future on FTX: BULL (+3x), BEAR (-3x), HEDGE (-1x), and HALF.

MOVE: These contrasts enable traders to bet how far the price of crypto will move over a time period. Each MOVE contract requires a margin based on the price of the underlying index. The more volatile a product is the higher its expected move. The fees charged on MOVE contracts are the same in magnitude as the fees charged on the underlying spot market.

Options: Traders can speculate on future price direction and hedge against their open positions with a range of call and put options that give the holder the right but not the obligation to buy or sell at a future strike price. You can go long or short options using leverage, at the expiration time, the futures contract settles to a number of dollars equal to its expiration price.

Partnerships

FTX has collaborated with many brands, athletes, individuals, and celebrities to push its initiative and harness a more global audience. Some of these partnerships are as follows,

In 2021, FTX became the first crypto company to land the naming rights to a stadium, the first to sign a deal with a Big 4 sports league, and the first to pay for a collegiate partnership entirely in crypto.

FTX entered into a partnership with Mercedes Formula 1 and its drivers in the midst of the 2021 season as the official cryptocurrency partner. The FTX Exchange logo was featured on the drivers’ hats and had prime placement on the car with amazing visibility from the driver’s view. Lewis Hamilton dominated all season and was involved in a series of thrilling moments, generating extensive FTX brand exposure throughout the season.

FTX and MLB finalized a historic multi-year partnership earlier in the year, which made FTX the Official Crypto Exchange of MLB and marked the first major crypto partnership with a “big four” sports league in the US.

It also named an arena to its name — FTX Arena. Apart from partnering with firms, FTX also partnered with public figures, including long-term ones with celebrity couple Tom Brady and Gisele Bündchen. Gisele and Tom have also committed to providing an annual multi-million-dollar contribution to charity throughout the duration of the partnership.

FTX has no deposit or withdrawal fees, and there are also no fees on futures settlements. In addition, OTC trading or trading from within your wallet is also fee-free as all costs are built into the price you are quoted.

Pros and Cons

Gathering aspects of the FTX exchange review that could influence your decision. However, taking so much knowledge at once can be devastating. So let’s make everything easier for you.

Pros

- A fresh take on the cryptocurrency marketA wide range of trading options to choose from

- Offers one of the most affordable fees in the cryptocurrency market.

- There are many different trading choices to choose from.

- Topnotch security and safety

- Cutting-edge trading platform with avant-garde features

- Mobile apps for iOS and Android are available

- To date, no spam or security breaches have been reported

Cons

- Restricted in the USA

- It may be a bit complicated for new users

Final Score

- Services offered: 4.5/5

- Reputation 5/5

- Cryptocurrency support: 4.8/5

- Fees: 4.7/5

- Security: 4.8/5

Review Score: Score : 4.8 / 5

You can join any of the Telegram communities to get updated information about the exchange by joining any of the following:

You can contact FTX Support here. For legal inquiries, please contact [email protected]. For media inquiries please contact [email protected].

FAQ

FTX stands for “Firstech Expediter”, and refers to Firstech’s lineup of OEM-grade remote starters designed for car dealerships and expeditors.

Users can deposit funds into an FTX account until February 28 at 0:00 AM (UTC) to earn VIP status. To participate, send an email with the following information to [email protected]

● FTX account email which does not exist referral relationship

● Contact details (Telegram/WhatsApp)

● Country/Region

● Screenshot of deposited funds

● Screenshot of your volume on other exchanges

FTX pays referral fees. Each user has a unique affiliate link. If a new user signs up with your referral code, you will receive 25%-40% of their fees, and they will get 5% of their fees back. For non-VIP referees, their taker fees minus referral rebates cannot go below 0.03%; if it would, the excess is subtracted from the referral rebates.

Participating in the Backstop Liquidity Provider program means that you pledge to take on the positions from accounts near bankruptcy. As part of this program, BLPs are required to keep a minimum of $500k of balances on FTX and be willing to absorb a minimum of $0.1m per minute and $0.3m per hour of liquidations. In addition, BLPs may be required to meet a market-making standard.

Disclaimer: This material must not be used as the basis for making any investment decisions. This serves only as helpful material about the crypto exchange. Trading digital assets involve risk and can result in the loss of investment capital. Hence, always make sure to do in-depth research before engaging or investing in any crypto assets

Recommended Articles