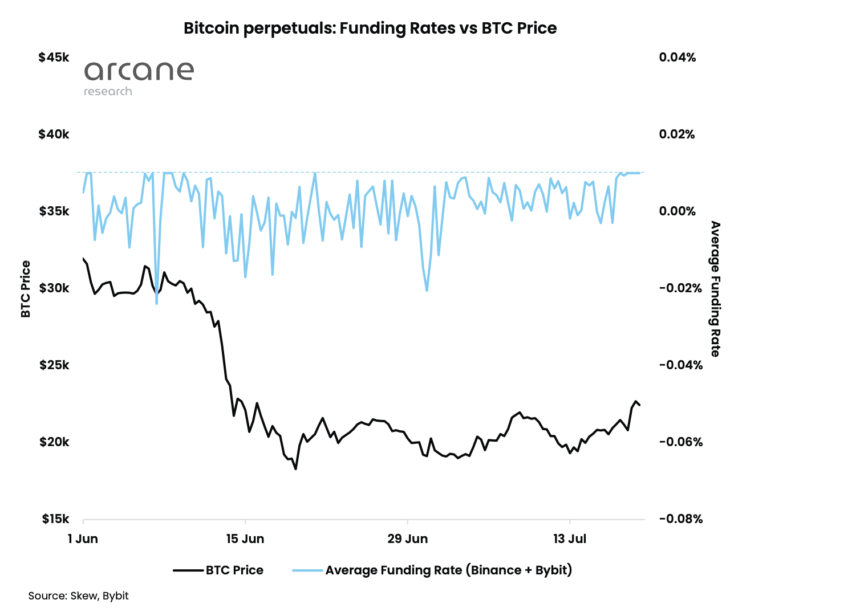

Bitcoin funding rates had seen a very negative month between mid-June and mid-July. The funding rates, which had previously remained muted, quickly declined below neutral and proceeded to spend the next one month on this level. However, there is a significant change as last week saw funding rates return to neutral.

Funding Rate Recovers On Exchanges

The bitcoin funding rates had been touching low points as the price of the digital asset struggled. This was concerning given that funding rates were expected to improve as the digital asset began to basically trade at what was described as a “discount.” This would not be farther from the truth, as funding rates fell to their lowest points this June. It indicated that perp traders were still bearish on the cryptocurrency and refrained from moving in.

Related Reading | Bitcoin Dominance Dives As Ethereum Takes Up More Space

Last week would come with good news as funding rates returned to neutral and stayed there. Binance and Bybit crypto exchanges both recorded funding rate levels of 0.01%. The return to neutral came as the price of bitcoin started a relief rally that saw it break above $23,000.

Funding rates return to neutral | Source: Arcane Research

Open interest had also followed the same route, although it retraced during the week when the price fell once more. It showed that there is still a lot of leveraging going on in the market since the bitcoin open interest was not much different from what was recorded the prior week, even with the decline.

Bitcoin Traders Turning Bullish

The recovery of bitcoin funding rates to a neutral level is a testament to the returning positive sentiment among traders and investors. It definitely does not signal that the market has returned to its previously bullish phase, but it is an indication that investors are now looking favorably at the bitcoin and crypto market at large.

BTC retraces downwards | Source: BTCUSD on TradingView.com

It tracks along with the Fear & Greed index which has now moved out of the ‘Extreme Fear’ territory for the first time in almost three months. It saw an incredible bounce from last week’s sentiment, with a score of 18 putting it in extreme fear. Although the market is still fearful, the recovery is seeing faith return to the market. It is also evidenced in the buying pressure that has been building this week.

Related Reading | Domino Effect On Stablecoins Leads To Reversal Of Growth Trend

The correlation of the funding rates with the price of bitcoin can either be good or bad from here on out, depending on how well the cryptocurrency performs in the market. If it continues its recovery trend, then funding rates may return above neutral for the first time in more than two months.

Featured image from CNBC, charts from Arcane Research and TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…