In its recently released third-quarter earnings report, crypto financial services firm Galaxy Digital revealed that it holds over $76 million worth of exposure to FTX, the mainstream crypto exchange that is now experiencing a liquidity crisis.

- Per the report, the $76.8 million of exposure is comprised of both cash and digital assets. Within that, $47.5 million is still in the withdrawal process.

- FTX appears to have stopped processing withdrawals on Tuesday after the company experienced overwhelming net outflows early this week.

- The company also experienced a net loss of $68.1 million in Q3, versus a net profit of $519 million in Q3 2021.

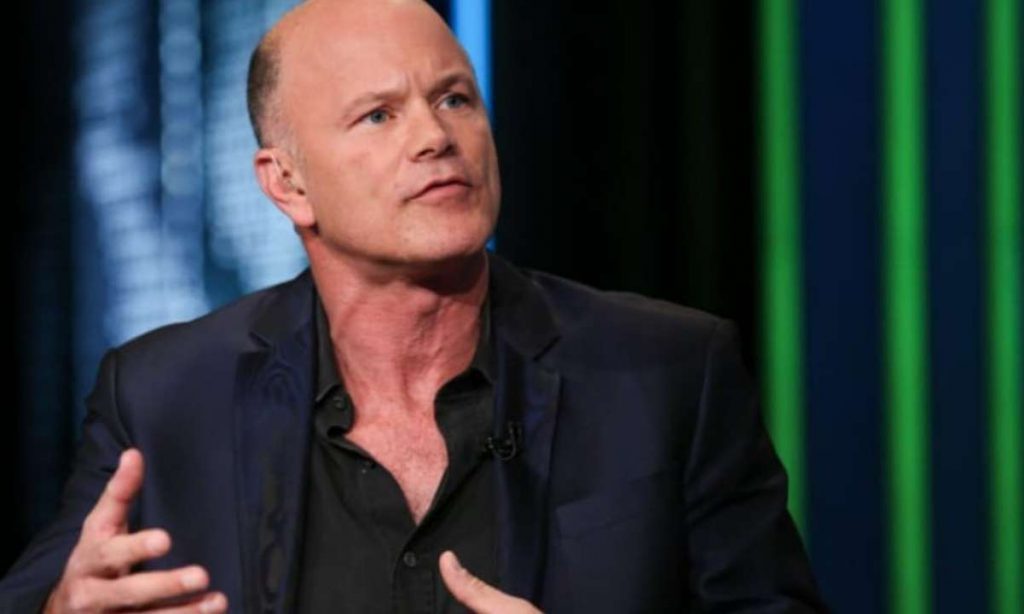

- Speaking on the firm’s earnings conference call, Galaxy CEO Mike Novogratz said that the FTX fallout has “put a short-term wrench” in the crypto industry. After Binance refused to bail out the firm, crypto markets have sunk to a total market cap of under $800 billion. Meanwhile, Galaxy’s stock (GLXY) has fallen to $3.92 as of Wednesday – a 15% drop.

- Novogratz added that the industry has been “nimble” enough to navigate scandals in the past, and will eventually return to being correlated with the macroeconomy.

- Galaxy co-President Chris Ferraro said that the firm held no exposure to Alameda – a sister company of FTX which has recently gone dark.

- Galaxy Digital was reported last week to be planning to reduce its headcount, in consideration of “optimal team structure and strategy.”

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.