Not content with disrupting the internet’s ad-based revenue model, web3 startup Gather is now looking to supercharge the world of decentralized finance.

CEO Reggie Jerath recently teased the upcoming launch of LibertyDEX, the newest protocol to be added to Gather’s expanding product suite. Built on Gather’s native hybrid blockchain network, LibertyDEX is a decentralized exchange that will offer a swathe of DeFi features including leveraged yield farming, protocol-based lending, and lightning-fast trading speeds.

Does the crypto world need yet another DEX? Jerath and the rest of the brain trust at Gather believe so. LibertyDEX has been created with holders of the $GTH governance token in mind and represents a key pillar of the project’s protocol layer, where stakeholders are incentivized to maintain transparency and security.

Liberty on Layer1

Although a release date has not yet been confirmed for Gather’s brand-new decentralized exchange, Jerath’s detailed Twitter thread suggests the product is close to launch.

The bedrock of the exchange is likely to be protocol-based lending, a feature that Jerath says excites the team most of all. Essentially, users who deposit LP tokens such as GTH/USDT on Liberty will have the opportunity to earn higher yields compared to existing stable farms available on the likes of Uniswap and PancakeSwap.

New projects listing on Liberty, meanwhile, will be allocated a percentage of the stable assets deposited by liquidity providers. Fees paid by these projects will then flow towards the protocol and token-holders, the latter of whom gain access to the stablecoin.

According to Reggie Jerath, an upcoming airdrop will prioritize all GTH holders who will eventually leverage on-chain governance to influence which projects are approved for listing.

This is not Gather’s first trading rodeo, of course; the Layer-1 network is already supported by global crypto-asset exchange platform AscendEX which facilitates mainnet on-chain staking. A Liquidity Provider Incentive Program is also active on Uniswap (ETH trading pair) and PancakeSwap (BNB trading pair).

Bringing Blockchain to the Mainstream

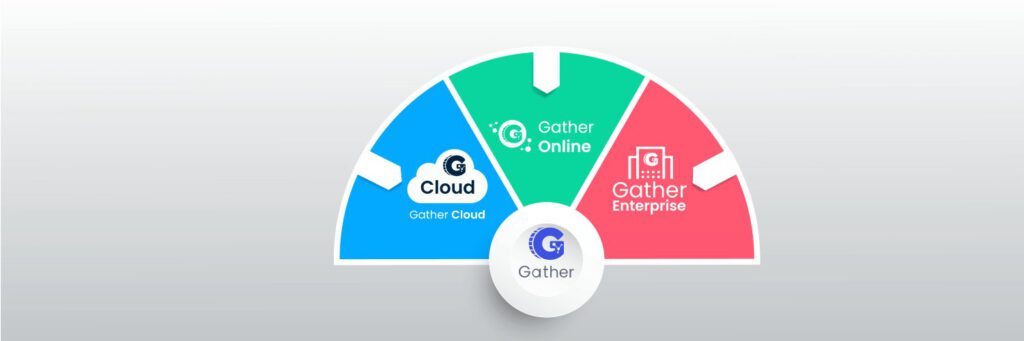

If Gather’s primary objective – to onboard as many mainstream users to blockchain – is obvious, its methods are not. The ecosystem is made up of three main layers – a hardware layer (Gather Online), a protocol layer (Gather Network), and an application layer (Gather Cloud) – and together these pillars aim to usher in a new paradigm in digital advertising, cloud computing, and token-based value transfer.

While Gather Online aggregates web visitors’ processing power and distributes it to enterprises for cloud computing (and to devs for crypto mining), the Network underpins “a marketplace-based platform where publishers meet with enterprises and developers.”

Gather’s native utility token, $GTH, is the carrot that incentivizes stakeholders to generate revenue by supplying processing power for the hardware layer and to maintain a healthy network for the application layer. Gather’s blockchain will also support merged mining via auxiliary chains, meaning smaller projects can easily tap into the hashing power of Gather’s parent chain. Best of all, it supports smart contracts to ensure interoperability between disparate chains.

2022 looks set to be a breakout year for the Dubai-based Gather, which recently opened its second office in India – and confirmed that 1000 clients are now signed-up to Gather Online.

Existing $GTH token-holders, as well as those intrigued by what the multi-layered protocol might deliver in the months and years to come, are likely to keep a close eye on LibertyDEX. Those eager to buttonhole Reggie and the team, meanwhile, should note that a Gather dinner has been mooted to coincide with the NFT.NYC event this summer. Dubbed “the Superbowl of NFTs,” the event is set to run from June 20 to June 23.