- Russia’s attacks on Ukraine has negatively impacted crypto and stocks.

- Meanwhile, gold’s price is surging to $1,949.

- The spectacle is causing many to rethink Bitcoin’s case as the new hedge standard.

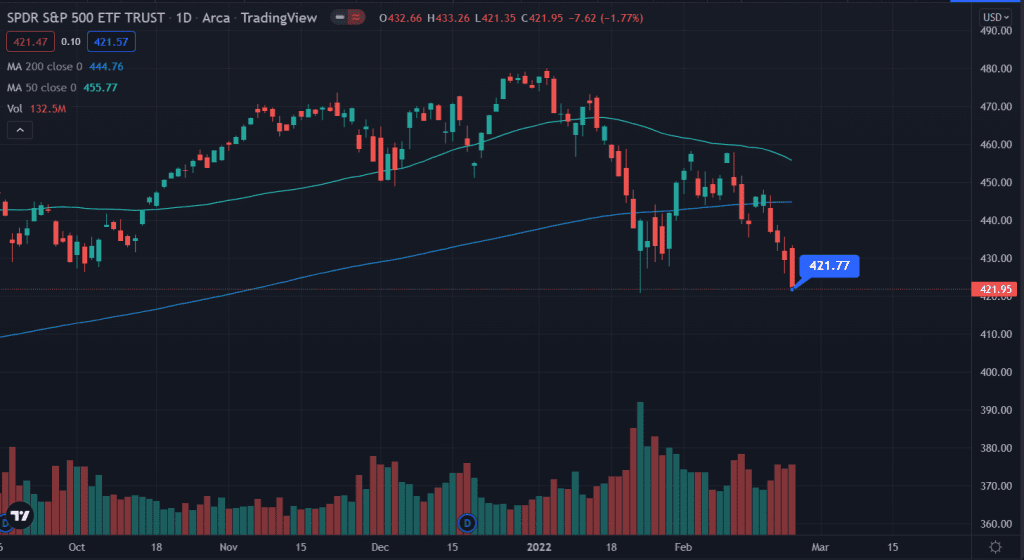

Russia’s invasion of Ukraine has brought various financial markets to their heels, with the entire crypto market witnessing a crash of 8.9%. Meanwhile, US stocks, including Dow Jones and S&P 500, are on a freefall.

Individual stocks such as Tesla and Apple plummeted to $760 and $159, respectively. Meanwhile, CoinQuora reported that Bitcoin and other cryptocurrencies are witnessing a -20% decline in the last 24 hours at the very least.

Amid the crypto and stock market FUDs due to reports of Russia’s invasion of Ukraine, people are pouring their money into gold as a hedge bet. In fact, gold saw a surge up to $1949, at the time of writing.

As expected, gold supporter and crypto critic Peter Schiff rubbed the issue on Twitter.

Pershaps the #Fed is relieved that #Russia invaded the #Ukraine as now it has an excuse not to raise interest rates in Mar. If it wasn’t this it would’ve been something else, but as far as excuses go this one’s hard to top. #Gold spiked 1.5% and #Bitcoin dumped 5.5% on the news.

— Peter Schiff (@PeterSchiff) February 24, 2022

Cryptocurrencies, particularly Bitcoin, are touted by some as the better hedge compared to gold. This was due to Bitcoin’s exponential growth in the past 10 years. However, Russia’s invasion of Ukraine alongside other market concerns has hampered the rally of cryptocurrencies alongside stocks.

On the other hand, gold’s recent surge is causing many to rethink whether Bitcoin is still the “digital gold”. In fact, CNBC published an article saying that the case for Bitcoin becoming the new standard is “falling apart”. At the time of writing, Bitcoin price is at $34,864.38 – a drop of 8.5% in the last 24 hours.