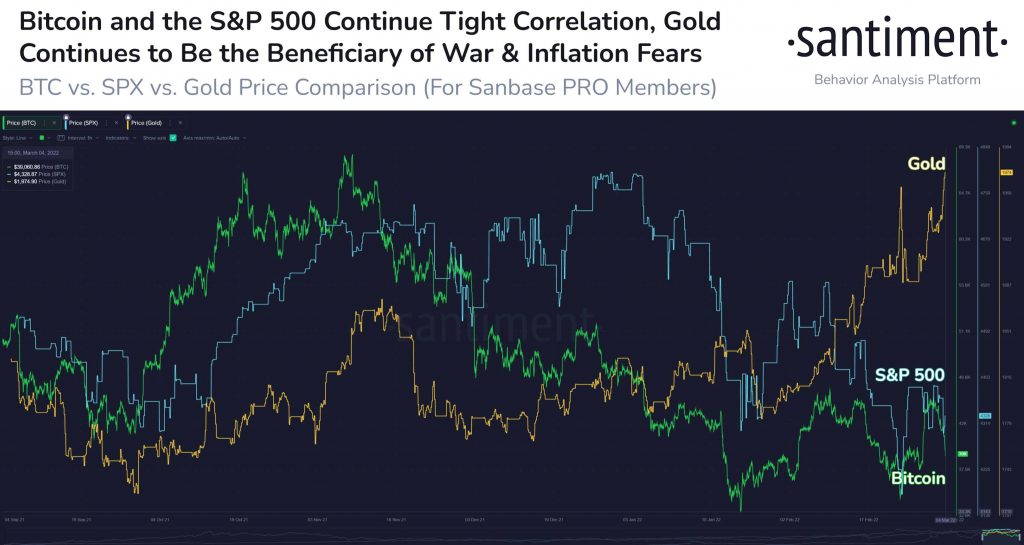

Bitcoin’s role in the global financial turns increasingly important amid the geopolitical situation panning out with the Russia Ukraine crisis. After a move last to decouple itself from the equity market. Bitcoin failed to hold the ground and is down more than 20% from its recent $45,000 high.

As of press time, Bitcoin is trading 4.16% down at a price of $37,980 with a market cap of $719 billion. If Bitcoin continues with its downward correction and fails to hold $35,000, we can see it further sliding to $30,000.

Well, guess who’s bragging all the limelight here? Bitcoin’s arch-rival and hedge asset, physical Gold. Amid the ongoing war crisis, the Gold price has shot up to its 19-month high moving past $2,000 per ounce.

Bloomberg’s senior commodity strategist Mike McGlone has often held a bull case scenario for Bitcoin in 2022. However, in one of his recent tweets, McGlone said that the chances of Bitcoin revisiting $30,000 is very high. But McGlone remains bullish that Bitcoin continues to show divergent strength over equity.

#Bitcoin $40,000 or #Nasdaq 14,000? Digital #Gold Set to Prevail – Bitcoin faces deflationary forces after 2021 excesses, but the crypto shows divergent strength. With 2002 losses less than half those for the Nasdaq 100, Bitcoin may be maturing toward global digital collateral pic.twitter.com/Yt8Q5q5qjt

— Mike McGlone (@mikemcglone11) March 4, 2022

advertisementBest optionsEarnEarn 20% APRWalletCold WalletEarnEarn 20% APR

Are Russians Buying Bitcoin Actually to Avoid Sanctions?

Amid the ongoing war, Russia has been facing heavy sanctions as the West plans to cut it off from the global financial system. Many believed that the last week’s market rally was because a large number of Russians were moving to crypto.

However, the narrative was strongly challenged as the Ruble-denominated crypto trading volumes collapsed later that week. In fact, the crypto trading volumes coming from Russia are on a downside. Popular Bitcoin critic Peter Schiff writes:

Russians who are looking to store their wealth in an asset that governments can’t seize are choosing #gold over #Bitcoin. Bitcoin is far too risky to be used as a safe haven or a store of value. Bitcoin has failed its first major test. I don’t think it will get a second chance!

The clear picture is that the yellow metal has yet again proved to be a more reliant hedge asset than Bitcoin in terms of the global crisis. Gold can further surge as the value of commodities head up to the north sharply with inflation expected to grow further.