The U.S. economy is currently staring at the chances of a major recession with inflation soaring and growth decelerating. On the other hand, the crypto market meltdown has drawn the attention of lawmakers as U.S. households own one-third of the global crypto market.

However, Wall Street banking giant Goldman Sachs doesn’t see much of a worry here. It notes that the crypto market correction will have little impact on the U.S. economy per see.

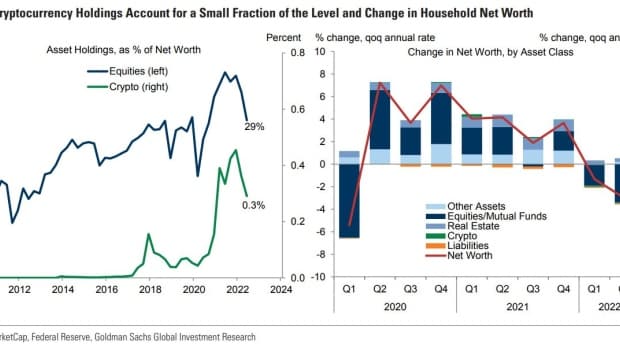

The Goldman Sachs economists explained that the overall U.S. household net worth stood at $150 trillion as per last year’s data. On the other hand, the crypto market has lost a $1 trillion valuation over the last year. Thus, the economists believe that this is still “very small” to the entire U.S. household net worth. In a note on Thursday, May 19, the Goldman Sachs economists led by Jan Hatzius wrote:

“We therefore expect any drag on aggregate spending from the recent declines in cryptocurrency prices to be very small as well”.

Impact of Crypto vs Stocks

During the recent correction, more than $7 trillion has been eroded from the U.S. equity market. Economists are studying the impact of this sell-off in the equity and the crypto market on the broader economy.

Trending Stories

Bloomberg quoted a study showing that every Dollar lost in stocks led to a reduction of 3 cents in spending. This five-month sell-off in 2022 means over a $300 billion spending cut. As per the Goldman Sachs study, stocks constitute 33% of the total U.S. household net worth by the end of 2021. On the other hand, crypto accounted for only 0.3%.

“These patterns imply that equity price fluctuations are the main driver of changes in household net worth, while cryptocurrencies are only a marginal contributor,” Goldman Sachs economists wrote.

The banking giant further adds: “cryptocurrency investors skew younger and male, a demographic group whose labor force participation has generally been less affected by wealth fluctuations”.