Goldman Sachs’ interest in crypto has been blossoming over the last few years and current trends suggest that this is not slowing down anytime soon. Recently, the investment banking firm carried out a survey in a bid to understand how its clients are interacting with the crypto market and the findings have revealed that institutional investors are still very bullish on the space.

Institutional Investors Want More Exposure

2021 was not only a big year for cryptocurrencies in terms of rising prices but also in terms of how many institutional investors wanted exposure to the market. This saw firms like Goldman Sachs proffer ways for their clients to gain some exposure to the market, albeit indirectly. However, it would seem that these clients remain undated as they look to increase their exposure to cryptocurrencies.

Related Reading | Socios Signs Multi-Year, $20M Deal With Football Star Lionel Messi

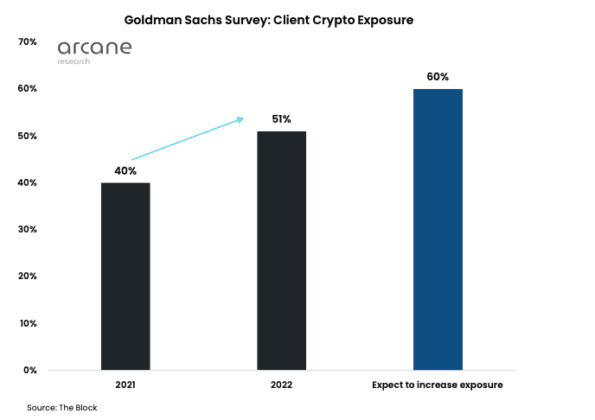

In the Goldman Sachs survey, out of the 172 respondents, reported that 51% of all of the firm’s clients admitted to already having some type of crypto exposure. This number was up from the 40% that responded in the affirmative last year, and even at that time, the 40% number was a significant one. But this was not the most interesting findings of the Goldman Sachs survey.

Goldman Sachs clients want more crypto exposure | Source: Arcane Research

That would turn out to be the number of clients who intend to increase their exposure over the next 1-2 years. A said 60% of the firm’s clients said they planned to increase the digital asset holdings that they currently possess.

Goldman Sachs Bringing Crypto To Clients

It is no surprise that clients of the firm have been increasingly interested in the space. Goldman Sachs has made headlines multiple times for providing exposure to the crypto market. An example of this was back in June 2021 when the firm had begun offering the opportunity for clients to trade Ethereum options and futures. Another survey from the investment firm a month later had confirmed that its wealthiest clients wanted to invest in bitcoin.

The firm’s website speaks volumes with regard to this as it now features content and services that extensively focus on the crypto market. Its move into this space is an obvious indicator of growing institutional interest in this space.

Total market cap sitting at $2.1 trillion | Source: Crypto Total Market Cap on TradingView.com

Goldman Sachs had announced last week that it successfully conducted the first non-deliverable option trade in crypto on record. It had carried this out in partnership with financial and investment management firm, Galaxy Digital, which also leans heavily towards crypto.

Related Reading | New Crypto Survey Shows 53% Of Americans Think Cryptocurrencies Will Be The ‘Future Of Finance’

Other institutional investors continue to bet big on the space. Recently, it was announced that MicroStrategy, the public company with the largest Bitcoin holdings, had secured a $200 million loan to purchase more Bitcoin.

Featured image from Plus TV Africa, charts from Arcane Research and TradingView.com