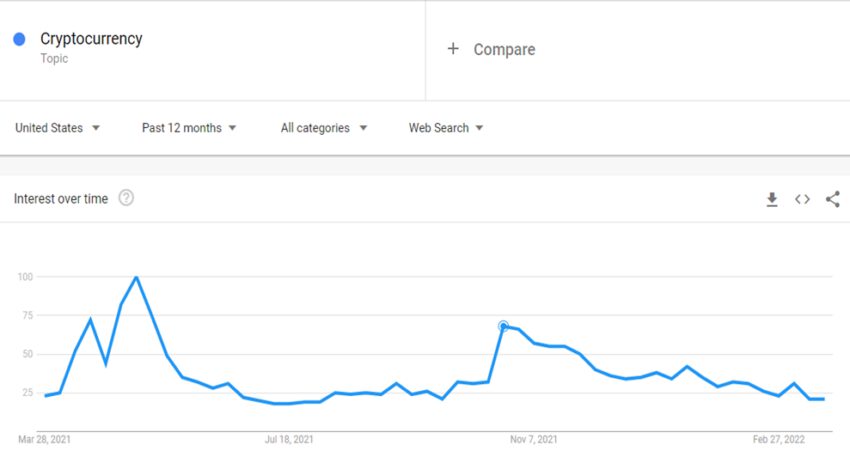

The continuous decline of the prices of digital assets in 2022 has led to a decrease in the interest in cryptocurrency by residents of the United States of America.

Interest in cryptocurrency has dropped to new high lows in the United States in March 2022. According to Be[In]Crypto Research, data from Google Trends shows interest in cryptocurrencies by residents of the United States have sunk in 2022.

Interest over time is the number of search interests in cryptocurrencies relative to a point that ranges from 0 to 100. This means that a value of 0 represents virtually no interest while a peak of 100 means cryptocurrencies dominate the search patterns of residents of the United States.

The term ‘cryptocurrencies’ reached a value of 100 in May 2021. During this period, several cryptocurrencies reached new all-time high prices. Among them was the second-largest cryptocurrency by market capitalization, ETH, the native asset of the Ethereum network which crossed $4,000 for the time. ETH eventually reached a monthly high of $4,362.35 on May 12, 2021.

The trading volume of Ethereum (ETH) in May 2021 was approximately $1.51 trillion. In the same period, the largest digital asset by market capitalization, Bitcoin (BTC) also recorded impressive trading volumes of $1.97 trillion.

Why the falling interest in cryptocurrency in 2022?

Falling trading volume have reflected in market prices can be largely attributed to the waning interest in cryptocurrency in 2022.

The trading volume of Bitcoin in January 2021 was approximately $2.15 trillion. This increased by 5% to approximately $2.26 trillion in February 2021. This transcended positively into the price of Bitcoin. BTC began Jan. 1, 2021, at $28,994.01 and spiked to $45,137.77 on Feb. 28, 2021 — a 55% increase in value in the span of two months.

In comparison to 2022, the trading volume of Bitcoin in January 2022 was approximately $923 billion. BTC trade volume dropped further to $671 billion in February, a 27% decrease in the span of 28 days,

This impacted the price of BTC massively. Bitcoin opened on Jan. 1, 2022, at $46,311.74. There was a huge decline in the days that followed due to negative crypto market sentiment which was deepened by Russia’s invasion of Ukraine towards the end of February. As a result, BTC declined by 6% of the opening day of the year’s price to $43,193.23 on Feb. 28, 2022.

The biggest year in the trading history of Ethereum was 2021. In January 2021, ETH trade volume reached $1.18 trillion. However, it experienced a slight decrease of 14% in investor interest that saw ETH record a trading volume of approximately $1 trillion in February 2021.

A spike in volume improved the price movements for Ethereum. ETH opened on Jan. 1, 2021, at $737.71 and saw a rally of 91% to $1,416.05 by Feb. 28, 2021.

In comparison to 2022, there has been a massive drop in investor interest in Ethereum. According to Be[In]Crypto Research, ETH trading volume in January 2022 was approximately $491 billion. There was a decline in trading volume in the second month of 2022 which saw 15% wiped off January’s value. On Feb. 28, 2022, the total trading volume was approximately $416 billion.

The price of Ether was not spared. ETH opened at $3,683.05 on Jan. 1 and the price eventually sunk to $2,919.20 on Feb. 28, 2022 — a 20% decrease in the span of two months.

Overall, Bitcoin and Ethereum saw a decrease in year-over-year trading volume in January and February 2022. Bitcoin saw drops of 57% and 70% in the volume recorded in January and February 2021 respectively.

Ethereum also saw declines of 58% in the trading volume recorded in January and February 2021 respectively.

Issues such as inflation, economy, and high cost of living have reached new peaks in 2022 and can be attributed as factors that have led to the dwindling interest in cryptocurrencies in the U.S.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.