Key Takeaways

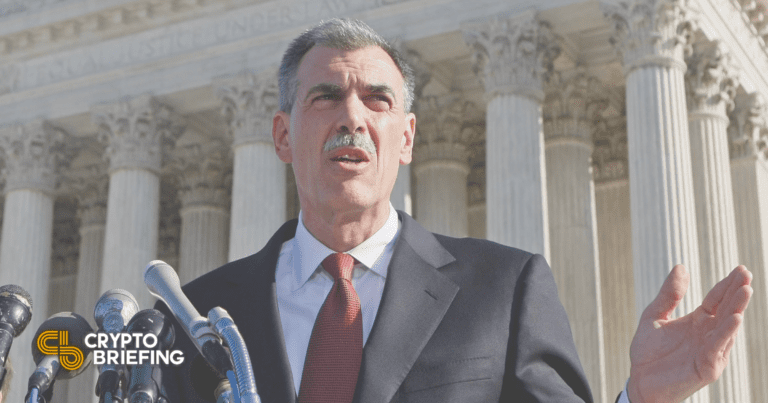

- Grayscale has retained the former U.S. Solicitor General Donald B. Verrilli, Jr.

- Verrilli will allegedly work to help the firm convert the Grayscale Bitcoin Trust to a spot Bitcoin ETF.

- The Securities and Exchange Commission has until Jul. 6 to decide on Grayscale’s spot Bitcoin ETF application.

Share this article

The world’s largest digital asset manager, Grayscale, has hired the former U.S. Solicitor General, Donald B. Verrilli, Jr., as an additional legal counsel to support its pending ETF application with the U.S. Securities and Exchange Commission. The firm has previously stated that suing the SEC over the matter is “on the table.”

Grayscale Beefs-Up Legal Team

Grayscale has bolstered its legal team with an eminent lawyer in preparation for a possible legal spat with the SEC.

The vice president of corporate communications at Grayscale, Jennifer Rosenthal, announced Tuesday night that the world’s largest digital assets manager had retained the former Solicitor General under the Obama Administration, Donald B. Verrilli, Jr., as an additional legal counsel.

Today, @Grayscale announced that we’ve retained former Solicitor General under the Obama Administration, Donald B. Verrilli, Jr., as additional legal counsel.

— Jennifer Rosenthal (@jenn_rosenthal) June 7, 2022

The decision comes ahead of the July 6 deadline when the SEC must either reject or approve the conversion of Grayscale’s Bitcoin Investment Trust (GBTC), to a spot Bitcoin exchange-traded fund. GBTC currently holds over 3.4% of all Bitcoin in circulation.

Grayscale’s GBTC investment trust shares are currently not redeemable and only available to accredited investors with a mandatory six-month holding period. This means that GBTC’s shares often trade at a significant discount to the trust’s net asset value because the market can’t arbitrage away the price disparities by redeeming shares.

To resolve this issue and make its product more attractive and accessible for investors, Grayscale applied to convert GBTC into a spot Bitcoin ETF with the SEC in October 2021. By converting to an ETF, GBTC shares would start trading like regular stocks on stock exchanges, unlocking a simultaneous share creation and redemption mechanism and allowing the fund to trade at parity with the net asset value of its holdings via arbitrage. However, despite many requests from reputable institutions, the SEC has yet to approve such a product, citing market manipulation and investor protection concerns.

“As we enter the final month before a response is due on our application to convert $GBTC to an ETF, we have retained Donald B. Verrilli, Jr., former Solicitor General of the United States, as additional legal counsel,” the official Grayscale account confirmed in a Twitter thread. The firm allegedly wants to be prepared “for all scenarios,” which—judging by its earlier statements—could include suing the securities agency over the matter. “we have ensured that GBTC is operationally ready to convert to an ETF and have been exploring options should the SEC not allow GBTC to convert to an ETF,” Rosenthal said when announcing the hiring move yesterday.

Verrilli, one of the country’s most experienced attorneys, has fielded over 50 cases before the United States Supreme Court, and will serve as a senior legal strategist working alongside Grayscale’s external attorneys and in-house counsel.

The Grayscale Bitcoin Trust is currently trading at a 29.4% discount to the net asset value of its Bitcoin holdings.

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies.