The third annual Bitcoin Investor Study published by Grayscale Research demonstrated continued growth in interest, awareness, and adoption of Bitcoin and the digital currency ecosystem at large. The surge in BTC adoption this year is substantial.

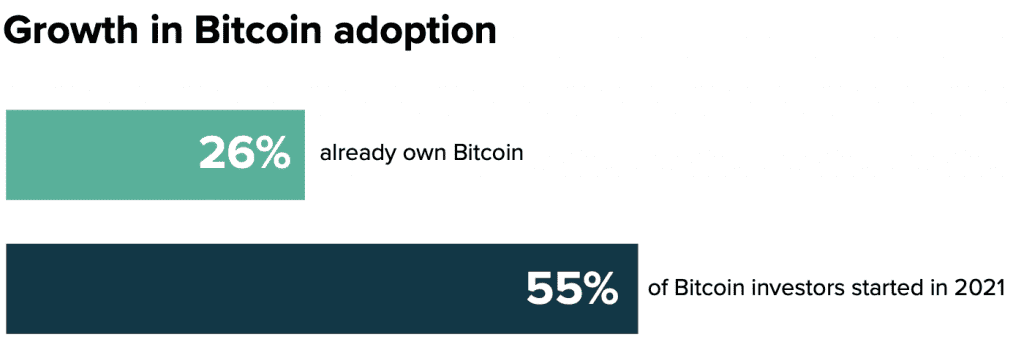

More than half of the American Bitcoin holders began their investment for the first time during the last 12 months . Whereas 26% of surveyed investors already own Bitcoin. A significant rise from 23% in 2020 and 2019 (36%).

Source: Survey

Another sign that investors are increasingly treating Bitcoin as a store-of-value asset is the fact that many are choosing not to sell their position. A majority of investors continue to hold their Bitcoin today.

This highlights that Bitcoin is viewed as a long-term investment. Another 14% consider BTC as a P2P medium for money transfers. Whereas 1/5th of panelists consider it a medium to pay for goods and services. The chart below highlights the same.

Overall, in terms of investment planning, three times as many investors would consider owning BTC as an investment rather than a currency.

In addition to this, crypto exchange platforms witnessed an immense rise as well. More than half (59%) mostly invested through crypto trading apps like eToro or Coinbase, representing a paradigm shift from last year when more than three-quarters of investors (77%) preferred a Bitcoin exchange. This portrays the trust the residents had over such platforms regardless of the regulatory concerns.

Diversification

It’s not just Bitcoin though, as the Grayscale report notes that more than half of investors were aware of Dogecoin and Ethereum. Almost three-quarters (74%) of investors have heard of Dogecoin, surpassing the level of awareness around Ethereum (56%). Litecoin, Cardano, and Tether are also on investors’ radar, with the awareness level hovering above 25% for each of them.

And most investors who own Bitcoin also own at least one other cryptocurrency:

Different age groups witnessed a similar diversification as per the research. Interest in Bitcoin investment products rose significantly among older investors. Investors between ages 55 and 64 (46% in 2021 from 30% in 2020), and female investors (53% in 2021 from 47% in 2020).

Here’s what Michael Sonnenshein, CEO of Grayscale Investments had to say.

“The results of the 2021 Bitcoin Investor Study confirm that more investors see long-term value in adding Bitcoin and digital currencies to their investment portfolios.

While it is encouraging to see attitudes towards crypto continue to evolve, it’s still early days for this industry. It’s incumbent on all of us to remain focused on educating the investing public, so investors — across generations and demographics — can access this once in a generation opportunity.”

There was near-universal increase in Bitcoin adoption across all age groups, genders and levels of education. The reported cited being able to invest very low amounts, accessibility at any time and a large sector growth potential as key reasons for its popularity. So overall this portrays bullish narratives across the region.

Need for Bitcoin ETF

Even with the rise of market segments and use cases, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), Bitcoin still accounts for 46% of the total value of crypto markets.

Grayscale revealed that more than three-quarters (77%) of US investors said they would be more likely to invest in Bitcoin if an ETF existed. The launch of a Bitcoin ETF played a pivotal role in the rise of BTC adoption.

In its concluding note, the report discussed a rising demand for Bitcoin education, as “42% of investors want to know more about Bitcoin.” It is noteworthy that this demand was lesser when compared to 47% and 49%

in 2020 and 2019 respectively. But on a positive side, it “reflected a growing familiarity with Bitcoin,” as per the report.