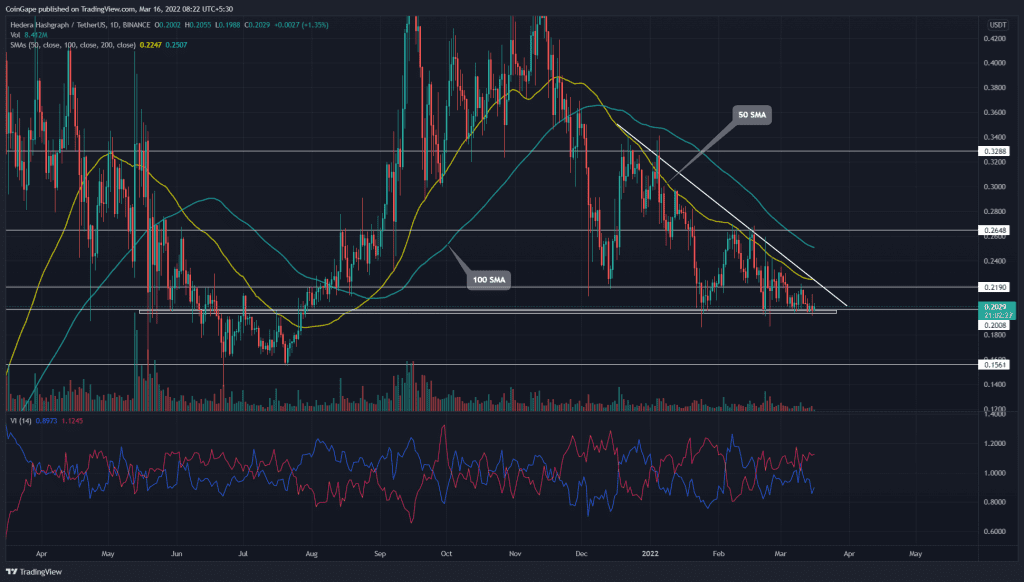

A long-wicks Doji candle displayed high volatility within the HBAR price charts on Monday. The altcoin retesting the neckline support of the descending triangle pattern teases a bearish breakdown. A successful fallout will slump the altcoin by 16%, reaching the $0.22 support.

Key points:

- The Daily-RSI chart projects a bullish divergence

- The intraday trading volume in the Hedera coin is $73.3 Million, indicating a 35.8% gain.

Source- Tradingview

On February 17th, the Hedera (HBAR) price turned down from the combined resistance of $0.27 and falling trendline. The bear cycle plunged the coin by 25%, resisting the $0.2 monthly support.

Furthermore, the coin price continued the sloppy consolidation in March, gradually narrowing within the range of descending triangle pattern. The bearish continuation pattern intensifies the supply pressure as the altcoin nosedive below the neckline.

However, the daily-RSI slope rallying with new higher lows suggests the rising bullish momentum. This positive divergence with respect to the last three swing lows in price action indicates the coin has a Higher probability for a bullish breakout.

If the buyers breach and sustain above the dynamic resistance trendline($0.22). The follow-up rally would drive the altcoin by 20% and the $0.268 mark.

Anyhow, a genuine breakout from either of the end levels will determine the upcoming rally.

Technical Indicator

The declining simple averages (50 and 100-days) maintain a bearish trend along with the resistance trendline. Moreover, the 50-day average line has crushed multiple bullish attempts resulting in the lower high formations.

However, a potential reversal aiming for the trendline breakout will eventually reach the 100-day average, resulting in a 12.54% growth. Furthermore, an increased grip over the trend can help surpass the $0.25 and reach the 200-day average at $0.328.

The daily volatile indicator shows the VI lines continue the bearish trend after avoiding the reversal crossover. However, a crossover at the 50-SMA breakout is plausible.