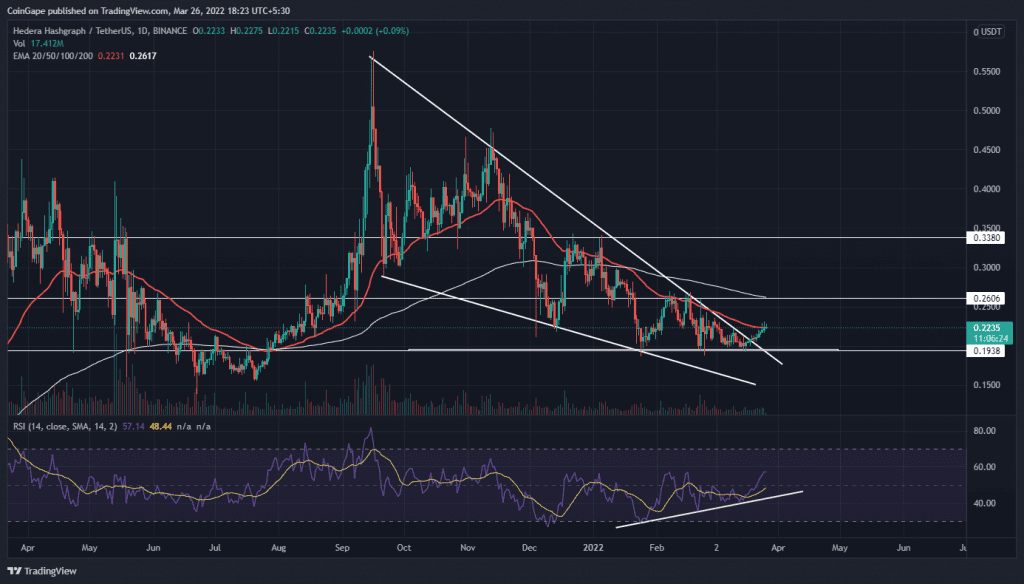

Despite forming five consecutive green candles on weekdays, the bullish momentum seems weak concerning the short body and higher tail rejections attached. Furthermore, the Hedera(HBAR) price has recently breached a long-coming resistance trendline, and supply pressure from above teases a price dip to a $2 support zone.

Key points:

- The bullish RSI divergence suggests an overall bullish tendency

- The HBAR buyers are struggling to overcome 50-day EMA

- The intraday trading volume in the Hedera coin is $72.7 Million, indicating a 31.92% gain.

Source- Tradingview

Since the HBAR downtrend began in Mid-September 2021, the coin price action has been confined within a falling wedge pattern. The sellers dumped the altcoin to its current lower low support at $2, indicating a 66% from the All-Time High resistance of $0.52.

The HBAR price gradually narrowed within the descending trendline, and $2 bottom support has resulted in a bullish breakout from the wedge pattern. So far, the post retest rally surged 8%, hitting the 50-day EMA(0.224).

However, the bull run showed multiple higher price rejection candles, suggesting the trades are selling on rallies and could initiate a minor pullback. As a result, the potential retracement could plunge 11.7% to the $2 mark.

Best optionsEarnEarn 20% APRClaim5 BTC + 200 Free SpinsWalletCold Wallet

A bounce back from this bottom support would indicate that the traders’ sentiment has flipped to buying the dip, suggesting the next bull cycle hit $0.26.

Technical Indicator

- The recovery rally faces strong resistance from the downsloping 50-day EMA, bolstering the possibility for reversal. Moreover, the 200-day EMA at the $0.26 mark provides an important pivotal point for buyers to overcome.

- However, RSI slope forming successive higher highs suggests increasing underlying bullish momentum.