Chainlink [LINK] seemed to turn a deaf ear to the ongoing bear market as it continued to carry out collaborations and integrations. This consistent growth could help renew investors’ faith in LINK which may have faltered as a result of the current bear market.

_____________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for Chainlink for 2022-2023.

_____________________________________________________________________________________

On 16 October, Chainlink took to Twitter to stated that the platform made 15 integrations across BNB, Ethereum, Moonbeam, and Polygon. These integrations may help Chainlink garner some much-required interest from potential and existing investors.

⬡ Chainlink Adoption Update ⬡

This week, there were 15 integrations of 4 #Chainlink services across 4 different chains: #BNBChain, #Ethereum, #Moonbeam, and #Polygon.

Reminder: Check your eligibility to participate in #Chainlink Staking v0.1. https://t.co/nOhbTwulv1 pic.twitter.com/07EWP74cOP

— Chainlink (@chainlink) October 16, 2022

Eye of the whales

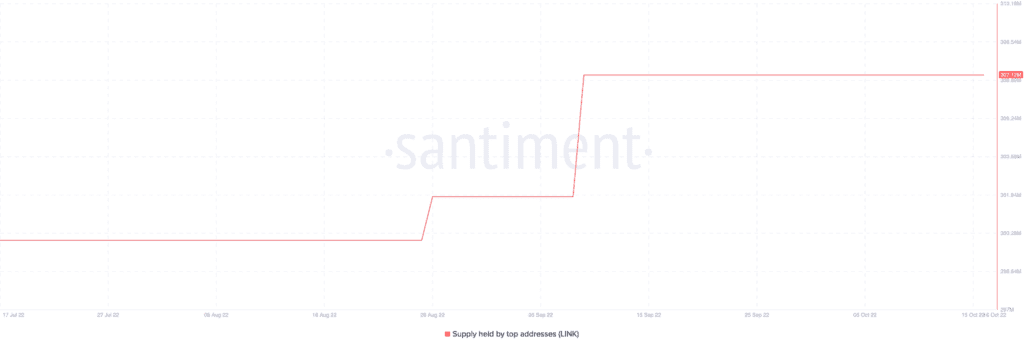

In a turn of events, Chainlink’s developments did catch the eye of the whales. As can be seen from the image below, whales were showing interest in LINK over the past three months.

According to WhaleStats, crypto whale tracking platform, LINK made it to the list of top 1000 ETH whales holdings on 17 October. ETH whales held approximately $46 million worth of LINK.

🐳 The top 1000 #ETH whales are hodling

$127,742,831 $SHIB

$82,459,341 $MKR

$70,419,159 $BIT

$57,450,680 $UNI

$46,933,354 $LINK

$45,043,172 $LOCUS

$36,840,600 $MOC

$36,498,530 $MANAWhale leaderboard 👇https://t.co/jFn1zIOXPB pic.twitter.com/uIq7F0s3Zv

— WhaleStats (tracking crypto whales) (@WhaleStats) October 16, 2022

However, despite whales and institutional investor interest, the number of daily active addresses on the network declined. As can be seen in the image below, daily active addresses decreased post 1 October.

A decline in Chainlink’s network growth was also observed in the same time frame. A decline in network growth indicated that new addresses that transferred LINK for the first time witnessed a drop. This also implied that interest from new addresses may be wearing off.

From link to unlink

One of the reasons for the waning interest in Chainlink could be a decline in Chainlink’s social mentions. According to LunarCrush, Chainlink’s social engagements depreciated by 18.89% over the past week. However, despite the decline in the number of engagements, weighted sentiment around Chainlink remained largely positive.

This indicated that the crypto community had more positive things to say about Chainlink than negative.

It appeared that at press time, Chainlink managed to capitalize on the positive sentiment. LINK’s price appreciated by 1.92%, however, its volume depreciated and fell by 6.49% in the last 24 hours.

However, Chainlink may have a chance to redeem itself. This was because of Chainlink’s staking protocol that will launch in December. Chainlink would be incentivizing users to improve its security by issuing rewards to stakers.

This move could potentially be a key factor in Chainlink’s growth over the next quarter.