Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- FTT found rebounding grounds but it could continue seeing reversals.

- The token’s Open Interest declined alongside an increase in price.

Following the drama around FTX’s liquidity crunch, its token continued to take the brunt of the entailing sell-offs. Binance’s intent to not pursue the acquisition of FTX due to the results of corporate due diligence has only added fuel to the FTT’s bearish fire.

Read FTX Token’s [FTT] Price Prediction 2023-24

FTT got ‘Rekt’ while registering a nearly $5 million liquidation over the past day. The buyers strived to defend the $1.53 baseline support after a bloodbath that entailed over 92% losses from 8-10 November.

At press time, FTX was trading at $3.07, up by 22.14% in the last 24 hours.

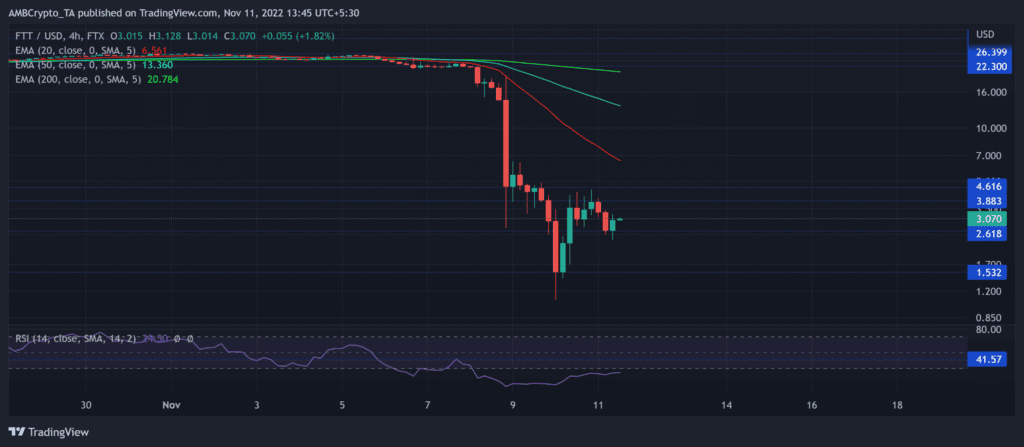

FTX touched its all-time low region

FTT’s bearish volatile break below the $22.3-level induced a free fall amidst the uncertainties in investor perception. After losing most of its value, the token exhibited rebounding inclinations from the $1.53 support.

But the $4.6-$3.8 range constricted this rebound while curtailing FTT’s volatility near its relatively high liquidity zone. A plausible reversal from the immediate resistance range can continue to pose substantial hurdles for the buyers.

However, due to the relatively high correlation with Bitcoin alongside the broader sentiment, the altcoin could easily see trend invalidations in the coming days.

FTT’s recent breakdown has pulled the alt below its 20 EMA (red), 50 EMA (cyan), and 200 EMA (green). From a relatively near-term outlook, the sellers would look to control the trend. The sustained south-looking tendencies of these EMAs could impair near-term buying efforts.

The Relative Strength Index (RSI) still swayed in its oversold region as the sentiment deteriorated. The buyers should still wait for a potential reversal above the 41-level before hoping for an easing in the selling pressure.

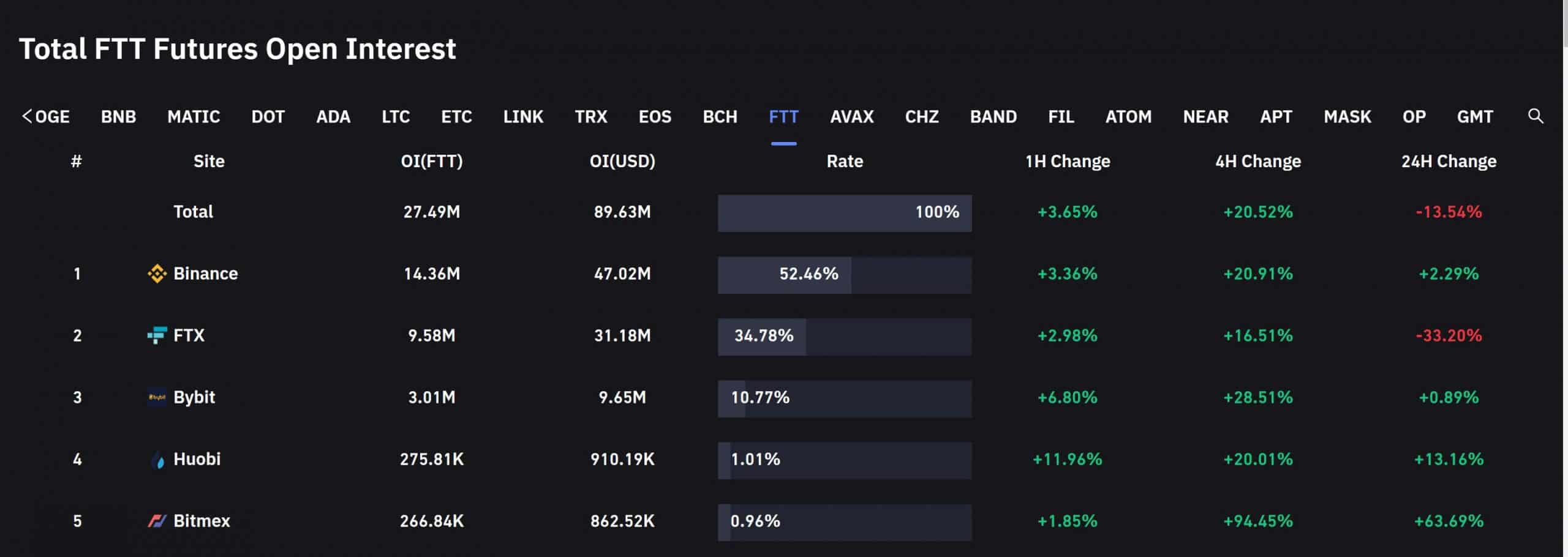

An increase in price alongside a plunge in Open Interest

According to data from Coinglass, the total FTT futures Open Interest across all exchanges marked a 13.5% decline in the last 24 hours. On the contrary, the price action registered an over 20% growth during the same time.

More often than not, rising prices alongside a decline in Open Interest hints at bearish tendencies. While the money is flowing out of the market, the price action could mark a reversal in the coming sessions.

Nonetheless, investors/traders must keep a close eye on Bitcoin’s movement as FTT shared an 88% 30-day correlation with the king coin.