XRP’s fate has remained uncertain, largely due to the lengthy SEC lawsuit against Ripple Labs. However, this provides a chance to evaluate the kind of opportunity that XRP’s subdued price performance has to offer.

What if the lawsuit is the worst-case scenario for Ripple and what would a best-case scenario look like? Fortunately, it is not that hard to imagine, thanks to the robust growth that Ripple’s ODL service has achieved since its launch. Ripple is strategically positioned to improve the traditional finance system. ODL was designed to facilitate faster and cheaper transactions in the remittance and banking industry through blockchain tech.

Tapping into growth in centralized finance

According to an analyst called Anderson (@X__Anderson), ODL might be the secret weapon behind XRP’s robust growth in the future. He recently highlighted the robust sales that ODL achieved between Q2 2021 and Q2 2022 as a sign of what is to come in the future.

I believe the current ODL volume is underrated, since such increase is exponential. We know Ripple had an average of $23 million per day in ODL-related sales last quarter.

Q2 2021 to Q2 2022 (one year), it went from $158 million to $2.1 Billion, more than 10x in a year.$XRP pic.twitter.com/DDZnyPuufZ

— Anders 🏁 (@X__Anderson) August 12, 2022

According to Anderson’s analysis, if ODL sees a 10x growth every year for the next five years, its daily sales will be worth trillions of dollars. Such utility would offer a huge boost to the demand for XRP. He also expects such utility to attract a lot of speculative volumes which will further strengthen XRP’s price action.

No doubt an overall increase in organic and speculative demand would be healthy for XRP. However, a look at it past performances may provide a better picture of what the future might hold for XRP.

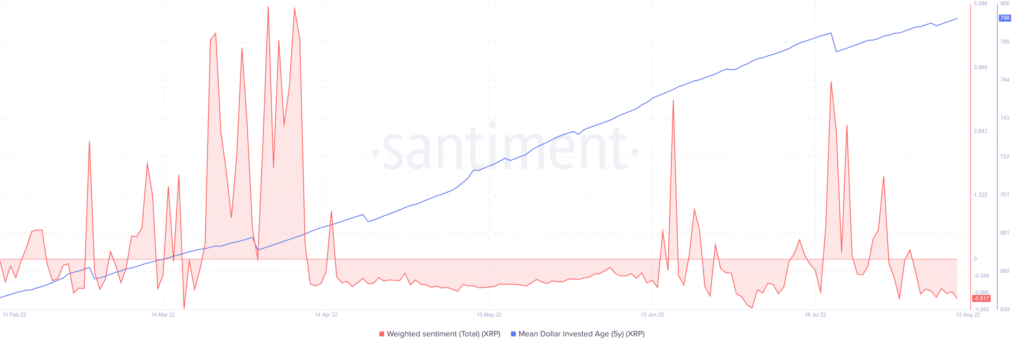

The average age of the XRP coins invested in the last 5 years has grown consistently. The mean dollar age peaked at 798.27 XRP, at press time.

Despite healthy 5-year growth, XRP’s press time price remained subdued. By extension, the prevailing sentiment is that it is undervalued. The aforementioned observation can be best represented by XRP’s weighted sentiment metric.

Furthermore, the 5-year MVRV ratio appeared to perform inversely compared to the mean dollar age. In fact, it further reinforced the undervalued sentiment.

What does this mean for the average XRP holder?

Well, all signs seemed to suggest that XRP’s $0.37 press time price was undervalued and discounted, especially compared to its previous highs.

ODL’s growth, however, paints a favorable picture of its future long-term growth. Hence, holding it for at least 5 years might be a good call (NFA). XRP’s short-term outlook remains uncertain though, especially due to the ongoing lawsuit.