Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- After breaking out from its bullish flag, Dogecoin reaffirmed its near-term bullish inclination.

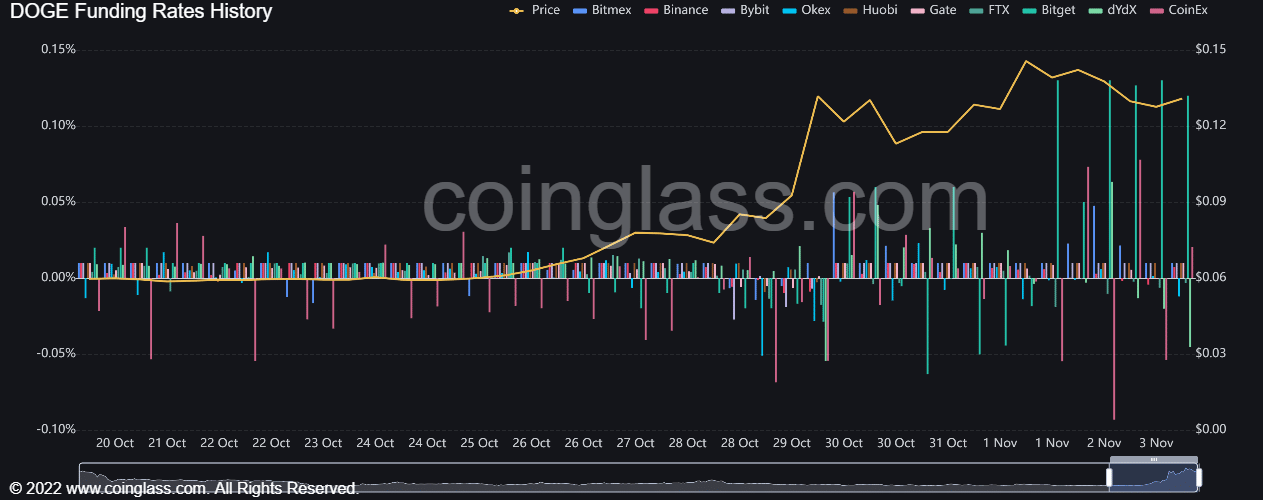

- DOGE’s funding rates corroborated with the broader bullishness and stood positive on most exchanges.

Last week’s rebound from the $0.06 baseline set the stage for Dogecoin [DOGE] bulls to propel unparalleled gains in the past few days. The broader investor sentiment toward the meme coin saw a substantial improvement as the price action found a comfortable spot above the 20/50/200 EMA.

Here’s AMBCrypto’s price prediction for Dogecoin [DOGE] for 2023-24

Meanwhile, the recent patterned breakout led DOGE to extend its high volatility phase. At press time, DOGE was trading at $0.1309, down by 4.79% in the last 24 hours.

Can the 20 EMA continue to support DOGE’s bullish endeavors?

The recent bull run aided the buyers in flipping the $0.112-mark from resistance to support after a whopping 159% ROI from 25 October to 1 November. In the meantime, the $0.14 ceiling exhibited a relatively high resistance in the last few days.

DOGE’s bullish flag breakout in the four-hour timeframe put the dog-themed coin in a better position to bounce back from the 20 EMA support and affirm a bullish edge.

A sustained sway above the 20 EMA could aid the buyers in provoking another rally. But the bears would aim to constrict the price in the $0.14 zone. A break above the $0.14-level could open pathways toward the $0.16 ceiling in the coming times.

Any immediate pulldowns could continue to find reliable rebounding grounds from the 50 EMA near the $0.112 support.

The Relative Strength Index (RSI) marked a slight decline and depicted an ease in buying pressure but maintained its spot above the equilibrium. Moreover, its lower peaks over the last few days bullishly diverged with the price.

Improved funding rates

Over the last few hours, DOGE’s funding rate on most exchanges stood positive after unveiling a strong uptrend. Should this trend continue, it would depict an increased bullish sentiment in the futures market. The buyers should look for a potential reversal on this front to gauge the chances of a price pulldown.

Finally, the dog-themed coin shared a 76% 30-day correlation with the king coin. Thus, keeping an eye on Bitcoin’s movement would complement these technical factors.