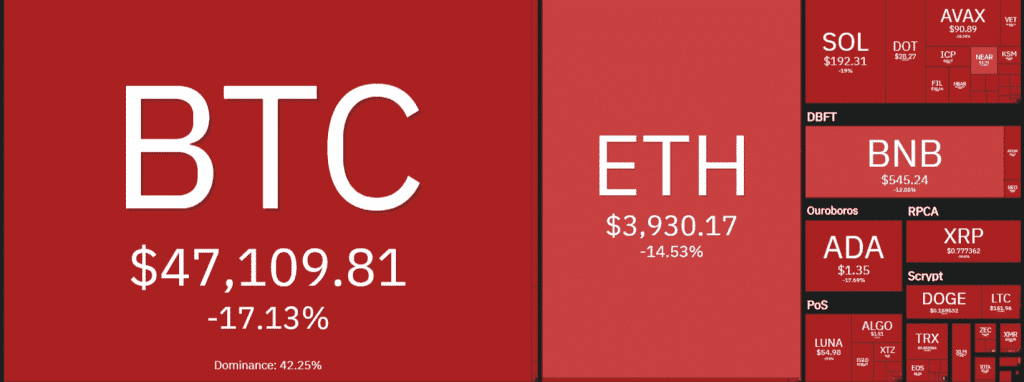

The crypto market recorded its worst day in six months as the majority of cryptocurrencies bled out in double digits. The crypto market mayhem saw the biggest liquidation day in 15 months as over $2.5 billion worth of leveraged positions got liquidated over the past 24-hours. The overall market cap fell by nearly 20% with over $500 billion getting wiped out in a matter of couple of hours.

The crypto market crash that flipped the sentiments on its head was believed to be triggered by a number of factors. The new COVID variant Omnicorn induced fears in the traditional market seems to be the primary reason. Market analysts have also blamed over leveraged positions and high funding rates on exchanges to be other factors that influenced the crypto market crash. The crypto funding rates have turned negative again and many belive its a bullish sign, even when majority of the market is trading in red.

Many also beleived the recent push for regulations in the US and call for strict policies on the cryptpo market especially stablecoins has also played a part in the recent crash. The Congress is going hold a hearing on December 8th where CEOs from top crypto platfroms such as Coinbase, FTX and several others would testify and try to lobby for progressive regulations.

Can Crypto Market Recover From the Current Downtrend?

After a highily bullish October, crypto pundits have predicted for a bullish final quarter, however, the start of December indicate otherwise. The Bitcoin Fear and Greed Index has dropped to “Extreme Fear” after a bearish one and a half month. Even though crypto market is currently going through a bearish downtrend, market analysts belive we hven’t reached a market top yet.

Plan B, a popular crypto analysts who has given a $100K Bitcoin price prediction based on the stock-fto-flow chart shared a 2017 bull cycle chart to point that the crypto market would absorb the loss before regaining the bulls.

For context, 2017 bull market pic.twitter.com/W16gCwTVve

— PlanB (@100trillionUSD) December 4, 2021