Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- Terra classic saw an expected reversal from its six-week trendline resistance, can it find reliable rebounding grounds?

- LUNC’s Social Dominance witnessed a downtrend.

Terra classic’s [LUNC] late-August recovery set the foundation for a solid bull run that pushed the alt toward its ATH post the alt’s rebranding.

Here’s AMBCrypto’s price prediction for Terra Classic [LUNC] for 2023-24

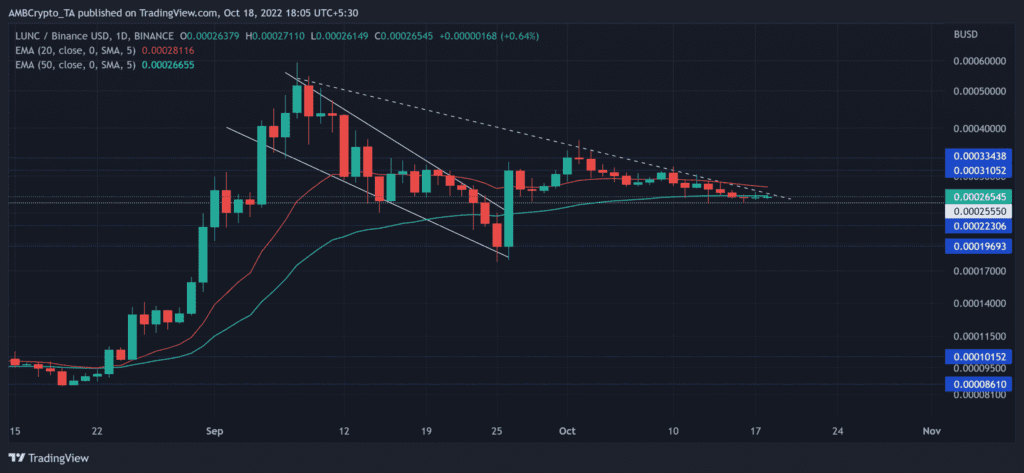

This bull phase aided LUNC in recording an over 490% growth toward the $0.0059-mark high. Since then, however, a retracement has set in while the alt struggled to sway above the 20 EMA (red).

The price action’s recent plunge chalked out a six-week trendline resistance (white, dashed). The coin could see a setback in the near term should this trendline resistance rekindle some selling pressure. At press time, LUNC was trading at $0.00026545.

After compressing in the $0.0001015-$0.000086 range for over a month, LUNC broke into a high volatility phase that entailed a solid bull run.

At press time, over 22.2 billion LUNC, or alternatively 0.32% of its total supply have been burned since the implementation of its burning mechanism. This mechanism aided in bolstering the near-term sentiment in favor of the buyers.

Nonetheless, the trendline resistance has kept on check on the buying rallies for over a month. The bears were quick to undermine the over-extended bull runs during this time.

Should the sellers sustain a close below the 20/50 EMA, LUNC could see a dull phase in the coming sessions.

The decline below the $0.00025 support level could hint at a potential selling signal. In this case, the bears would look to retest the $0.00022-$0.00019 range before a likely revival.

An immediate or eventual recovery beyond the barriers of the 20 EMA and the trendline resistance would affirm a change in near-term momentum. These circumstances would warrant a strong buying signal. The first major resistance level in this case would lie in the $0.00031 region.

A gradual increase in Social Dominance

After the network’s meltdown in May 2022, LUNC’s social dominance correspondingly plunged. Additionally, over the last two months, the crypto’s dominance marked a consistent decline.

A potential reversal on this front can aid the bulls in finding a rally. Off late, the correlation between these two has been quite high, as evidenced by the chart.

On the other hand, an analysis of the long/short ratio across all exchanges revealed a slight edge for the sellers over the last 24 hours.

All in all, investors/traders must keep a close watch on Bitcoin’s movement. The latter could potentially affect the broader market sentiment.