Elrond, unlike most of the market’s altcoins, has actually had a great November. However, only as far as network growth is concerned. Its expansion into the DeFi sector has proven to be rather fruitful as the Maiar DEX made several records for Elrond.

In fact, the network might soon emerge to be significant competition.

Elrond and Maiar’s last 10 days

The day after Maiar’s launch on 19 November, the whole DEX hype was expected to end up as a trend event. However, Elrond actually proved everyone wrong and managed to rake in organic growth pretty quickly.

In just 10 days after its launch, the mainnet had over one million accounts created on it. Furthermore, transaction figures breached the 17 million-mark.

The Maiar liquidity incentive program launched by Elrond appears to have achieved its desired outcome. Especially since the activity on the network has been thriving.

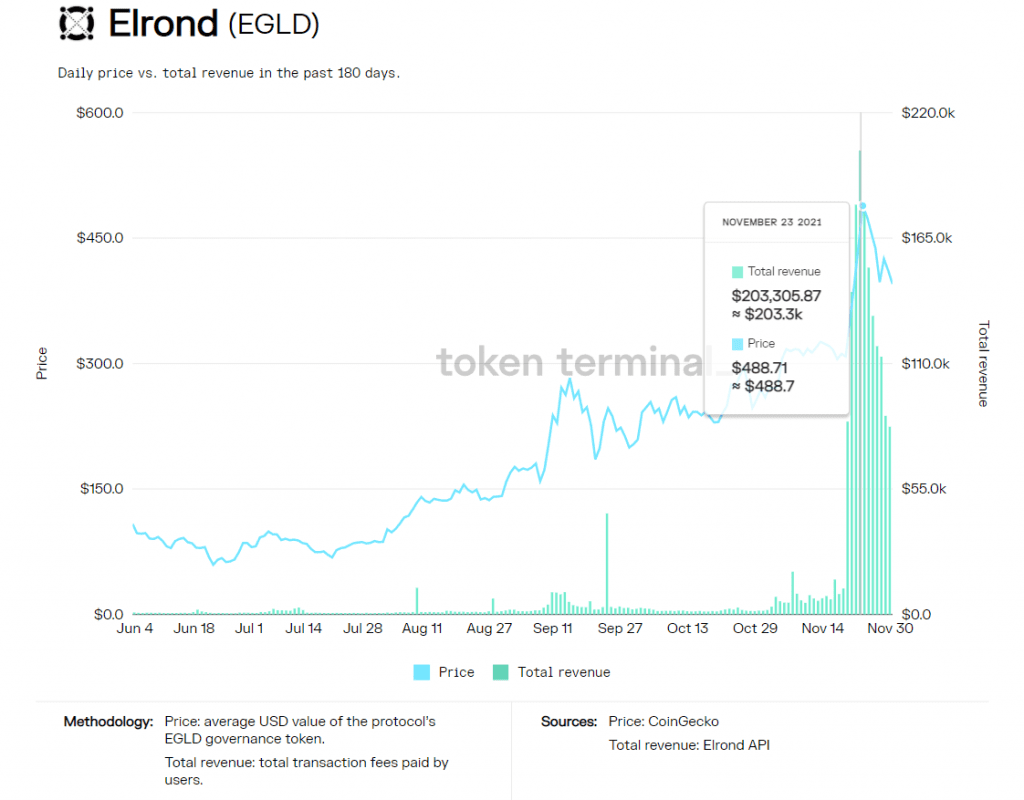

Interestingly, the total revenue (transaction fees) since its launch has been averaging close to $100k, peaking at $203k on the charts.

Elrond total revenue | Source: TokenTerminal

What’s more, even the trading volume of EGLD in the spot market touched $1.2 billion four days after its launch.

Elrond trading volume | Source: TokenTerminal

This bullishness from investors led to the total value locked (TVL) on the Maiar DEX growing by 1,910% over the last 10 days. At the time of writing, the same was flashing a figure of $1.85 billion.

Consequently, the aforementioned growth has contributed to Elrond emerging as the tenth-largest chain in the DeFi space.

Maiar DEX TVL | Source: TokenTerminal

Alas, most of this bullishness, for the moment, is only limited to DeFi as the same has not been reflected in the spot market. Other than volumes, nothing much has improved for the good.

The altcoin is maintaining its path of a steady hike within the uptrend bracket. While it did rise by 60% in three days on 22 November to hit a new all-time high of $491, it soon fell by 23% to land at $380, at the time of this report.

Elrond price action | Source: TradingView – AMBCrypto

The upper trend line is yet to be tested as support and the breakout will only occur when the entire market moves into a bullish state. Until then, it is essential that Elrond maintains the lower trend line as a support level.