Published 5 seconds ago

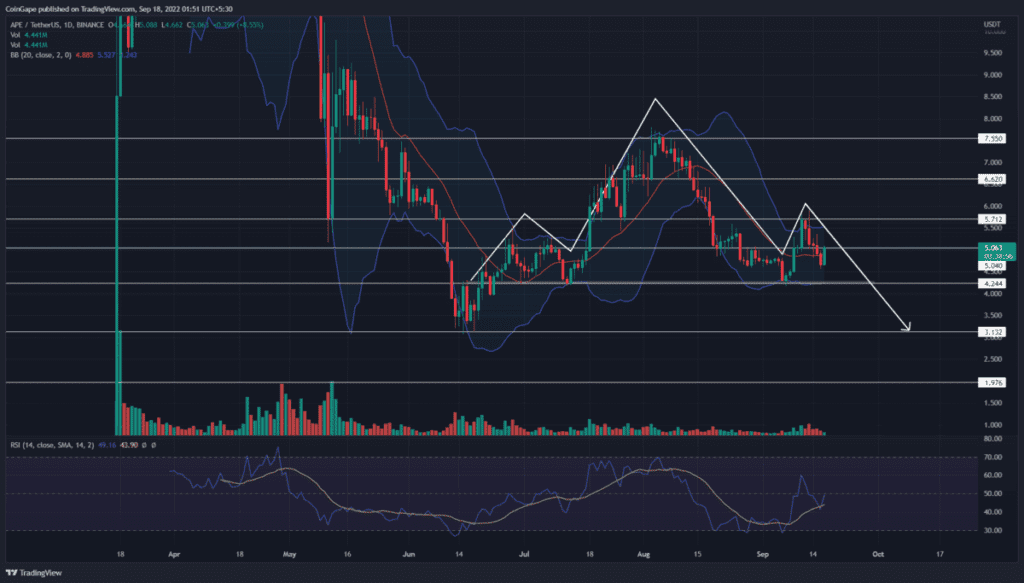

The V-Top reversal from the $5.7 resistance plummeted the Apecoin price below the $5 support. The altcoin is currently in a retest phase, and the post-retest fall may pull the prices to $4.42 support. Moreover, this level also acts as neckline support for head and shoulder pattern.

advertisement

Key points Apecoin price analysis:

- The post-retest fall may plunge the price by 15%

- The 20-day EMA offers dynamic resistance to Apecoin priceApecoin price

- The intraday trading volume in Apecoin is $157.6 Million, indicating a 20.8% gain

Source-Tradingview

The Apecoin daily technical chart shows the formation of a head and shoulder pattern. This bullish pattern is often found in market tops as the prices display a trend reversal, switching from higher high formation to lower low formation.

Trending Stories

Amid the recent sell-off in the crypto market, the altcoin turned down from the $5.7 resistance and bolstered the right shoulder portion of the pattern. The four-consecutive red candles registered a 19% loss and plug prices to $4.57 marked low.

Also read: Just-In: ApeCoin (APE) Community Gets Its Separate BAYC NFT Marketplace

Furthermore, the falling prices break a 20-day EMA and the local support of $5, indicating the sellers aim for another leg down. However, today, the coin is 7% and retests the breached resistance of $5.7.

However, the bullish candle aligned with lesser volume indicates weakness in bearish momentum. Thus, if the selling pressure persists, the Apecoin price may revert from the $5.5 resistance and breach the neckline support of $4.24.

A bearish breakdown from this pattern would accelerate the bullish momentum and challenge the June bottom support of 4.2%. The Apecoin price could reach the $2 mark per technical set-up.

On a contrary note, a daily candle above $5.7 will undermine the bearish pattern.

Technical Indicator

Bollinger band: the coin price breach the pattern’s midline from below, suggesting the buyers are looking for trend control. This mean line may also act as a dynamic resistance.

advertisement

RSI indicator: the daily-RSI slope nosedived below the neutral line indicates the bearish sentiment building up among market participants.

- Resistance levels: $5.4 and $6

- Support levels: $4.2 and $3.2

Share this article on:

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.