If you ask a Cardano investor to look lively or be excited about the bull run at this moment, they might never talk to you again. That has been the case of the 6th largest digital asset, which hasn’t been able to break into any bullish gears since the beginning of September. After reaching a market high of $3.02, ADA has consistently declined over the past couple of months, currently consolidating under the $2 mark.

However, misery could be at the end of its road for Cardano. The final week of November might allow the asset an opportunity to recover against the bears.

Europe’s largest crypto exchange green-lights Cardano

The organization in discussion is none other than Bitstamp. The company is the largest platform in Europe and it is the longest-standing crypto exchange. In its recent announcement, it mentioned that order matching will start and trades will be accessible from 24 November, at approx 3:00 PM UTC.

Bitstamp might be behind major exchanges in terms of trading volumes but it is one of the most credible platforms with significant market liquidity. A majority of its share comes from European traders and Cardano’s listing opens the possibility of new investors adding ADA to their portfolio.

#Cardano360 November edition is coming on Thursday, 25th 16:30 UTC

As ever, @timbharrison, IOG team & guests from across the ecosystem with news & updates on all things #Cardano.

Subscribe to our Youtube channel and hit the 🔔https://t.co/KUnhUBZfDx pic.twitter.com/fQr2KqXgaa

— Input Output (@InputOutputHK) November 19, 2021

In addition to that, Cardano’s 360 November event is taking place on the 25 November, 2021. Each year, significant updates and developments are disclosed during this event and it may potentially trigger a bullish recovery for the digital token.

Will market structure align with community development?

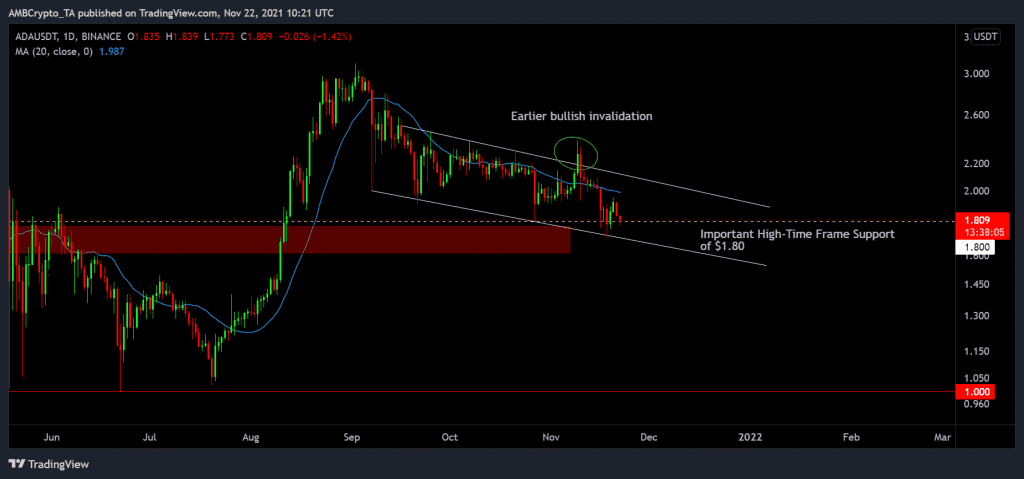

Source: Trading View

Now, the bullish structure can be observed for Cardano on the 1-day chart. It has been oscillating under a descending channel since the beginning of September, but the only issue is that it continues to hover near the $1.80 support range. The importance of this range has been highlighted in a previous article, and currently, it might be time for Cardano to exhibit a demand buy-squeeze in order to break the bearish sentiment.

Source: coinglass

There was contradiction all over the place for Cardano in the futures market. While the funding rate may have remained bullish, the dropping Open-Interest suggested a lack of interest from derivatives traders. However, Cardano spot HODLers indicated that the number of investors holding between the time period of 1 month – 12 months has continued to rise.

Inference can be drawn that these hodlers are not looking to extend selling pressure, hence the accumulation addresses are increasing.

At the moment, it is a long waiting game for Cardano, but a breakout is possibly coming in weeks.