The crypto market has witnessed a smooth rally since mid-July, with Bitcoin and Ethereum rising 29% and 72%. The upside momentum will persist for some time, but likely be short-lived as it is a bear market rally.

Moreover, cryptocurrencies held by top exchange addresses are rising, and the market is reaching an inflection point that will decide the upcoming price momentum.

Crypto Market May Witnessed a Short-Term Rally

The crypto market is enjoying an upside rally despite the FUD surrounding the Fed rate hike and recession. U.S. House Speaker Nancy Pelosi’s visit to Taiwan spurred some fears, but it’s now over. The crypto market is witnessing a market-wide rally today.

According to crypto analyst CryptoBirb, the crypto market rally will be short-lived. As of now, only 7% of cryptocurrencies are above the 200-day moving average, whereas 80% are above the 50-day moving average. It indicates a bear market rally — the bear market period during which prices rally.

He believes the market will rally for some time, but will likely be followed by a correction. Currently, the crypto prices are rising for most cryptocurrencies, with Bitcoin and Ethereum prices rising 3% and 6% to $23,559 and $1676, respectively.

Trending Stories

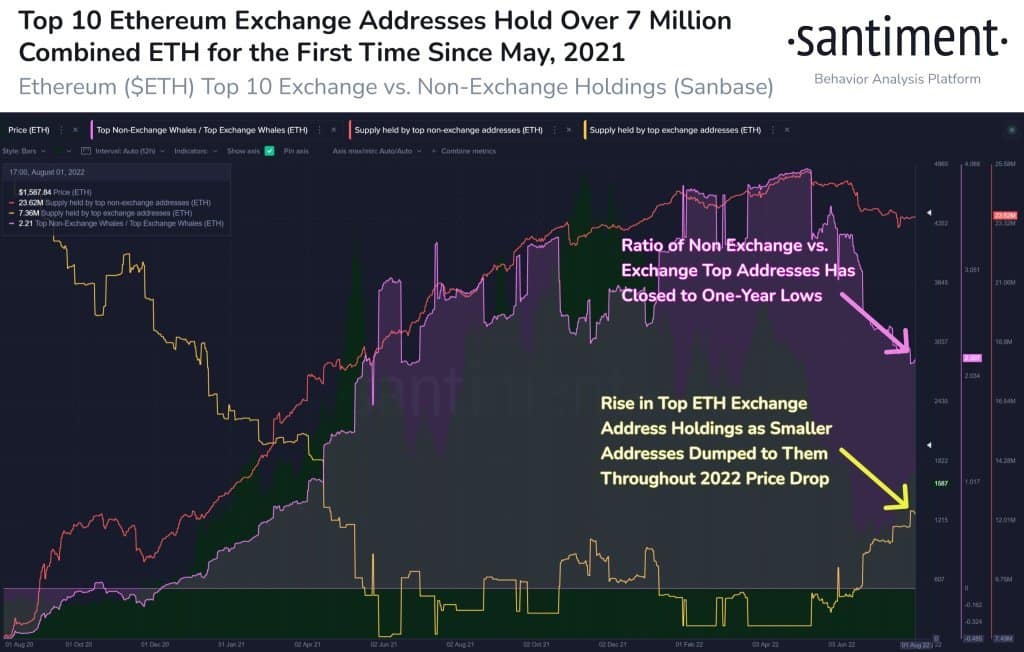

According to the on-chain platform Santiment, the Ethereum Top Exchange vs Non-Exchange Holdings data shows the Ethereum supply held by top exchanges is rising as traders dump their holdings. Since the start of 2022, traders have dumped significant holdings to the top exchanges.

At present, the top 10 exchange addresses hold more than 7 million Ethereum, for the first time since May 2021. A decline in top ETH exchange holdings will be a bullish signal for the Ethereum price.

“Ethereum has seen its supply held by top exchange addresses rise, which makes sense with traders dumping their holdings on to large exchanges during the 2022 slide. Watch for a decline in top ETH exchange address holdings as a bullish signal.”

Bitcoin (BTC) Spot vs Derivatives Led Rally

Bitcoin (BTC) has witnessed two types of rallies over the last 4 years — Derivatives-led and Spot-led. During the derivatives-led rally in 2019 and early 2020 volume is concentrated on derivates exchanges than spot exchanges. Spot does not play a significant role and the rally is short-lived and smaller price increases.

During a spot-led rally in mid-2020 and 2021, the rally is longer and the price increased drastically due to active spot buying by investors. Therefore, investors must look for the “spot inflow index” to determine best investing opportunities in the future.